Estate management has changed dramatically over the past decade. Furthermore, property management budgets now serve as the key element that determines success. Today’s smart property owners understand that effective budget planning means more than expense tracking. Instead, it’s the financial foundation that determines asset longevity, stakeholder satisfaction, and operational excellence.

Managing high-value properties creates complex challenges. Additionally, balancing stakeholder expectations, regulatory compliance, and market changes demands new thinking. Traditional budgeting approaches that worked in previous decades have become outdated in today’s environment.

Why Modern Estates Need Advanced Property Management Budget Systems

Research shows that properties with advanced budget planning have significantly fewer emergency maintenance situations. Moreover, they maintain higher satisfaction scores among stakeholders. The difference between exceptional estate operations and average ones isn’t budget size. Rather, it’s the strategic intelligence built into their financial planning processes.

Industry experts emphasize that an effective budgeting process facilitates smooth transition into new financial years and sets the stage for reaching financial goals 9 Challenges Facing Real Estate Managers Today | Accruent. This highlights how systematic financial planning creates operational stability across complex estate portfolios.

The New Approach: Strategic Financial Architecture

Smart Planning Over Quick Fixes: Leading estate operations now use data to predict property needs before they become expensive emergencies.

Clear Communication: Advanced budget systems translate complex financial data into simple insights that non-financial stakeholders can understand and support.

Asset Growth Framework: Strategic property budgeting directly links operational expenses with long-term asset value improvement and preservation strategies.

Risk Planning: Smart planning accounts for everything from climate-related property risks to changing stakeholder lifestyle needs.

Hidden Challenges in Estate Property Budget Planning

The industry often underestimates the complexity behind successful property financial planning. Additionally, estate operations that excel at budget management understand they’re stewarding family legacies. Furthermore, they preserve generational wealth through strategic financial decisions.

Common Challenges Most Operations Miss:

- Stakeholder Dynamics: Managing budget discussions when multiple parties have different risk tolerances and spending philosophies

- Regulatory Changes: Increasing compliance costs across jurisdictions that can dramatically impact traditional budget assumptions

- Technology Integration: Hidden costs of maintaining modern estate infrastructure while preserving property characteristics

- Vendor Relationships: Balancing cost efficiency with service quality as specialized service providers consolidate

- Climate Adaptation: Forward-thinking budget allocation for resilience improvements that traditional models never anticipated

The most sophisticated family offices and asset managers navigate these complexities through anticipatory budget architecture. This means financial planning that evolves with changing dynamics and market conditions.

Property Budget Evolution: From Cost Control to Value Creation

Estate management leaders who consistently outperform their peers embrace a key truth. Exceptional property management budgets don’t just control costs—they create value. This distinction separates competent estate operations from transformational ones.

The Value Creation Framework:

- Portfolio-Level Intelligence: Central budget systems that provide real-time insights across all properties and investments

- Smart Maintenance Planning: Enhanced forecasting that transforms reactive repairs into strategic preservation investments

- Stakeholder Alignment: Structured communication processes that build confidence through financial transparency

- Flexible Resource Allocation: Dynamic budget frameworks that respond to changing priorities and market opportunities

Operations achieving the highest levels of satisfaction consistently demonstrate one characteristic. They view their property management budget as a strategic asset, not an operational burden.

Technology Advantages in Estate Budget Excellence

The competitive advantage in estate management increasingly comes from technology sophistication. Additionally, the most successful estate operations use advanced property financial planning platforms. These platforms address real-world complexities that generic financial software cannot handle.

Modern estate budget management requires technology that understands the unique intersection of financial stewardship. Furthermore, it must handle stakeholder dynamics and operational excellence that defines luxury property management.

Next-Generation Budget Intelligence:

- Smart Expense Analysis: Advanced analytics that identify cost reduction opportunities while maintaining service quality standards

- Automated Communication: Intelligent reporting that presents financial information in formats appropriate for different audience preferences

- Cross-Property Insights: Comparative analysis capabilities that reveal optimization opportunities across entire portfolios

- Compliance Integration: Automated tracking of jurisdiction-specific requirements that impact budget allocations

Project managers using these advanced systems report significant improvements in both operational efficiency and stakeholder satisfaction.

Future Trends in Estate Budget Management

Current trends and emerging requirements suggest three key shifts. These will reshape property management budget approaches over the coming decade:

Environmental Resilience Integration: Climate adaptation costs will become standard budget line items. Properties will proactively invest in resilience rather than reactive repairs.

Stakeholder Complexity Evolution: Budget systems will need to accommodate increasingly complex decision-making processes. Additionally, they must handle multi-generational considerations.

Regulatory Optimization: Smart operations will leverage jurisdiction-specific advantages in their property portfolio allocation and budget strategies.

Estate operations that understand and prepare for these trends will position themselves as strategic partners. Rather than operational vendors, they become trusted advisors.

