Family Office Asset Management: Why Systems Beat Spreadsheets

The fundamental challenge facing family office asset management today comes down to one phrase: “Systems over heroics.” You’re managing exceptional properties and valuable assets with talented people performing daily heroics. However, heroics don’t scale. Furthermore, they don’t survive staff transitions. In addition, they’re bleeding money you can’t see.

The Hidden Costs of Manual Asset Management

The Real Cost of Manual Family Office Operations

When you acquire a complex property without documentation, you’re starting from zero. For instance, one family office principal described spending a year just figuring out how to run his newly purchased home. His estimate? Access to the previous owner’s property knowledge would have been worth $100,000 minimum.

This lack of estate management clarity creates cascading problems. Every time your estate manager troubleshoots something, they’re building knowledge that lives only in their head. Consequently, when they leave, that knowledge walks out the door.

The math is stark: one family office calculated a 90% reduction in transition costs after implementing purpose-built systems. As a result, they transformed knowledge from personal to institutional.

Why Spreadsheets Fail at Asset Management Scale

Your Excel workbooks and SharePoint sites work until they don’t. Specifically, here’s what breaks:

The Insurance Policy Scenario: Your insurance renewal is coming up. Where’s the documentation? Is it on the insurance SharePoint site or the property site? You spend an hour hunting before finding it buried three folders deep. Meanwhile, the deadline is tomorrow.

The Vendor Payment Problem: Your HVAC vendor sends a bill. Subsequently, you need to verify the work against your maintenance schedule, check it against your budget, and confirm it with the property manager. In total, that’s three different systems, two phone calls, and 45 minutes of your day.

The Multi-Generation Challenge: You’re managing properties for G1, G2, and G3. Each generation has different service levels. G1 gets a butler, G2 gets an estate manager, G3 manages their own home with support. Try organizing that in spreadsheets across multiple properties and generations.

One family office managing that exact scenario described their previous process: “We were performing a lot of heroics, and we’re good at it. But it shouldn’t be that difficult.”

Fortunately, private estate management solutions eliminate this complexity.

Recognizing Asset Management Breaking Points

Critical Warning Signs in Asset Management Operations

You know you’ve hit the breaking point when:

- Your team works in seven different tools – Calendar, email, SharePoint, Monday, Excel, Procore, and Google Docs. As a result, each transition between tools costs time and introduces errors.

