Physical Asset Valuation for Family Offices: The $5 Trillion Blind Spot Eroding Wealth

The $200,000 Ferrari That Became a $25,000 Problem

Physical asset valuation for family offices often reveals crisis moments that destroy value in hours. It’s Friday at 5 PM when your client’s vintage Ferrari needs attention before Monday’s major auction. Without proper maintenance records, what should be routine $25,000 service becomes a $200,000 restoration emergency. Why? Because nobody tracked the engine rebuild schedule or documented the last major service.

This isn’t hypothetical. It’s happening right now in family offices across the country. Moreover, here’s the uncomfortable truth: 70% of wealthy families lose their wealth by the second generation, and 90% by the third.

The culprit isn’t market drops or poor investment choices—it’s the systematic neglect of physical asset valuation that represents the majority of family wealth. Furthermore, according to Goldman Sachs 2025 Family Office Report, family offices manage an average of $2.7 billion in assets, yet most lack systematic approaches to valuing their physical holdings.

Why Physical Asset Valuation for Family Offices Demands Urgent Attention

While you carefully track every financial investment, can you accurately tell the current condition and value of every physical asset in your portfolio right now? Your portfolio likely includes properties worth tens of millions, yet most management teams operate with dangerous blind spots. Consequently, hidden costs destroy physical asset value by 15-20% annually through pure neglect. Moreover, these losses compound year after year, creating massive wealth erosion over time.

Three Crisis Scenarios That Reveal Physical Asset Valuation Gaps

Family offices face recurring crises that stem from inadequate valuation processes. These scenarios demonstrate how valuation gaps translate into financial losses. Moreover, each crisis is preventable with systematic approaches.

Crisis #1: The Compliance Nightmare in Asset Documentation

Your client’s art collection fails an insurance appraisal because authentication documents and history records are scattered across multiple galleries and auction houses. The resulting coverage gaps and re-authentication costs could have been prevented with proper asset intelligence. Furthermore, the time spent reconstructing documentation delays other strategic priorities.

Real numbers: One family office discovered their $8M art collection had only $4.5M in actual coverage due to outdated valuations. The insurance gap exposed them to $3.5M in unprotected value for three years. Additionally, when they finally updated coverage, premiums increased 40% due to the concentrated risk exposure.

Crisis #2: The Silent Value Drain From Deferred Maintenance

Deferred maintenance across your property portfolio is eroding asset values by 3-5% annually—money that’s simply disappearing because no one has a complete picture of what needs attention. In fact, predictive maintenance for high-value portfolios prevents 80% of these value erosion scenarios. Therefore, the ROI on systematic maintenance tracking exceeds 500% within just three years.

Real numbers: A $50M property portfolio losing 4% annually to deferred maintenance represents $2M in value destruction—every single year. Over a decade, that’s $20M+ in preventable losses. Moreover, deferred issues compound, turning $5,000 fixes into $50,000 emergencies when systems fail catastrophically.

Crisis #3: The Documentation Gap That Costs Millions in Taxes

Critical records on ownership history, condition, and valuation exist only in scattered notes or family memory. When succession planning begins, key information is often lost or incomplete. Therefore, estate asset tracking platforms become essential for preserving institutional knowledge. Additionally, complete documentation prevents family disputes that often arise during generational transitions.

Real numbers: During one generational transfer, heirs couldn’t locate purchase records for a vintage car collection worth $4M. Without proof of acquisition costs, they faced an additional $600K in capital gains taxes. Furthermore, the IRS audit triggered by the incomplete documentation cost another $150K in legal and accounting fees.

The Strategic Framework for Physical Asset Valuation Success

Effective physical asset valuation for family offices requires systematic approaches treating these holdings with the same rigor as financial portfolios. Specifically, here’s your action plan to gain complete asset visibility:

Phase 1: Conduct a Comprehensive Physical Asset Portfolio Audit

Action: Create a complete inventory of every physical asset across all properties with current market values.

6 Essential Documentation Elements:

- Asset identification – Serial numbers, unique identifiers, location tracking

- Condition assessment – Current state, maintenance history, conservation needs

- Valuation records – Professional appraisals updated within 12-24 months

- Ownership documentation – Purchase records, certificates, authentication papers

- Insurance analysis – Coverage amounts vs. current values, gap identification

- Replacement planning – Expected lifespan, replacement costs, timing strategies

Implementation timeline: Start with your highest-value properties first. Dedicate one property per month to complete documentation. Within six months, you’ll have visibility into 90% of your asset value. Moreover, families typically discover 20-30% more value than initially estimated. Additionally, this discovery phase often reveals insurance gaps and maintenance needs requiring immediate attention.

