How Family Offices Can Achieve Complete Visibility Across Real Estate and Household Operations

Family office asset management visibility remains one of the most critical—and overlooked—challenges facing wealth managers today. You’re managing multiple properties, dozens of vendors, scattered documentation, and a team that somehow makes it work—until someone leaves. Then the knowledge walks out the door with them.

If you’ve experienced the 2 a.m. email asking “Who services the HVAC at the Palm Beach property?” or watched a new manager spend six months learning what the previous person knew instinctively, you understand the problem.

The real cost isn’t just the time spent hunting for information. It’s the 15-20% premium you’re paying in carrying costs because you can’t see what’s actually happening across your portfolio.

The Asset Management Visibility Crisis Facing Family Offices

Modern family office asset management faces a fundamental challenge: critical information exists everywhere and nowhere simultaneously. Consequently, achieving true visibility across operations becomes nearly impossible.

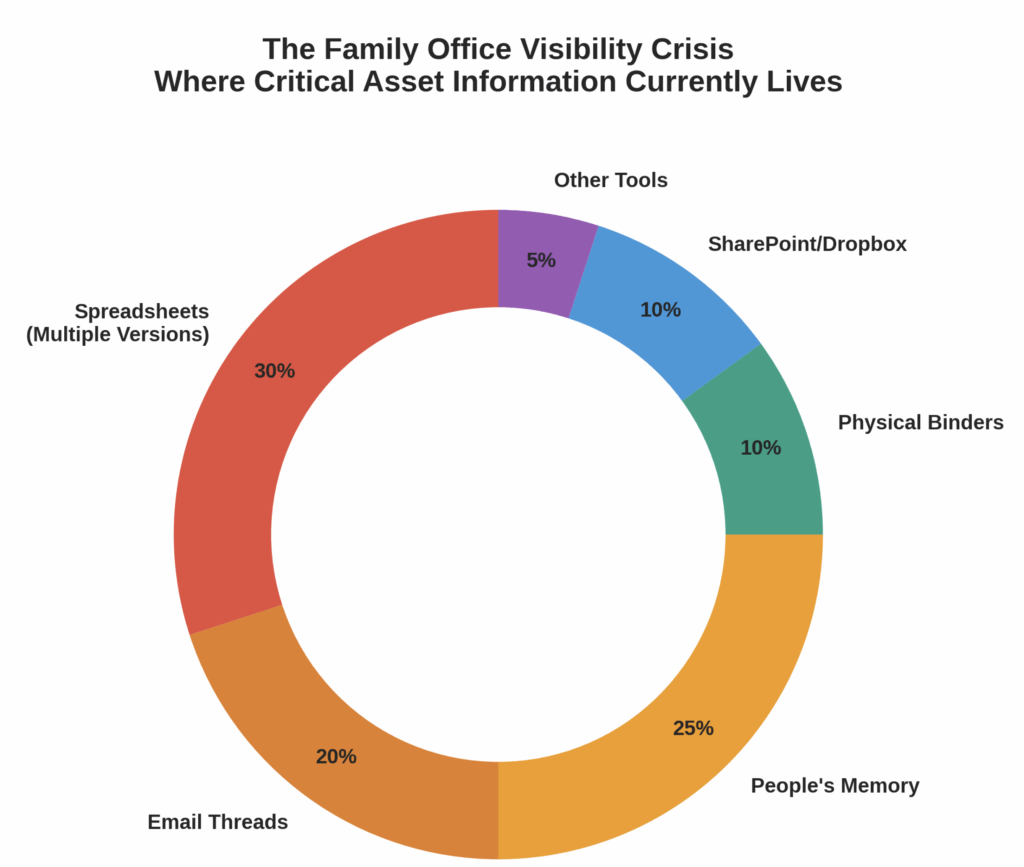

Where your asset data currently lives:

- Spreadsheets (multiple versions, multiple owners)

- Vendor binders gathering dust

- Email threads spanning years

- SharePoint folders with inconsistent naming

- People’s heads (the most vulnerable location)

Figure 1: Distribution of critical asset information across disconnected systems in typical family office operations

When team transitions occur, institutional knowledge disappears. As a result, new managers require 6-12 months to reach operational effectiveness. Moreover, previous owners’ insights—worth $25,000 to $100,000 in avoided mistakes—vanish permanently. Therefore, improving family office asset management visibility becomes essential for operational continuity.

