For Financial Advisors

Most advisors ignore a portion of clients’ wealth by only managing financial assets. Expand your service offerings by integrating physical assets to deliver a complete portfolio strategy and deeper client engagement.

Clients trust you with their wealth—reducing expenses and carrying costs around physical AUM frees capital for reinvestment.

Do these common challenges sound familiar?

Lack of Visibility

Physical assets are scattered across spreadsheets, emails, and siloed systems—offering no real-time view or standardized reporting, and making it difficult to assess value, risk, or performance.

Hidden Costs

Physical assets require capital to manage and maintain, reducing available funds for reinvestment. Without technology, controlling costs is nearly impossible.

No Integrations

Physical assets are often left out of portfolio management tools, creating an incomplete wealth picture and limiting advisors’ ability to deliver holistic strategies or estate planning.

Leverage Physical Assets Strategically

Onboard Physical AUM

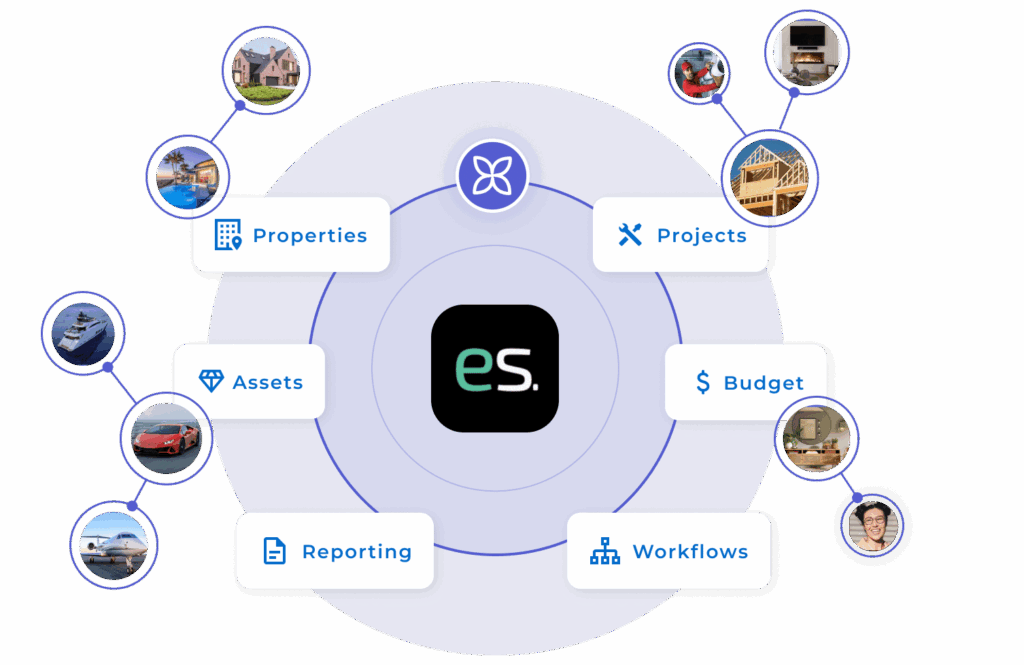

EstateSpace integrates with your financial tech stack.

Seamlessly unify client portfolios and deliver real-time physical asset insights to enhance your advisory services.

Elevate Performance

Increase efficiency, reduce costs.

AI-driven tools protect, maintain, and optimize assets once hard to manage or measure. Extend client services or provide direct to existing management teams.

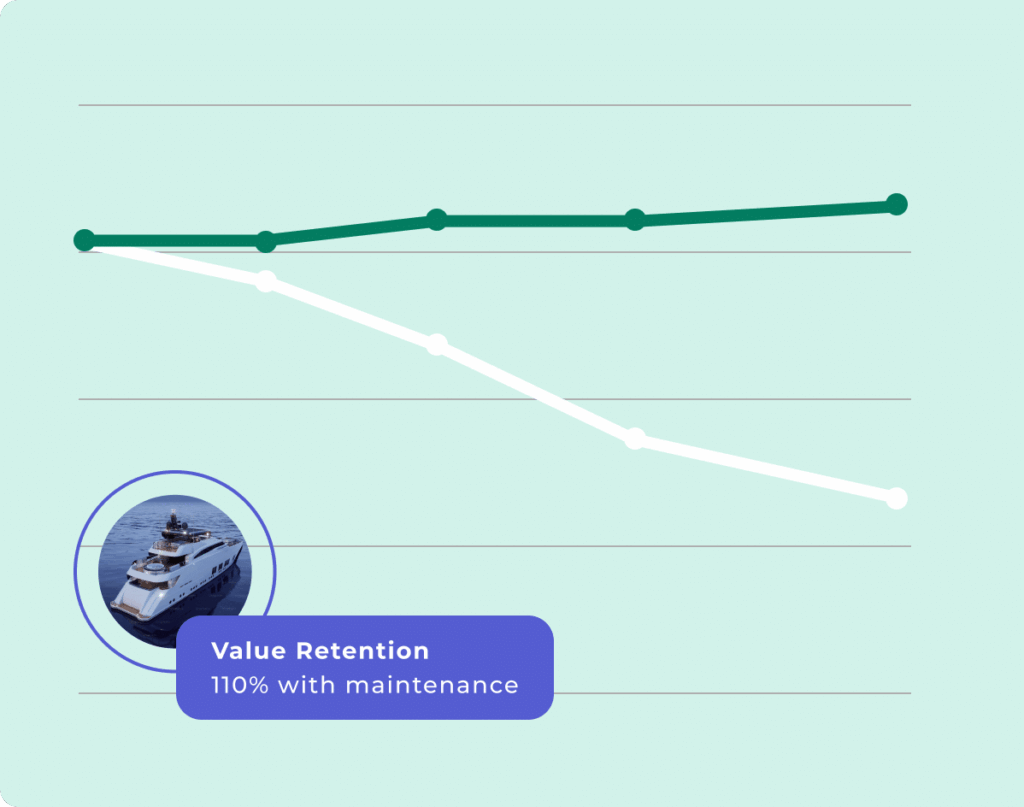

Maximize Returns

See the full picture. Unlock new opportunities.

Integrating physical assets lets you differentiate. Build deeper, more meaningful relationships and enables long-term value tracking across the portfolio.