Pro tip: Don’t just list what you own—document age, condition, maintenance history, and replacement timelines. For vehicles, track service intervals, mileage, and storage conditions. For art pieces, maintain authentication records, conservation history, and valuation updates. Furthermore, consistent documentation standards enable accurate comparison across similar assets in your portfolio.

Phase 2: Establish Predictive Maintenance for Asset Value Preservation

Action: Move from reactive to predictive maintenance scheduling that preserves asset values.

Why this matters: Assets don’t break randomly—they follow predictable patterns. Luxury vehicles need major services every 5,000-10,000 miles, while art pieces require conservation checks every 5-10 years depending on medium and environmental conditions. As a result, proper scheduling at optimal intervals preserves value and prevents emergency repairs. Furthermore, predictive approaches cost 60-70% less than reactive emergency fixes.

4 Critical Maintenance Categories:

| Asset Type | Inspection Frequency | Major Service Interval | Value Impact if Neglected |

|---|---|---|---|

| Luxury Vehicles | Every 3–6 months | Every 5,000–10,000 miles | 10–15% value loss per year |

| Fine Art | Annual condition checks | Conservation every 5–10 years | 5–8% value loss per decade |

| Real Estate Systems | Quarterly inspections | Major systems every 10–15 years | 3–5% value loss annually |

| Wine Collections | Continuous monitoring | Cellar audit every 6–12 months | 2–4% loss per year (spoilage) |

Implementation: Create maintenance calendars for each property. Use simple spreadsheets initially, but plan to move to integrated systems as your portfolio grows. Furthermore, asset management automation eliminates the 60% admin burden manual tracking creates. Consequently, your team can focus on strategic decisions rather than administrative tasks.

Pro tip: Track cost per asset for maintenance across similar categories. Vehicle collections with significantly higher maintenance costs (over 8% of value annually) often signal underlying mechanical issues. Similarly, art pieces requiring frequent conservation may have environmental storage problems needing strategic fixes. Therefore, cost tracking becomes an early warning system for systemic issues.

Phase 3: Integrate Financial Data for Complete Asset Visibility

Action: Connect maintenance expenses to asset performance metrics for complete financial visibility.

The integration advantage: When you link operational data with financial tracking, patterns emerge. You can identify which assets are appreciation champions versus value drains. Therefore, breaking data silos across asset management creates the unified visibility that drives better decisions. Moreover, integrated data enables portfolio-level analysis that’s impossible when information lives in separate systems.

5 Key Performance Metrics to Track:

- Total cost of ownership – Purchase price + maintenance + storage + insurance over time

- Maintenance cost as % of value – Should stay under 5-8% for most asset categories

- Appreciation vs. market benchmarks – Is your art growing 8-12% annually like blue-chip works?

- Insurance efficiency ratio – Coverage amount / actual replacement value (target: 95-100%)

- Liquidity timeline – How quickly could each asset be monetized if needed?

Implementation: Review quarterly reports showing maintenance spending vs. asset values. Vehicle collections consuming more than 5-8% of value annually in maintenance need immediate attention. Art pieces requiring frequent conservation work need environmental assessments.

Moreover, one family office discovered their wine collection’s climate control was failing, costing 3% annual value loss. The $50,000 system upgrade prevented $150,000 in annual spoilage—paying for itself in four months.

