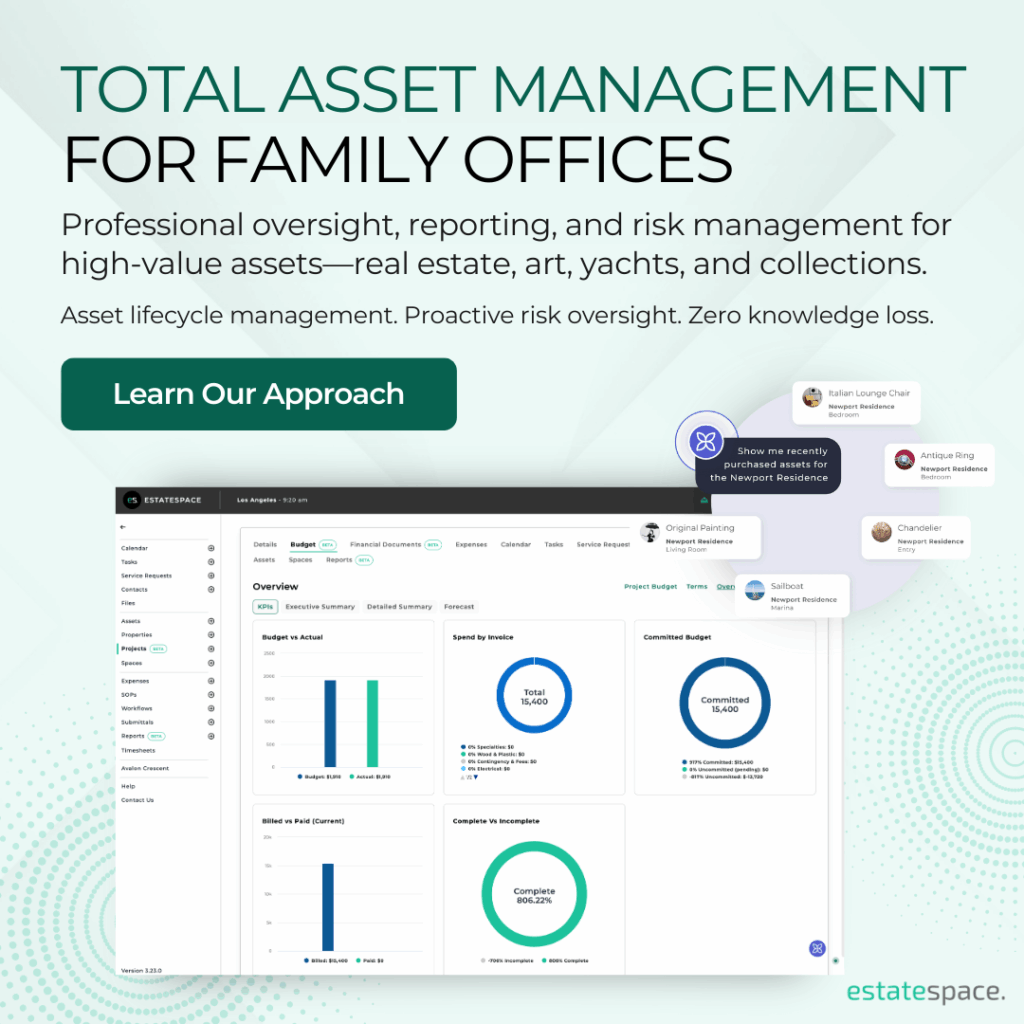

Family offices managing ultra-high-net-worth portfolios increasingly understand that software for family office operations has become essential rather than optional. Moreover, artificial intelligence is fundamentally changing how these organizations approach complex physical asset management. From real estate and aircraft to vehicles and fine art, AI enables features that traditional approaches simply cannot match.

Furthermore, the most successful family offices are finding that AI-powered technology transforms scattered, reactive operations into streamlined, proactive asset management. This delivers measurable value while reducing admin burden. Additionally, AI intelligence is changing decision-making processes by providing predictive insights and automated workflows that were impossible with manual systems.

The AI Revolution in Wealth Management Technology

Artificial intelligence is fundamentally changing software for family office platforms. The industry is moving from reactive management to predictive intelligence. Additionally, where family offices once relied on spreadsheets and disconnected systems, AI-powered platforms now provide institutional-grade features. These platforms predict needs rather than simply respond to them.

Modern estate management operations show how AI transforms traditional approaches into intelligent, proactive systems that enhance operational efficiency while reducing manual overhead.

How AI is Transforming Software for Family Office Operations:

- Machine Learning Maintenance: Algorithms predict maintenance needs before equipment failures occur across property portfolios

- Smart Document Processing: Natural language processing organizes complex legal and financial paperwork automatically

- Predictive Portfolio Analytics: AI identifies investment opportunities and risk exposures across diverse asset portfolios

- Automated Workflow Management: Intelligent coordination eliminates manual bottlenecks between teams and vendors

EstateSpace’s AI-powered platform represents this transformation. We provide family offices with intelligent technology that learns from patterns and continuously improves operational efficiency. This reduces the admin burden that traditionally consumed valuable staff time.