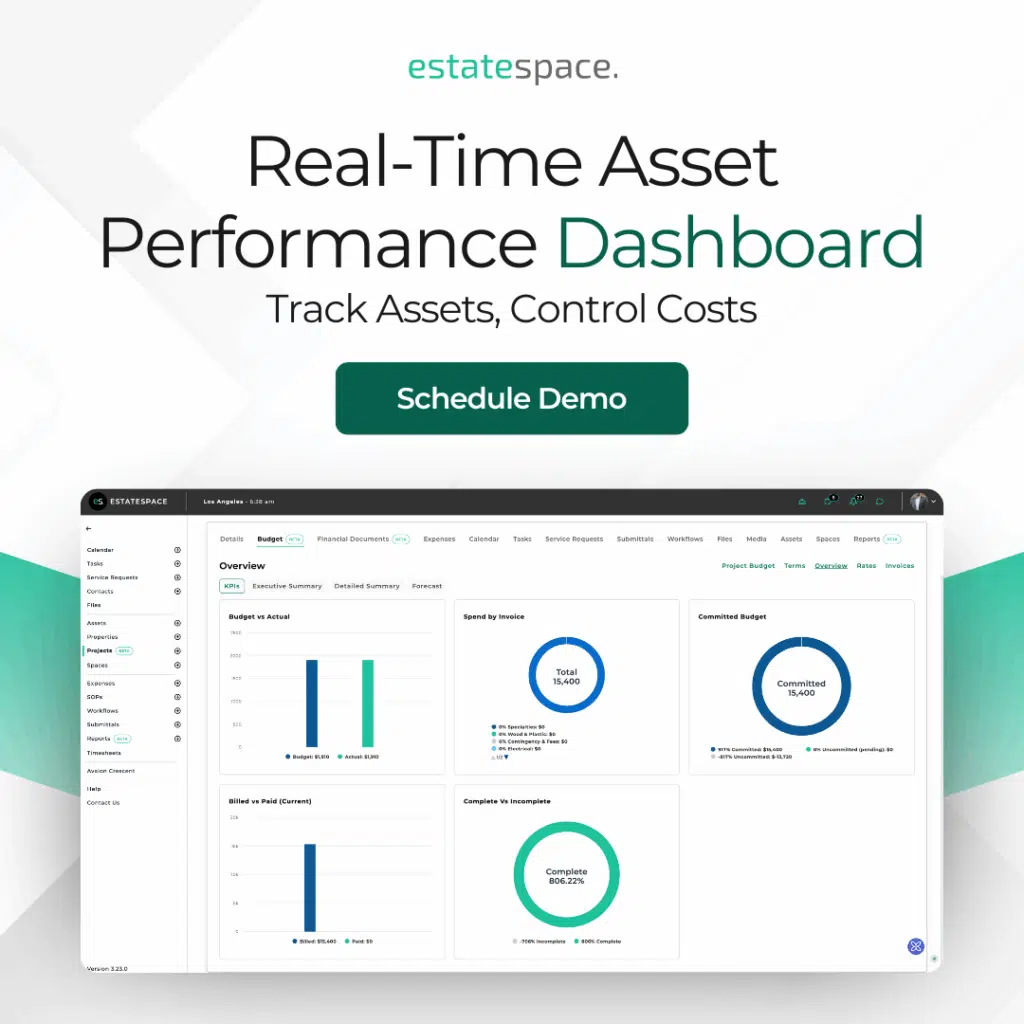

- Simple questions take hours – “Show me all plumbing maintenance costs for the year” should take 30 seconds, not an afternoon of spreadsheet archaeology.

- New hires take months to ramp up – Because the knowledge exists in someone’s head, not in your systems. Therefore, every staff transition becomes a crisis. According to Campden Wealth’s 2024 Family Office Operational Excellence Report, staff turnover was identified as the biggest operational concern for family offices after cybersecurity, with approximately 70% indicating difficulty recruiting staff and 65% concerned about retaining existing staff.

- Principals ask the same questions repeatedly – “Where are we on the Aspen renovation budget?” If answering requires pulling data from three places and building a report manually, you’re doing heroics.

Clearly, these are signs you need comprehensive physical asset risk management.

The Solution: Purpose-Built Asset Management Technology

The Systems Approach to Family Office Asset Management

Purpose-built estate management systems solve this differently. Specifically, here’s how:

Single Source of Truth: Every property, every asset, every vendor, every document lives in one place. Your insurance policy sits with the property it covers. Similarly, your HVAC maintenance history sits with the HVAC unit. Furthermore, your project costs roll up automatically to property-level budgets.

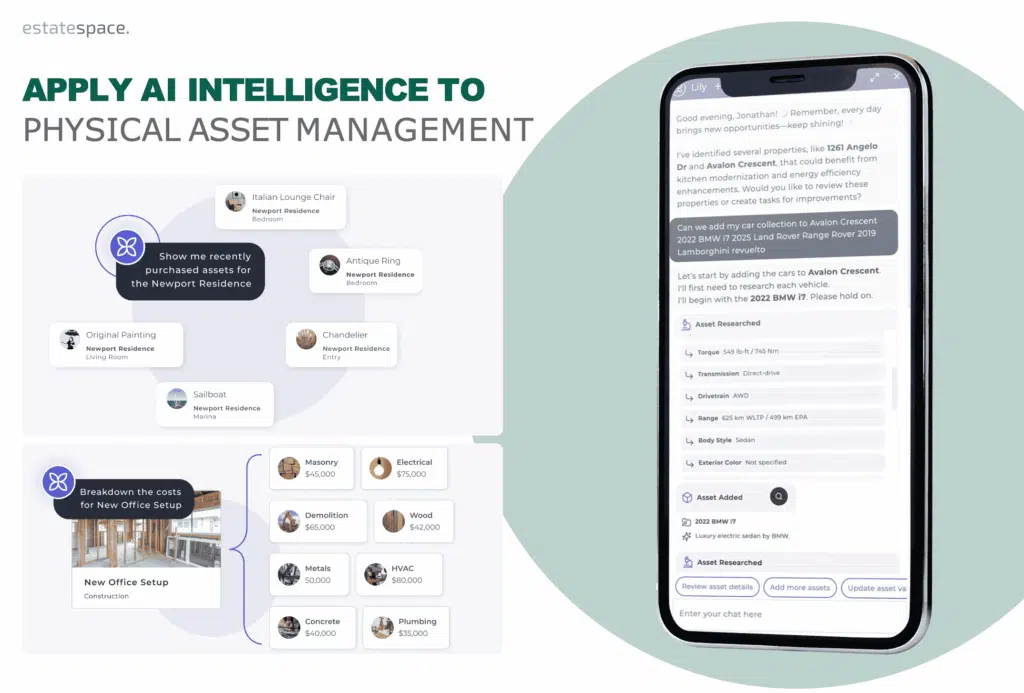

AI Eliminates Administrative Burden: Instead of manually tracking that your insurance renews in 60 days, AI-powered workflows monitor it and alert you. Moreover, instead of building maintenance schedules from scratch for each property, AI suggests them based on asset type and manufacturer recommendations.

