When Your Family Office Runs Like a 1990s Business in a 2025 World

Michael stared at the stack of printed reports covering his desk—the same reports his team had been manually compiling for the past decade. Meanwhile, his phone buzzed with urgent messages: the London property manager needed budget approval, the art collection insurance was expiring, and the principal’s daughter was asking about sustainable investment options. As he opened yet another spreadsheet to track down information scattered across twelve different systems, Michael realized their $2 billion family office needed modern family office software solutions to replace this outdated technology.

This scenario plays out daily in family offices worldwide. Furthermore, without modern family office software solutions, even the most sophisticated wealth management operations struggle with fragmented systems and manual processes.

Why Traditional Methods Are Failing Modern Family Office Software Solutions

Managing multi-generational wealth has evolved far beyond simple investment oversight. Today’s family offices coordinate complex portfolios, multiple properties, philanthropic initiatives, and intricate family governance structures. However, many still rely on outdated approaches that create operational vulnerabilities.

According to Simple’s 2024 Family Office Technology Report, 65% of respondents use generative AI, yet many family offices remain digitized only with Excel, Word, and Email. This creates a significant technology gap.

The Cost of Operational Fragmentation in Family Office Software Solutions

Information Silos: Critical data scattered across multiple platforms makes comprehensive portfolio oversight nearly impossible when principals need it most.

Manual Inefficiencies: Staff spend excessive time on data entry and report compilation rather than strategic wealth management and family advisory services.

Communication Breakdowns: Without centralized systems, important decisions get delayed and family members receive inconsistent information.

Security Vulnerabilities: Sensitive family information shared through unsecured channels exposes families to privacy breaches.

The Strategic Imperative for Modern Family Office Software Solutions

Family office software solutions address these challenges by creating integrated platforms designed specifically for ultra-high-net-worth families. Moreover, these systems transform operational efficiency while enhancing sophisticated service levels.

Essential Capabilities for Today’s Family Office Software Solutions

Centralized Wealth Oversight Modern platforms provide real-time visibility across all family assets—from traditional investments and real estate to art collections and private company holdings.

Secure Communication and Collaboration Purpose-built communication tools ensure family members, advisors, and staff can coordinate effectively while maintaining required privacy and discretion.

Automated Reporting and Analytics Advanced systems generate sophisticated reports automatically. This frees staff to focus on analysis and advisory services rather than data compilation.

Compliance and Documentation Management Systematic tracking of regulatory requirements and family governance protocols ensures consistent adherence to family objectives.

For comprehensive guidance on managing complex family assets, explore our detailed resource on Understanding Estate Management: Beyond Household Operations.

How Advanced Family Office Software Solutions Transform Operations

Modern platforms leverage advanced technologies to deliver capabilities that were impossible with traditional approaches. Consequently, these innovations enable family offices to operate with institutional-grade efficiency.

AI-Powered Intelligence and Automation in Family Office Software Solutions

Predictive Analytics: Machine learning algorithms analyze investment patterns and market trends to provide actionable insights for strategic planning.

Automated Task Management: Routine administrative tasks like compliance monitoring and report generation operate automatically. This frees staff for higher-value activities.

Risk Assessment: AI systems continuously monitor portfolios for concentration risks and compliance issues. Teams receive alerts about potential concerns before they become problems.

Integration and Scalability Features

Multi-Asset Management: Platforms handle everything from public securities and private investments to real estate and art in unified systems.

Global Coordination: Cloud-based solutions enable seamless coordination across multiple offices and time zones while maintaining security standards.

Vendor Integration: Modern platforms connect with banks, custodians, and investment managers to automate data flows.

These operational challenges often intersect with broader risk management concerns. Therefore, learn more about protecting family wealth in our analysis of Physical Asset Risk Management for Family Offices.

Implementation Strategy for Successful Family Office Software Solutions

Successfully transitioning to modern systems requires systematic planning that addresses technical requirements and change management needs.

Phase 1: Assessment and Planning

Current State Analysis: Document existing systems, workflows, and pain points to understand specific requirements and integration challenges.

Stakeholder Alignment: Ensure family members, staff, and key service providers understand the benefits and requirements of digital transformation.

Phase 2: Platform Selection and Configuration

Vendor Evaluation: Select solutions that match specific family needs, integration requirements, and long-term growth plans.

System Configuration: Customize platforms to reflect family governance structures, investment policies, and operational workflows.

Phase 3: Integration and Optimization

Data Migration: Systematically transfer historical information while ensuring accuracy and completeness of family records.

Process Refinement: Optimize workflows based on platform capabilities and initial experience to maximize efficiency gains.

Many operational complexities can be addressed through targeted technology solutions. Therefore, explore our examination of Private Property Management Challenges: 5 AI Workflows That Work for specific implementations.

Building Long-Term Operational Excellence

Implementing effective systems extends beyond immediate efficiency gains. It builds foundation for multi-generational wealth management success.

Succession and Continuity Planning

Knowledge Preservation: Systematic documentation ensures that critical family and operational knowledge survives staff transitions and generational changes.

Next-Generation Engagement: Modern platforms provide younger family members with the technological sophistication they expect while maintaining traditional values.

