When Your Million-Dollar Assets Are Managed Like Garage Sale Items

Picture this: Your family office oversees a $500 million portfolio that includes multiple properties, a yacht collection, vintage automobiles, and priceless art. Yet when the principal asks about the Picasso’s last appraisal or the yacht’s maintenance schedule, you find yourself frantically searching through emails, calling vendors, and realizing your spreadsheets haven’t been updated in months. This chaos demonstrates exactly why you need a robust asset management software solution to organize your valuable holdings.

This scenario highlights the critical need for a comprehensive asset management software solution designed specifically for family offices managing diverse, high-value portfolios. Furthermore, without proper systems, even the most valuable assets can become operational liabilities rather than protected investments.

Why Traditional Asset Management Software Solutions Fall Short for Family Offices

Asset managers and family office directors face unique challenges that generic tools simply cannot address. Moreover, the stakes are exponentially higher when managing assets worth millions rather than thousands.

Critical Operational Breakdowns

- Scattered Information: Unfortunately, asset details spread across multiple spreadsheets, emails, and vendor systems

- Reactive Maintenance: Similarly, expensive emergency repairs that could have been prevented with proactive care

- Communication Gaps: Furthermore, poor coordination between asset managers, vendors, and family members

- Security Risks: Additionally, sensitive asset information shared through unsecured channels

These challenges create significant financial risks. Therefore, a purpose-built asset management software solution becomes essential for protecting high-value portfolios.

As McKinsey’s analysis of Asia-Pacific family offices reveals, the number of single-family offices has quadrupled since 2020, with these entities increasingly seeking sophisticated technology solutions to manage complex, multi-jurisdictional portfolios effectively.

How Asset Management Software Solutions Transform Operations

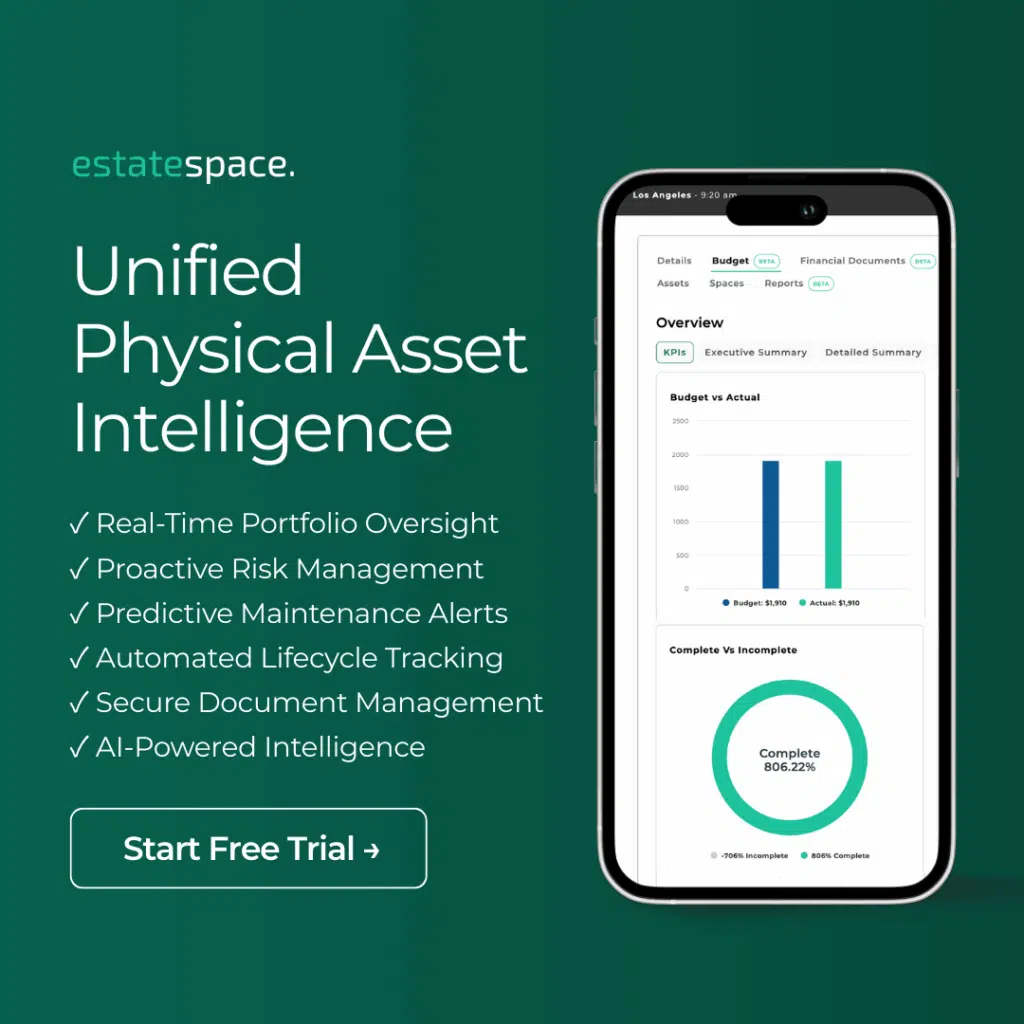

Modern asset management software solutions like EstateSpace address these challenges through integrated platforms designed specifically for high-value asset portfolios. Our comprehensive platform transforms how family offices manage their diverse investments.