Knowledge That Survives Transitions: When your estate manager leaves, the new person doesn’t start from zero. Instead, they inherit digital processes, complete vendor histories, and documented procedures. Consequently, the 4-6 month ramp-up time drops to weeks.

Real-World Family Office Asset Management Example

Consider the art collection scenario. Your principal is bringing in artwork that needs assessment for insurance.

The Heroics Approach:

- Take photos with your phone

- Then, email them to yourself

- Next, download to your computer

- After that, upload to a shared drive

- Subsequently, create a spreadsheet with details

- Then, email the spreadsheet to the insurance broker

- Finally, hope nothing gets lost in translation

The Systems Approach:

- Photograph the piece directly in the platform

- AI suggests relevant attributes (artist, dimensions, provenance)

- Link to existing insurance policy

- Set appraisal reminder for 3 years

- Generate insurance report with one click

- Everything stays connected to the asset forever

The time savings? About 40 minutes per piece. Therefore, multiply that across a collection of 200 pieces, and you’ve saved 133 hours of administrative work.

Importantly, AI estate management workflows handle these processes automatically.

Multi-Property Asset Management Efficiency

Here’s where private estate management solutions create exponential value in family office asset management:

First, set up one property correctly with all its processes, vendor lists, and maintenance schedules. Now that becomes your template. As a result, property two takes 60% less time. By property three, you’re replicating proven systems, not reinventing wheels.

For example, one asset management team described starting with their most complex property, getting it dialed in, then scaling to 50+ properties using the same framework. Ultimately, what would have taken years happened in months.

Measuring Family Office Success

Key Performance Indicators for Asset Management Success

You know you’ve moved from heroics to systems when:

- Questions get answered in seconds, not hours – “Show me every place we use this vendor” returns instant results across all properties using estate management software.

- Staff transitions don’t cause panic – Your new estate manager opens the platform and sees exactly how the previous person managed everything, complete with vendor relationships and maintenance history.

- Principals get proactive insights – Rather than asking “when does the HVAC warranty expire?”, they receive an alert 60 days before expiration with maintenance history and replacement cost analysis.

- Your team works from anywhere – Mobile access means property managers update information in real-time from the field. Consequently, no more waiting until they’re back at a computer to document work.

Your Family Office Implementation Roadmap

Building Your Action Plan for Family Office Asset Management

Moving from heroics to systems doesn’t happen overnight. However, with the right roadmap, the transition becomes manageable. Essentially, here’s your step-by-step guide:

Initial Phase (Weeks 1-2): Assess Your Current State

- First, document how many tools your team uses daily

- Next, calculate time spent hunting for information

- Finally, identify your most complex property as the pilot

Planning Phase (Weeks 3-4): Define Your Framework

- Initially, map out property structure (buildings, rooms, assets)

- Then, list critical vendors and their contact details

- Additionally, identify recurring maintenance schedules

Implementation Phase (Weeks 5-8): Implement and Test

- Begin with one property using an AI estate management platform

- Subsequently, train your team on the new workflows

- Afterwards, document what works and what needs adjustment

Growth Phase (Beyond Week 9): Scale and Optimize

- Start by replicating successful framework to additional properties

- Next, let AI automate repetitive administrative tasks

- Ultimately, build estate management clarity across your entire portfolio

Moving Forward with Family Office Asset Management

Next Steps for Modern Family Office Asset Management

The best family office asset management comes from purpose-built technology that understands your unique challenges. You’re not managing a single rental property or running a hotel. Instead, you’re orchestrating complex, multi-generational portfolios where a single missed detail can cost six figures.

Your team is talented. Indeed, they perform daily heroics keeping everything running. However, they shouldn’t have to.

Systems should handle the administrative burden. Additionally, AI should automate the repetitive work. Meanwhile, your people should focus on the high-value work that actually requires human judgment.

That’s not just more efficient. Rather, it’s how you build infrastructure that survives transitions, scales across properties, and gives you the risk management visibility you need.

Whether you’re a family office, asset manager, or project manager overseeing complex holdings, EstateSpace provides the unified platform you need.

Ready to move beyond heroics? See how it works for complex portfolios like yours.