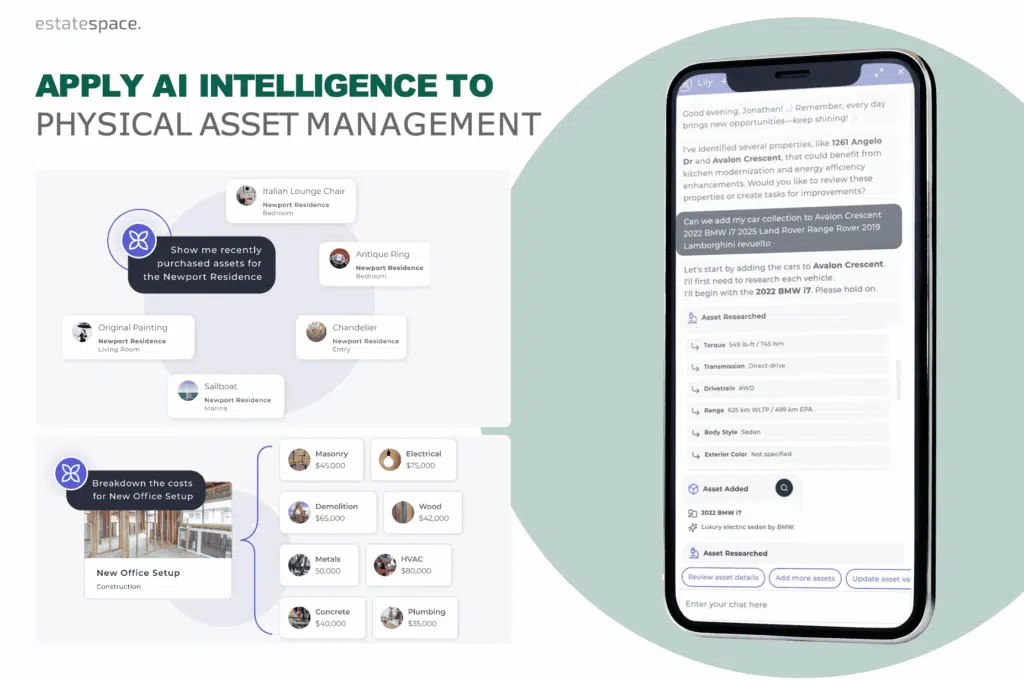

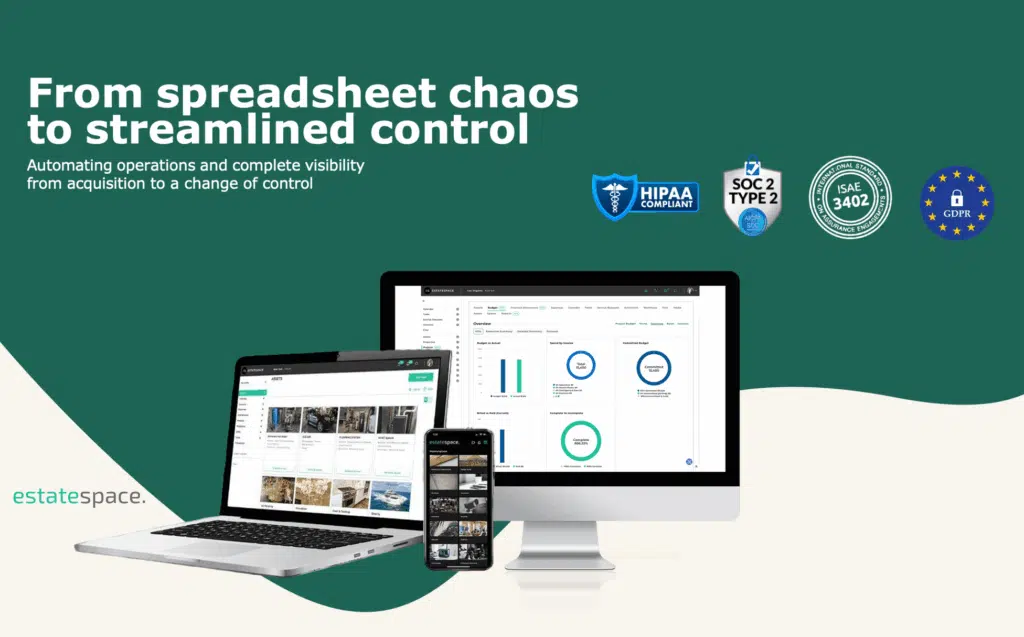

Technology Enabling Accurate Physical Asset Valuation

The most successful family offices have moved beyond spreadsheets to integrated platforms providing:

Real-Time Asset Valuation Dashboards

See the condition and value of every asset across your portfolio in one view. No more hunting through emails or calling multiple vendors for status updates. In addition, real-time visibility enables proactive decisions rather than reactive crisis management. Consequently, you can identify emerging issues before they become expensive problems.

What this looks like: A single dashboard showing all properties, vehicles, art, and collectibles with:

- Current estimated values

- Last appraisal dates

- Upcoming maintenance requirements

- Insurance coverage status

- Environmental monitoring alerts

Automated Maintenance Scheduling Systems

Systems remind you when inspections are due, warranties are expiring, or replacements should be planned—before they become emergencies. Furthermore, AI-powered platforms learn from your portfolio and suggest optimal maintenance timing based on asset performance patterns. As a result, you prevent the crisis scenarios that destroy value overnight.