Performance Enhancement and Cost Management

Operational Efficiency: Automation and integration typically reduce administrative time by 40-60%. This allows staff to focus on strategic advisory services.

Cost Transparency: Comprehensive tracking of all family expenses provides clear visibility into operational costs and vendor performance.

Successfully managing family office operations often requires building lasting relationships with multiple stakeholders. For family offices planning long-term operational excellence, systematic approaches are crucial. Learn more in our guide to Post Construction Management: Client Relationships That Last.

Ready to Transform Your Family Office Operations?

The difference between struggling with outdated systems and operating with confidence comes down to embracing modern technology designed for wealth management complexity. Nevertheless, success requires more than technology—it demands strategic implementation and ongoing optimization.

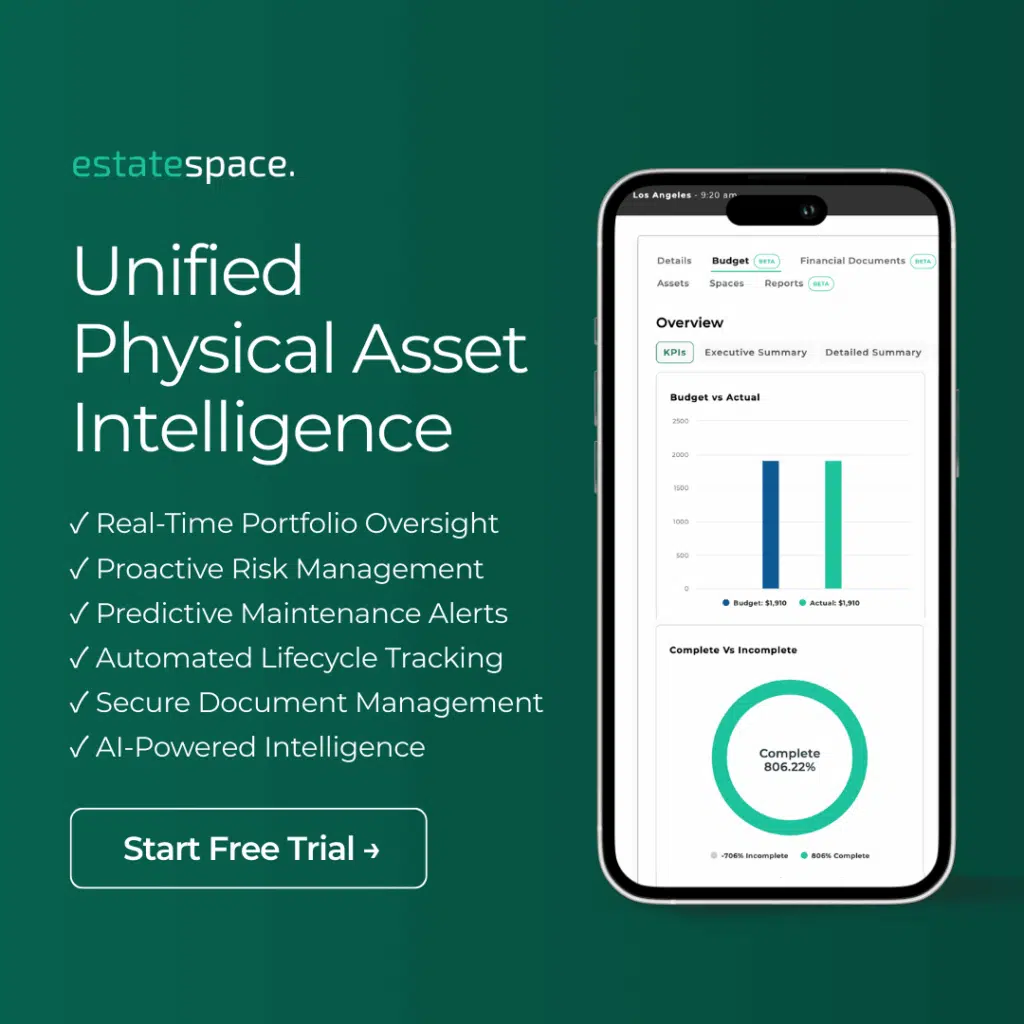

EstateSpace provides comprehensive solutions designed specifically for ultra-high-net-worth families managing complex, multi-generational wealth. Our comprehensive platform integrates seamlessly with existing operations while providing advanced capabilities.

Family offices using EstateSpace consistently achieve:

- 50% increase in operational efficiency through automation and integration

- Enhanced security and privacy protection for sensitive family information

- Improved decision-making through real-time portfolio visibility and analytics

- Simplified compliance management across multiple jurisdictions

Your family’s wealth represents generations of success and achievement. Similarly, your operational infrastructure should reflect that same level of sophistication and excellence. Moreover, your staff deserves tools that enable exceptional service delivery.

Contact us today to discover how EstateSpace can transform your family office operations and provide the technological foundation for multi-generational wealth management success.

EstateSpace delivers purpose-built solutions designed specifically for ultra-high-net-worth families requiring sophisticated wealth management, operational efficiency, and security that modern family office operations demand.