Addressing Critical Pain Points in Family Office Operations

Effective software for family office operations must solve unique challenges that generic business tools cannot address. Moreover, family offices require special features that understand the complexity of managing diverse physical asset portfolios. These systems must maintain trust standards and privacy while delivering measurable results.

Professional asset managers working with family offices consistently report that traditional software falls short when dealing with the special requirements of high-value asset portfolios.

Key Challenges Requiring Specialized Software for Family Office Solutions:

- Complex Asset Tracking: Physical assets are difficult to track and maintain across multiple properties and locations without intelligent automation

- System Integration Issues: Disconnected systems create liability exposure and compliance gaps that put families at risk

- Admin Burden: Substantial manual effort is required for proper asset management without AI assistance

- Reactive Management: Traditional approaches miss opportunities for value preservation and proactive risk reduction

Advanced software for family office operations transforms these challenges into competitive advantages. Through AI-powered automation and institutional-grade oversight features, modern platforms deliver solutions that manual processes cannot match.

AI Intelligence Transforming Family Office Operations

Leading software for family office operations uses artificial intelligence to deliver features that were previously impossible with manual processes. Therefore, AI agents provide real-time intelligence and automated workflows that enhance decision-making. This reduces operational complexity while positioning family offices at the forefront of wealth management innovation.

Physical asset risk management for family offices benefits significantly from AI-powered monitoring and predictive analytics that identify potential issues before they impact asset values.

AI-Enhanced Software for Family Office Features:

Predictive Maintenance Intelligence: Machine learning prevents costly asset damage by analyzing patterns across property portfolios and recommending optimal maintenance timing.

Automated Compliance Tracking: AI ensures regulatory requirements are met consistently across jurisdictions, reducing legal risk and admin overhead.

Digital Asset Histories: AI-powered systems preserve institutional knowledge automatically, enabling smooth transitions between generations and staff changes.

Real-Time Financial Reporting: Automated analytics provide complete oversight of physical asset performance with instant insights and customizable dashboards.

EstateSpace’s AI intelligence specifically supports family office professionals by eliminating routine tasks. This enables strategic focus on high-value client relationships. Moreover, our platform’s machine learning features continuously improve, adapting to each family office’s unique operational patterns while delivering measurable ROI averaging 8x investment.

How EstateSpace’s AI Platform Supports Professionals

EstateSpace’s AI-powered software for family office operations specifically supports professionals by transforming how they approach complex asset management challenges. Additionally, our artificial intelligence continuously learns from operational patterns. This enables predictive insights that help professionals anticipate client needs rather than simply react to them.

Project managers overseeing complex renovations and asset improvements benefit from AI-powered coordination that streamlines vendor management and timeline optimization.

How EstateSpace’s AI Intelligence Supports Family Office Teams:

- Strategic Focus: Automated workflow orchestration frees professionals to focus on relationship management and strategic planning

- Proactive Risk Management: Predictive analysis provides early warnings about potential asset issues before they impact client portfolios

- Intelligent Documentation: AI organizes complex legal and financial documentation automatically, ensuring nothing falls through the cracks

- Enhanced Client Communication: AI-driven reporting generates comprehensive insights that improve client presentations and decision-making

The result is family office professionals equipped with AI intelligence that amplifies their expertise rather than replacing it. Therefore, EstateSpace enables professionals to deliver exceptional client service while managing increasingly complex asset portfolios more efficiently than traditional manual approaches allow.

Market Trends Driving AI-Powered Software for Family Office Adoption

Research shows that artificial intelligence is fundamentally reshaping software for family office operations across the industry. Additionally, data shows that 70% of family offices now prioritize AI-powered real-time data access for better decision-making. Over 60% have adopted cloud-based AI solutions within the past three years to enhance operational features. These trends reflect broader AI transformation patterns across family offices as the industry adopts intelligent automation to stay competitive.

Understanding traditional asset oversight limitations helps family offices appreciate the transformative value that AI-powered platforms bring to modern wealth management operations.

Market Trends Driving AI Adoption:

- Transparency Requirements: Stakeholders demand AI-enhanced asset oversight and automated reporting for real-time visibility

- Advanced Risk Management: Complex portfolios require machine learning algorithms for sophisticated monitoring across diverse asset classes

- Operational Efficiency Demands: Traditional manual processes cannot meet the speed and accuracy requirements of modern family offices

- Succession Planning Needs: AI-preserved institutional knowledge systems ensure smooth generational transitions

EstateSpace’s software for family office operations addresses these industry transformation needs. We provide professionals with intelligent automation that learns and adapts, ensuring sustainable competitive advantages in an increasingly technology-driven wealth management environment.