As the CFA Institute notes in their analysis of modern family offices, preserving institutional knowledge across generations has become critical as families navigate unprecedented complexity in wealth management. Furthermore, their research emphasizes that family offices must adopt innovative operational models and strengthen risk management strategies to safeguard legacy while driving sustainable growth. Ultimately, enhanced asset management visibility enables these improvements.

What Complete Asset Management Visibility Actually Means

True operational visibility extends beyond knowing where documents live. Instead, it means having real-time answers to critical questions that drive decision-making:

Property-level visibility:

- Insurance renewal dates across all policies

- Maintenance schedules and completion status

- Vendor performance and contract terms

- Actual spending vs. budget by property

- Asset condition and lifecycle status

Portfolio-level insights:

- Total carrying costs by property and category

- Vendor spend concentration and risk

- Maintenance patterns revealing systemic issues

- Budget variance trends requiring attention

- Risk exposure across insurance and compliance

Asset managers achieving this level of visibility reduce administrative time by 60% while eliminating reactive crisis management. In addition, this transformation directly addresses hidden operational costs that erode portfolio value. Consequently, family office asset management visibility becomes a competitive advantage rather than just an operational necessity.

The Traditional Approach: Why It Fails at Scale

| Tool | What It Does | What It Can’t Do |

|---|---|---|

| Spreadsheets | Track static data | Maintain relationships, alert proactively, scale across properties |

|

Property Management Software |

Manage leases and rent | Handle household operations, maintenance across property types |

| Task Management Apps | Assign to-dos | Build institutional knowledge, connect to assets and vendors |

| Document Storage | Store files | Extract actionable data, create maintenance schedules |

Each tool handles one aspect of operations. However, none connect the pieces. More critically, none transform information into institutional knowledge that survives personnel changes.

When project managers attempt to extend construction relationships into ongoing operations, these disconnected systems create an insurmountable barrier. Therefore, understanding private estate management challenges reveals why fragmented approaches consistently fail to deliver adequate family office asset management visibility.

AI Workflows Transform Asset Management Visibility Into Oversight

Artificial intelligence eliminates the gap between having information and having insight. As a result, modern AI estate operations don’t just organize data—they actively manage operations while improving family office asset management visibility.