What this prevents: The $200,000 Ferrari restoration crisis. The $600,000 tax problem from missing records. The $3.5M insurance gap discovered only after a loss. Moreover, automated systems eliminate the human error that causes most valuation failures.

Financial Integration Platforms

Platforms connect operational activities directly to asset values, showing exactly how maintenance investments impact overall portfolio performance. As a result, you can make data-driven decisions about where to allocate resources for maximum value preservation. Therefore, strategic planning becomes evidence-based rather than assumption-driven.

What this enables: Strategic decisions like “Should we restore this vintage car for $150,000 or sell as-is for $400,000?” With complete cost and appreciation data, the answer becomes clear. Additionally, integrated data reveals patterns invisible in siloed systems.

Vendor Coordination Tools

Central communication tools keep contractors, property managers, and family office staff aligned on priorities and timelines. Additionally, vendor performance tracking ensures you’re getting quality work that actually preserves value. Consequently, you build strategic partnerships rather than transactional relationships.

What this solves: The coordination nightmare of managing 15 contractors across 8 properties in 4 states. One family office reduced vendor coordination time by 70% while improving service quality through systematic performance tracking. Furthermore, documented vendor performance enables data-driven selection for future projects.

Physical Asset Valuation Best Practices from Leading Family Offices

1. Annual Valuation Reviews (Not Triennial)

Most family offices update physical asset valuations every 3 years. However, top performers do it annually. Why? In volatile markets, a 3-year-old appraisal for a $5M art piece could be off by $1M+. That’s a 20% valuation error creating insurance gaps and tax miscalculations. Therefore, annual reviews prevent the compounding errors that destroy value over time.

Action: Schedule annual valuation updates for assets over $500,000. Use rolling 3-year cycles for lower-value items. Moreover, prioritize assets in volatile markets for more frequent updates.

2. Environmental Monitoring for High-Value Items

Climate control failures destroy more value than theft. Wine collections, art, vintage vehicles—all require precise environmental conditions. Consequently, one temperature spike can cost millions in irreversible damage.

Real example: A wine collection worth $3M experienced a 3-day climate control failure. Temperature rose 15°F above optimal. Result: $450,000 in spoilage—15% of total value lost in 72 hours. Furthermore, the lost bottles included irreplaceable vintages, compounding the financial loss with historical significance.

Action: Install IoT sensors with 24/7 monitoring and instant alerts for environmental deviations. Cost: $5,000-$15,000. Value protected: Millions. Additionally, automated alerts enable rapid response before damage becomes catastrophic.

3. Quarterly Family Office Asset Reviews

Top family offices treat physical assets like portfolio holdings—with quarterly reviews examining:

- Valuation changes and market trends

- Maintenance costs vs. budget

- Insurance coverage adequacy

- Disposition opportunities

- Acquisition strategies

Moreover, regular reviews create accountability and prevent the drift that leads to value erosion. As a result, issues get addressed when they’re still manageable rather than after they’ve become crises.

Action: Add 30 minutes to quarterly investment committee meetings for physical asset review. Use standardized dashboards showing key metrics and trends. Furthermore, assign specific team members responsibility for tracking and reporting.

4. Professional Appraisal Networks

Maintain relationships with certified appraisers across all asset categories. When you need quick valuations for insurance, estate planning, or sales, having established relationships with qualified professionals saves time and ensures accuracy. Additionally, ongoing relationships provide market intelligence you can’t get elsewhere.

Action: Build your appraiser network now:

- Art: ASA or ISA certified specialists by medium

- Vehicles: Classic car appraisers with auction house connections

- Jewelry: GIA-certified gemologists

- Wine: Wine Spectator-recognized specialists

- Real Estate: MAI-designated appraisers

Consequently, when urgent valuations are needed, you have trusted experts ready to respond immediately.

5. Digital Documentation Standards

Establish standard documentation protocols for all physical assets. Every asset should have:

- High-resolution photos (updated annually)

- Condition reports (updated at inspection intervals)

- Provenance/history documentation

- All appraisal reports (chronological file)

- Maintenance and conservation records

- Insurance certificates and claims history

Therefore, complete documentation eliminates the gaps that create tax problems, insurance disputes, and family conflicts during transitions.