Strategic Value Creation Through AI-Powered Platforms

Advanced software for family office management creates value beyond operational efficiency. It enables strategic asset optimization and proactive wealth preservation. Therefore, families implementing comprehensive technology solutions position themselves for long-term success in an increasingly complex asset management environment.

Estate maintenance cost control becomes significantly more effective when supported by AI-powered scheduling and predictive analytics that optimize resource allocation and prevent costly emergency repairs.

Measurable Value Delivered by AI-Powered Systems:

- 33% Administrative Time Reduction: AI automation enables staff to focus on strategic initiatives rather than routine tasks

- Proactive Asset Protection: Machine learning prevents costly asset deterioration through predictive maintenance scheduling

- Enhanced Compliance Assurance: Automated systems ensure regulatory requirements are consistently met across all jurisdictions

- Preserved Institutional Knowledge: AI systems capture and maintain operational expertise to support smooth generational transitions

EstateSpace’s software for family office operations delivers these benefits through AI-powered intelligence specifically designed for physical asset management complexity. Our product overview demonstrates how integrated AI capabilities transform operational challenges into competitive advantages.

Advanced AI Features for Complex Asset Management

Modern software for family office operations must address the sophisticated requirements of managing diverse, high-value asset portfolios. AI-powered platforms provide capabilities that manual systems simply cannot match, particularly when dealing with multiple properties, complex vendor networks, and regulatory requirements across different jurisdictions.

Predictive maintenance for high-value asset portfolios demonstrates how AI transforms reactive maintenance approaches into proactive strategies that preserve asset value while reducing operational costs.

Advanced AI Capabilities:

Intelligent Asset Intelligence: AI systems analyze patterns across similar assets to predict optimal maintenance windows, identify potential issues early, and recommend value-enhancement opportunities.

Automated Vendor Management: Machine learning optimizes vendor selection, performance tracking, and contract management while maintaining compliance with family office standards.

Predictive Financial Modeling: AI analyzes asset performance trends to provide forward-looking insights for strategic planning and investment decisions.

Cross-Portfolio Optimization: Advanced algorithms identify opportunities for operational efficiencies and cost savings across multiple properties and asset classes.

AI-Powered Future of Wealth Management

Family offices that embrace AI-powered software for family office management today position themselves advantageously for future challenges and opportunities. Moreover, EstateSpace’s artificial intelligence platform continues evolving, providing increasingly sophisticated capabilities. These enhance asset management and operational efficiency while supporting professionals with intelligent automation.

AI-powered asset management for family offices represents the future of wealth management technology, where predictive intelligence and automated workflows enable unprecedented levels of operational excellence.

The most successful family offices recognize that AI-enhanced software for family office operations represents strategic investment in long-term operational excellence. This goes beyond merely technological upgrade. Therefore, choosing EstateSpace’s AI platform specifically designed for physical asset complexity ensures sustainable value creation across generational wealth transfer while empowering professionals with predictive intelligence.

AI-Driven Strategic Advantages:

- Operational Excellence: 33% reduction in administrative time enables professional focus on strategic client initiatives and relationship building

- Proactive Risk Mitigation: AI-powered monitoring prevents costly asset deterioration through predictive maintenance and early intervention

- Automated Compliance: Intelligent systems ensure regulatory requirements are consistently met without manual oversight

- Future-Ready Operations: AI-preserved institutional knowledge supports smooth generational transitions with predictive succession planning

Overcoming Implementation Challenges

Successfully implementing software for family office operations requires careful planning and change management. However, AI-powered platforms like EstateSpace are designed to minimize disruption while maximizing value creation from day one.

Private property management challenges can be effectively addressed through AI workflows that automate routine tasks while providing intelligent insights for strategic decision-making.

Best Practices for AI Implementation:

Start with Strategic Assessment: Identify the specific operational challenges and efficiency opportunities that AI can address most effectively for your family office.

Phased Deployment Approach: Begin with core asset management functions before expanding to advanced AI features, ensuring user adoption and system optimization.

Staff Training and Support: Provide comprehensive training on AI capabilities while emphasizing how technology enhances rather than replaces human expertise.

Continuous Optimization: Leverage AI’s learning capabilities to continuously improve system performance and adapt to evolving family office needs.

The Bottom Line: AI as Competitive Advantage

AI is fundamentally transforming software for family office operations from reactive management to predictive intelligence. EstateSpace’s AI-powered platform supports family office professionals by delivering automated workflows, machine learning insights, and intelligent automation that traditional manual approaches cannot match.

This positions forward-thinking organizations for sustained operational excellence in an increasingly AI-driven wealth management landscape. Family offices that embrace AI today gain significant competitive advantages in efficiency, risk management, and client service delivery.

The transformation is not just about technology—it’s about empowering family office professionals with the tools they need to deliver exceptional value while managing increasingly complex asset portfolios with confidence and precision.

Ready to discover how AI intelligence can transform your family office operations?

Contact EstateSpace and see how our AI-powered platform delivers institutional-grade oversight while reducing administrative burden by 33% through intelligent automation designed specifically for high-value asset management.