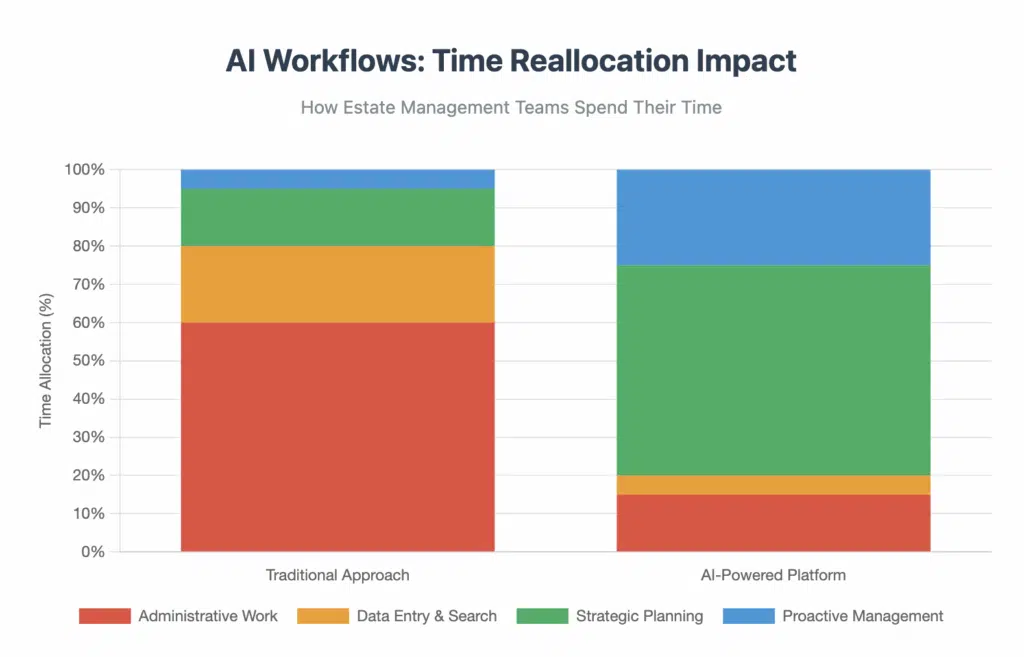

Figure 2: How AI-powered platforms shift team focus from administrative work to strategic planning

AI-powered operational improvements:

Automated data capture – Drop a spreadsheet, upload vendor invoices, or photograph an asset. Subsequently, AI extracts relevant information and creates structured records automatically. What previously required manual data entry now happens in minutes.

Predictive maintenance scheduling – AI generates maintenance calendars based on manufacturer specifications, historical patterns, and best practices. Furthermore, preventive maintenance workflows prevent expensive emergency repairs.

Proactive risk monitoring – Insurance expiration alerts, warranty deadline notifications, and vendor contract renewals occur automatically. Consequently, nothing falls through cracks because a person forgot to set a reminder. Additionally, AI-driven risk management provides continuous oversight.

Intelligent reporting – AI synthesizes spending patterns, identifies cost anomalies, and surfaces operational trends requiring attention. Meanwhile, reports that once took hours to compile now generate on-demand using AI-driven insights.

This represents fundamental transformation in estate management, not incremental improvement. As a result, teams shift from reactive administration to strategic oversight. Moreover, this enhanced visibility enables proactive decision-making across all portfolio operations.

Building Systems That Survive Transitions: Institutional Asset Management Visibility