Strategic Implementation for Property Budget Success

Property management budgets represent either strategic assets or competitive liabilities in today’s environment. The transformation from traditional expense tracking to strategic financial stewardship requires both mindset evolution and technology advancement.

As detailed in our comprehensive estate management operations guide, the most successful estate operations integrate budget management with every aspect of property stewardship.

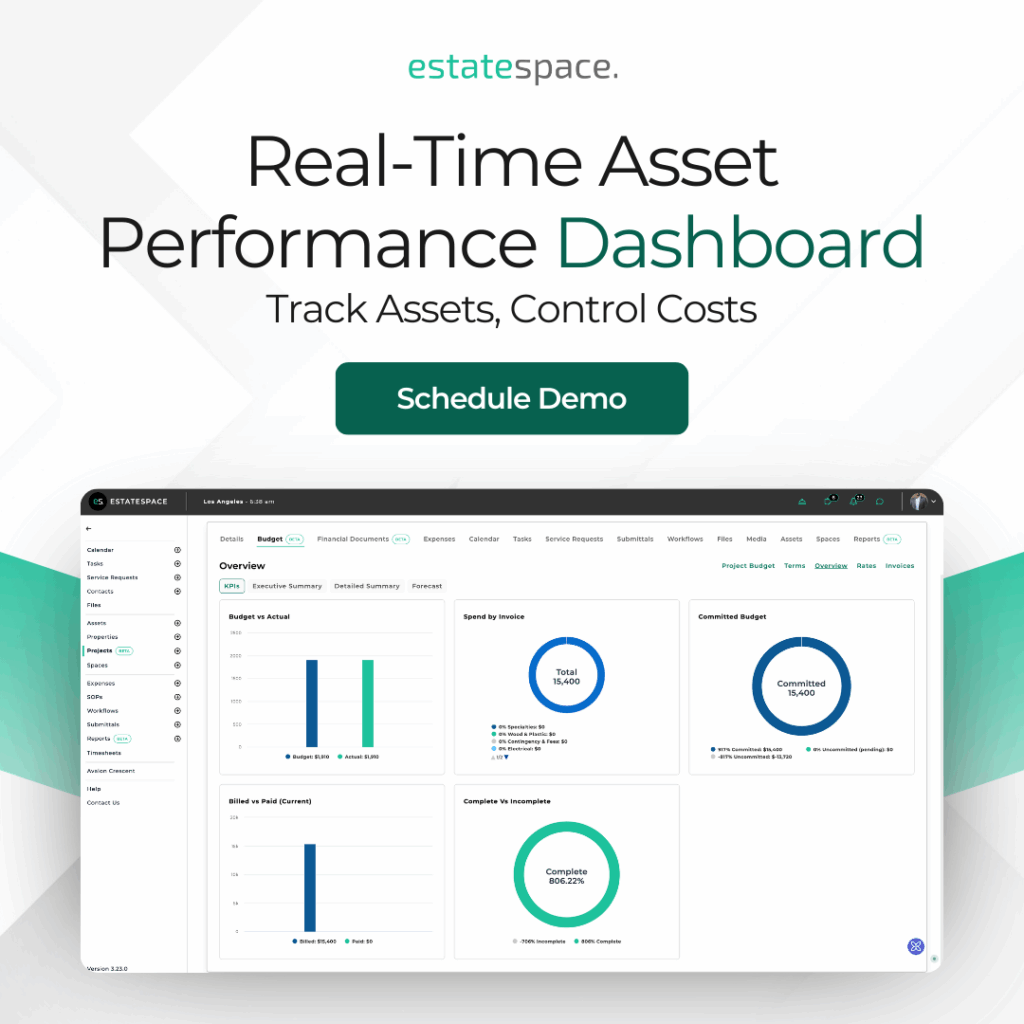

EstateSpace’s product overview demonstrates how technology can elevate estate budget management from administrative necessity to strategic advantage. Additionally, it provides the intelligence and automation required for exceptional results.

Your Path to Better Property Management Budget Planning

The estate operations that will thrive understand that small improvements to existing budget processes won’t suffice. Instead, they’re implementing transformational approaches that position property management budgets as strategic tools for legacy preservation and value creation.

Effective property management budgets serve as the foundation for all estate stewardship decisions. From routine maintenance scheduling to major capital improvements, they guide every choice. When properly structured and executed, they provide the financial clarity and predictability that enable confident decision-making across all operational areas.

Remember that property management budget planning isn’t just financial planning—it’s legacy stewardship. Therefore, it determines whether properties enhance or diminish family wealth over generations.

Ready to transform estate financial stewardship from cost management to value creation? Schedule a Private Demo and discover how advanced property management budget systems revolutionize operational excellence.

Because in estate management, exceptional financial stewardship means never settling for adequate when excellence is achievable.