Action: Create digital asset files using consistent naming conventions and folder structures. Cloud-based storage with role-based access ensures information survives team transitions. Moreover, automated backup systems prevent catastrophic data loss.

The ROI of Systematic Physical Asset Valuation

Let’s quantify the financial impact with real numbers:

Scenario: $100M Family Office Portfolio

Asset Breakdown:

- Real estate: $60M (3 primary residences, 2 vacation properties)

- Art and collectibles: $20M

- Vehicles: $12M (vintage and luxury fleet)

- Wine and spirits: $5M

- Jewelry and watches: $3M

Annual Costs Without Systematic Valuation:

| Cost Category | Annual Impact | 10-Year Impact |

|---|---|---|

| Deferred maintenance value loss (3–5% of physical assets) | $3.0M – $5.0M | $30M – $50M |

| Insurance gaps and over-coverage inefficiency | $250K – $500K | $2.5M – $5M |

| Emergency repairs vs. planned maintenance premium | $400K – $800K | $4M – $8M |

| Missed appreciation opportunities (poor timing) | $500K – $1M | $5M – $10M |

| Tax inefficiency from poor documentation | $200K – $400K | $2M – $4M |

| Total Annual Value Destruction | $4.35M – $7.7M | $43.5M – $77M |

Annual Costs With Systematic Valuation:

| Investment Category | Annual Cost |

|---|---|

| Digital asset management platform | $50K – $100K |

| Professional appraisal updates | $75K – $150K |

| Enhanced maintenance protocols | $200K – $300K |

| Staff training and implementation | $50K – $100K |

| Total Annual Investment | $375K – $650K |

Net Annual Savings: $3.7M – $7.05M

10-Year Value Preservation: $37M – $70.5M

ROI: 570% – 1,080%

These aren’t theoretical numbers. They’re based on actual family office data showing systematic physical asset valuation for family offices delivers 5-10x returns through value preservation alone—before counting appreciation optimization and tax efficiency gains.

Implementation Roadmap: Your First 90 Days

Weeks 1-2: Asset Discovery and Prioritization

- Inventory all physical assets across properties

- Identify highest-value items (top 20% by value)

- Assess current documentation gaps

- Establish baseline valuation dates

During this phase, focus on understanding the full scope of your portfolio. Additionally, prioritize assets that represent the greatest financial exposure or immediate risk.

Weeks 3-4: Professional Network Assembly

- Contract certified appraisers for each major category

- Schedule initial valuation assessments for high-value items

- Set up vendor management protocols

- Establish communication frameworks

Next, you’ll build the professional relationships essential for ongoing valuation accuracy. Furthermore, establishing these connections early prevents delays when urgent valuations are needed.

Weeks 5-8: Documentation and Systems Setup

- Photograph and document all major assets

- Digitize existing records and appraisals

- Set up digital asset management system

- Create maintenance calendars and schedules

At this stage, systematic documentation begins transforming scattered information into actionable intelligence. Moreover, digital systems enable the automation that makes ongoing management sustainable.

Weeks 9-12: Integration and Review

- Connect operational data to financial systems

- Generate first comprehensive asset portfolio report

- Conduct quarterly review with family office leadership

- Refine processes based on initial insights

Finally, integration creates the unified visibility that drives better decisions. As a result, you’ll see patterns and opportunities that were invisible when data lived in silos.

Beyond 90 Days:

- Quarterly asset portfolio reviews

- Annual valuation updates

- Continuous improvement of processes

- Expansion to medium and lower-value assets

Consequently, the systematic approach you’ve established in 90 days becomes the foundation for long-term wealth preservation.

Key Principles for Successful Physical Asset Valuation

1. Treat physical assets like financial portfolios. They require systematic documentation, regular valuation, strategic planning, and active management. Consequently, family offices applying investment discipline to physical assets preserve significantly more value across generations. Moreover, this disciplined approach enables data-driven decisions rather than reactive crisis management.

2. Prevention is 100x cheaper than correction. Environmental monitoring costs $10,000. However, climate control failure costs $450,000. Insurance gap analysis costs $5,000, but discovering the gap after a loss costs millions. Therefore, proactive investment in systematic valuation pays for itself many times over through crisis prevention.