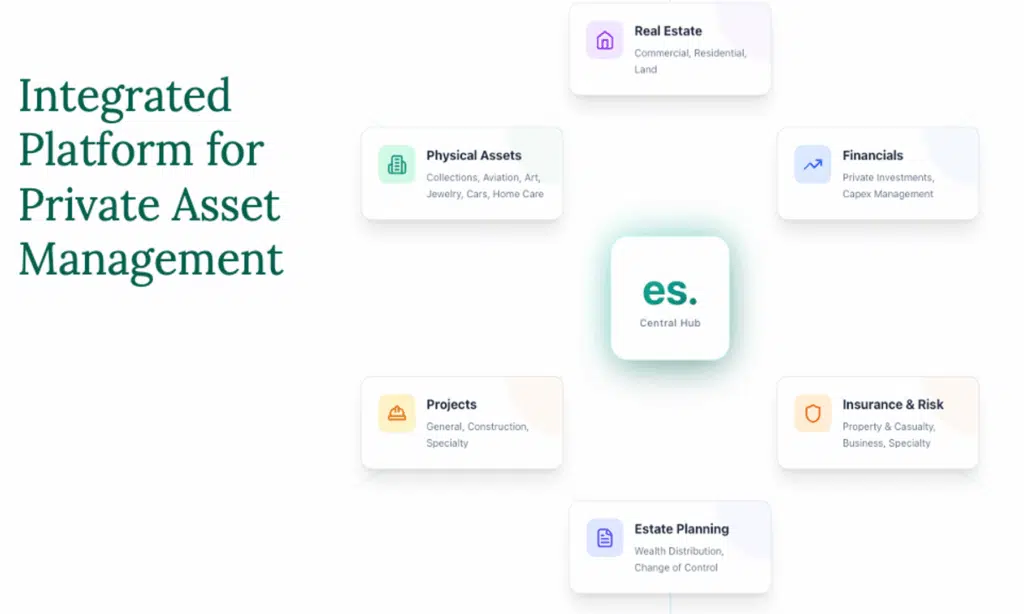

Institutional knowledge shouldn’t depend on individual memory. Instead, purpose-built AI estate management platforms consolidate everything from acquisition through decades of ownership to eventual transfer. Therefore, they create permanent family office asset management visibility that transcends personnel changes.

Complete lifecycle management includes:

- Acquisition phase – Project budgeting, contractor coordination, as-built documentation captured during construction

- Operations phase – Ongoing maintenance, vendor management, expense tracking, team workflows

- Transfer phase – Complete asset history, vendor relationships, operational procedures documented for succession

When configured properly, new team members access decades of institutional knowledge immediately. Consequently, previous manager insights remain available indefinitely. Furthermore, this continuity ensures consistent service quality regardless of staffing changes.

Family offices implementing comprehensive AI platforms report 6-month transition periods reduced to 2-3 weeks. Similarly, estate asset tracking systems provide the foundation for this transformation. As a result, organizations achieve superior family office asset management visibility while reducing operational risk.

Measuring Real Asset Management Visibility: Key Indicators

Operational health metrics:

- Time-to-answer basic questions – How long does finding vendor contact information, paint colors, or service history require?

- Administrative burden percentage – What portion of team time goes to searching for information vs. strategic work?

- Transition effectiveness – How quickly do new team members reach full productivity?

- Unplanned expense ratio – What percentage of spending is reactive emergency work vs. planned maintenance?

- Knowledge retention score – How much critical information disappears when team members leave?

Organizations with strong visibility answer routine questions in seconds, allocate less than 20% of time to administrative tasks, onboard new managers in weeks not months, maintain unplanned expenses below 10% of total spending, and lose zero institutional knowledge during transitions. Consequently, estate maintenance cost control becomes measurable and manageable when proper family office asset management visibility exists.

Implementation: From Chaos to Control

Achieving complete visibility requires systematic consolidation, not additional tools. Moreover, estate management efficiency depends on replacing fragmented systems with unified AI-powered platforms. Therefore, strategic implementation ensures sustainable family office asset management visibility.

Migration pathway:

- Audit current information locations – First, document where critical data currently lives

- Prioritize by impact – Next, focus first on high-value assets and frequently-needed information

- Consolidate systematically – Then, move data to unified platforms with AI-powered automation

- Establish workflows – Subsequently, define processes for ongoing information capture and maintenance

- Monitor and refine – Finally, track visibility metrics and adjust as operations scale

Most organizations underestimate operational inefficiencies by 15-20%. However, implementing comprehensive estate management solutions enables data-driven improvements that immediately enhance portfolio performance. In addition, the transformation through AI estate management delivers measurable results: reduced administrative burden, proactive risk management, and institutional knowledge that survives transitions. Ultimately, superior family office asset management visibility drives competitive advantage.

The Path Forward

Complete visibility across real estate and household operations isn’t a luxury—it’s operational necessity. Specifically, family offices managing complex portfolios require systems that match their sophistication level. Furthermore, achieving robust family office asset management visibility separates industry leaders from those struggling with outdated methods.

The choice isn’t whether to consolidate information. Rather, it’s whether you do it proactively or after the next costly transition reveals gaps in institutional knowledge. Consequently, early adoption of AI-driven estate operations provides lasting competitive advantages.

AI-driven estate operations eliminate administrative burden while building knowledge that survives personnel changes. In conclusion, the technology exists. Implementation separates leaders from those still managing with spreadsheets.

Ready to transform scattered information into institutional knowledge? Learn our approach to achieving complete visibility across your portfolio.