Centralized Asset Visibility

Real-Time Tracking: Maintain complete visibility into every asset’s location, condition, and status through a unified dashboard. Additionally, automated updates ensure information remains current and accessible to authorized stakeholders.

Comprehensive Profiles: Each asset maintains a complete digital record including purchase details, maintenance history, appraisals, insurance information, and documentation.

Streamlined Management Processes

Integrated Communication: Replace email chains with secure, organized channels that maintain complete conversation histories and attach documents directly to asset records.

Automated Workflows: Establish systematic processes for maintenance scheduling, appraisal reminders, and compliance tracking that operate automatically.

Proactive Maintenance and Care

Predictive Scheduling: AI-driven algorithms analyze usage patterns and manufacturer recommendations to schedule optimal maintenance timing.

Automated Alerts: Receive proactive notifications for upcoming maintenance, expiring warranties, and compliance deadlines.

This systematic approach is particularly valuable for demonstrating measurable value and maintaining detailed reporting for family office principals.

Implementation Framework for Asset Management Software Solution Success

Successfully deploying an asset management software solution requires a systematic approach that addresses both immediate operational needs and long-term strategic goals.

Phase 1: Assessment and Setup

Complete Inventory: First, conduct thorough documentation of all assets including detailed descriptions, locations, conditions, and values. This baseline provides the foundation for effective digital management.

System Configuration: Subsequently, configure the platform to match specific family office workflows, reporting requirements, and access controls.

Phase 2: Integration and Training

Staff Onboarding: Next, ensure all team members understand system capabilities and can effectively utilize features for maximum efficiency.

Vendor Integration: Additionally, establish connections with existing service providers, ensuring seamless information flow and communication channels.

Phase 3: Optimization

Performance Monitoring: Furthermore, establish key performance indicators for asset condition, maintenance costs, and vendor performance to track management effectiveness.

Continuous Improvement: Finally, regularly review and refine processes based on performance data and changing family office needs.

For comprehensive guidance on estate management best practices, explore our detailed resource on Understanding Estate Management: Beyond Household Operations.

Risk Management Through Digital Asset Management Software Solution Oversight

High-value asset management involves significant risk exposure that requires systematic mitigation. Furthermore, these operational challenges often expose underlying vulnerabilities. Learn more about protecting valuable portfolios in our analysis of Physical Asset Risk Management for Family Offices.

Key Risk Mitigation Areas

- Financial Protection: Initially, proactive maintenance preserves asset values and prevents costly emergency repairs

- Compliance Assurance: Meanwhile, automated tracking of regulatory requirements and legal obligations ensures adherence

- Security Enhancement: Additionally, controlled access to sensitive asset information and location data protects privacy

Many operational complexities can be addressed through targeted AI solutions. Consequently, explore our examination of Private Property Management Challenges: 5 AI Workflows That Work for specific technology implementations.

The Strategic Value of Professional Asset Management Software Solutions

Implementing a comprehensive asset management software solution creates strategic advantages that enhance overall family office performance.

Enhanced Decision-Making: Consequently, complete asset performance data supports strategic decisions about acquisitions, dispositions, and optimization strategies.

Improved Transparency: Furthermore, real-time reporting builds trust with family members and external advisors through organized information sharing.

Succession Planning: Successfully managing family assets often extends beyond current generation needs. For families planning long-term transitions, building systematic processes is crucial—learn more in our guide to Post Construction Management: Client Relationships That Last.

Ready to Transform Your Asset Management Software Solution Approach?

The difference between reactive asset management and strategic portfolio optimization comes down to having the right technology foundation. An asset management software solution isn’t just about tracking assets—it’s about building operational infrastructure that protects and enhances family wealth across generations.

EstateSpace clients consistently achieve:

- Complete asset visibility across diverse, high-value portfolios

- 33% reduction in maintenance and operational costs

- Enhanced risk mitigation through systematic documentation

- Improved stakeholder satisfaction through transparent reporting

Your assets represent decades of wealth creation. Similarly, your family’s legacy deserves institutional-grade protection. Moreover, your operational efficiency directly impacts long-term asset performance.

Contact us today to discover how EstateSpace’s asset management software solution can transform your family office operations and provide comprehensive oversight your portfolio deserves.

EstateSpace provides purpose-built asset management software solutions designed specifically for family offices managing complex, high-value portfolios with the discretion, security, and sophistication that modern wealth management demands.