3. Documentation quality determines succession success. Complete records enable smooth generational transfers. In contrast, incomplete documentation creates tax nightmares, family disputes, and value destruction. In fact, 90% of third-generation wealth loss stems from poor documentation and valuation practices. Consequently, investing in documentation infrastructure becomes one of the highest-ROI activities any family office can undertake.

4. Technology is the scalability multiplier. Manual processes collapse as portfolios grow. Furthermore, AI-powered platforms handle complexity that humans cannot, enabling better decisions with less administrative burden. As a result, family offices using systematic technology approaches manage 3-5x more assets per team member while maintaining higher quality oversight.

5. Professional networks are competitive advantages. No single team has expertise across all asset categories. Therefore, curated specialist relationships provide market intelligence and execution capabilities that preserve and grow value. Additionally, these networks become more valuable over time as relationships deepen and knowledge compounds.

Take Control of Your Physical Asset Value

Greek philosopher Epictetus understood this principle centuries ago: “Some things are within our control, and some things are not.” While you can’t control market downturns or natural disasters, you absolutely can control how well you understand and manage your physical assets.

The families who successfully preserve wealth across generations share one common trait: they treat their physical assets with the same rigor and attention as their financial investments. Consequently, they avoid the 90% wealth loss rate that plagues families without systematic valuation approaches.

Your next steps for implementing world-class physical asset valuation:

This week: Choose your highest-value property and begin documenting every major system and asset

This month: Establish maintenance schedules for all critical systems across your top three properties

Next quarter: Implement integrated reporting connecting maintenance activities to asset values

The complexity of managing substantial physical asset portfolios requires more than traditional approaches. It demands technology purpose-built for the unique needs of sophisticated asset owners who understand that true wealth preservation starts with complete asset visibility.

Transform Physical Asset Chaos Into Strategic Advantage

EstateSpace provides comprehensive asset management solutions designed specifically for family offices requiring institutional-grade physical asset valuation capabilities.

Our Origin Story: Built by Operators, Not Consultants

We’re not consultants who think they understand your challenges. Instead, we’re former estate operators who spent 16 years drowning in the exact problems you face today. Consequently, we built EstateSpace because nothing else solved the physical asset valuation crisis we lived daily. Moreover, every feature in our platform addresses a real pain point we experienced firsthand.

Platform Capabilities That Eliminate Valuation Gaps

Our platform delivers:

AI-powered documentation – Drop spreadsheets and photos, get complete asset records in minutes. Furthermore, our AI learns from your portfolio patterns and suggests optimal documentation standards.

Automated valuation tracking – Market monitoring with alerts when assets hit appreciation thresholds. Additionally, continuous tracking prevents the 3-year valuation gaps that create insurance and tax problems.

Predictive maintenance scheduling – AI generates optimal service timing preventing emergency repairs. As a result, you avoid 80% of the costly conservation crises that destroy value.

Real-time portfolio dashboards – Complete visibility across all properties and asset categories. Therefore, decision-making becomes data-driven rather than reactive.

Insurance gap analysis – Continuous coverage monitoring preventing millions in exposure. In fact, most clients discover significant gaps within the first 30 days.

Vendor performance tracking – Systematic evaluation ensuring quality work preserving value. Moreover, performance data enables strategic vendor relationships rather than transactional ones.

Quantified Impact: The Numbers That Matter

- 60% reduction in administrative burden

- 40% faster succession planning

- 95% capture of appreciation opportunities

- 80% prevention of conservation crises

- Zero transition gaps when team members leave

These aren’t marketing claims—they’re average results from family offices who’ve implemented systematic physical asset valuation approaches. Furthermore, most see ROI within the first 12 months.

Your Next Step: A Practical Conversation

Schedule a conversation with someone who’s lived your frustration and built the solution. No sales pitch—just a practical discussion about physical asset valuation challenges and whether EstateSpace makes sense for your portfolio complexity. Additionally, we’ll share specific strategies relevant to your asset mix and organizational structure.

Three Questions to Guide Your Decision:

- Can you accurately state the current value and condition of every asset over $100,000 right now?

- Do you have systematic processes preventing 3-5% annual value erosion from deferred maintenance?

- Could your team execute a complete generational wealth transfer with zero documentation gaps?

If you answered “no” to any question, the cost of inaction exceeds the investment in systematic valuation by 5-10x annually.

Your physical assets represent decades of wealth accumulation. The question isn’t whether to implement systematic valuation—it’s how quickly you can stop the value erosion happening right now.

Start with what you can control. Start with complete physical asset valuation visibility.