Why High-Value Asset Management Feels Like an Uphill Battle (And How AI Changes Everything)

If you’re reading this at 2 AM because you’re still reconciling property maintenance costs across three different spreadsheets, you’re not alone. AI-powered asset management is transforming how family offices handle multi-generational portfolios and how asset managers streamline client properties. The struggle with scattered systems is real—and it’s costing more than just sleep.

The Hidden Cost of Scattered Systems

Last week, I spoke with a family office director who discovered their team was spending 60% of their time just gathering information. “We have the best people,” she said, “but they’re drowning in administrative chaos instead of protecting our assets.” This is exactly why AI-powered asset management has become essential.

Sound familiar? When your estate management operations are scattered across 10-20 different tools, every day becomes a treasure hunt for critical information. The result? Private property management challenges that compound into serious financial exposure.

What Keeps Asset Professionals Up at Night

The professionals we work with consistently share three core frustrations that AI-powered asset management directly addresses:

Knowledge Risk: What happens when your longtime property manager retires and takes decades of vendor relationships and maintenance history with them? Family offices consistently cite this as their biggest operational vulnerability.

Reactive Management: Instead of preventing issues, teams spend their days putting out fires. Emergency repairs cost 3-4 times more than preventive maintenance, yet predictive maintenance for high-value asset portfolios remains elusive without proper systems.

Client Expectations: Today’s ultra-high-net-worth families expect the same real-time visibility for their physical assets that they have for their financial portfolios. Yet most asset managers are still generating monthly reports manually.

These challenges align with recent industry research. A Deloitte report surveying 354 single family offices globally identified technological advancements and operational efficiency as top concerns facing family offices in 2024, confirming what we see daily in our conversations with clients.

How AI-Powered Asset Management Transforms Operations

The game-changer isn’t just consolidating tools—it’s leveraging AI-powered asset management to anticipate needs before they become problems. Modern AI workflows can:

- Predict maintenance needs before equipment fails, reducing emergency costs by up to 40%

- Automate routine tasks like scheduling and vendor coordination, freeing up 60% of administrative time

- Generate insights from asset data that would take humans weeks to compile

Consider how mastering the shift from construction to residential maintenance services becomes seamless when AI maintains complete project history and automatically schedules ongoing care based on manufacturer recommendations and usage patterns.

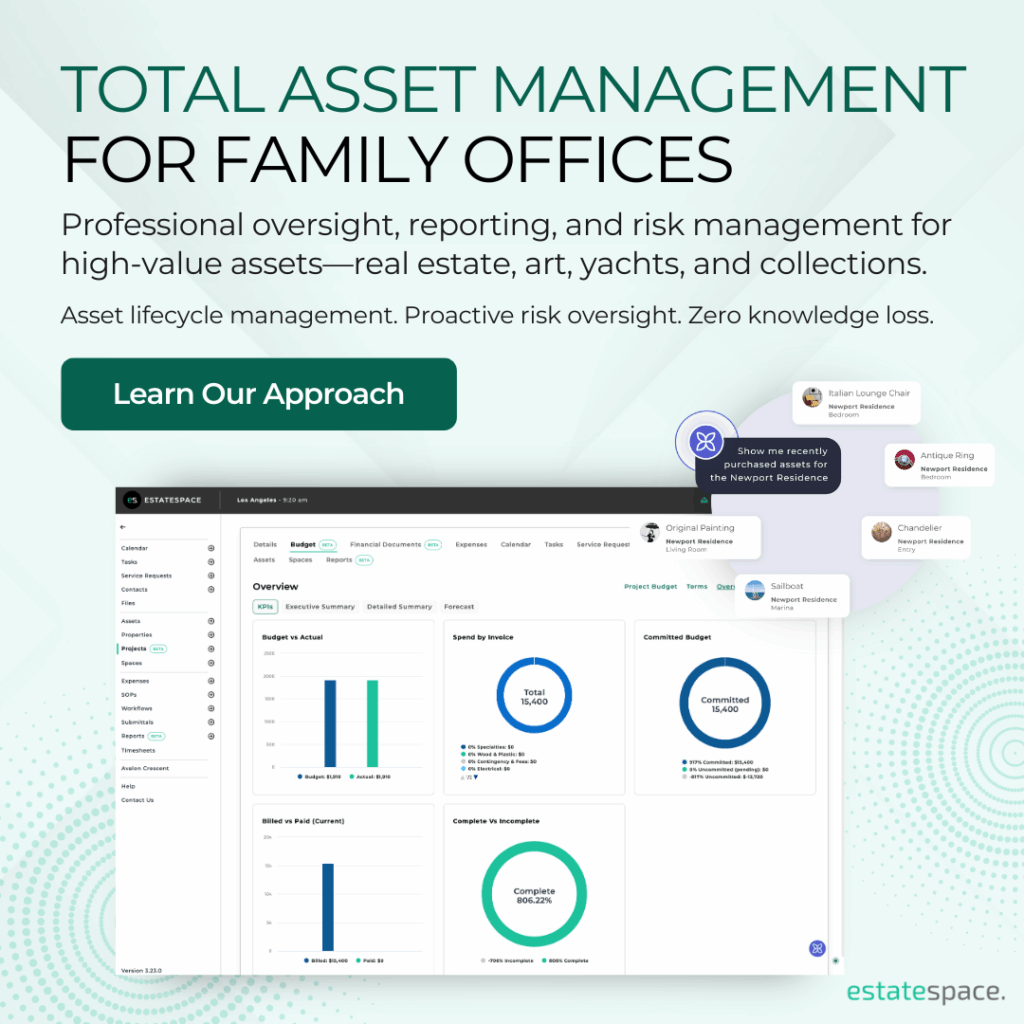

The EstateSpace Difference: AI-Powered Asset Intelligence

EstateSpace isn’t just another platform—it’s the first AI-powered asset management ecosystem built specifically for high-value physical assets. Our product overview showcases AI agents that work 24/7 to:

- Consolidate scattered data from acquisition to ownership transfer

- Generate predictive alerts for maintenance, compliance, and risk management

- Automate workflows that previously required constant manual oversight

Project managers using our platform report delivering projects on time and budget while building ongoing client relationships through seamless operational transitions. Meanwhile, family offices achieve institutional-grade oversight without expanding their teams.

Real-World Impact: Beyond Software Features

AI-powered asset management delivers outcomes that matter beyond traditional features:

For Family Offices: Reduce carrying costs by 33% while ensuring knowledge preservation across generational transitions. No more losing critical asset information when key team members leave.

For Asset Managers: Transform from reactive administrators to strategic advisors. Generate sophisticated reports in minutes, not days, while preventing costly compliance issues.

For Project Managers: Turn one-time construction projects into ongoing asset management relationships, with complete visibility from build to long-term maintenance.

Learning from Industry Leaders

Essential software for family office operations has evolved rapidly, with leading offices sharing strategies for estate maintenance cost control through data-driven approaches. The most successful teams implementing AI-powered asset management focus on:

- Implementing AI solutions for property management challenges before problems compound

- Developing systematic approaches to asset oversight that scale with portfolio growth

- Building vendor relationships that support long-term value preservation

Making the Transition: Practical Next Steps

Change doesn’t happen overnight, but the cost of inaction compounds daily. AI-powered asset management platforms offer immediate benefits. Start by:

- Auditing current inefficiencies: Track how much time your team spends on manual data gathering versus strategic asset management

- Calculating hidden costs: Most offices spend 15-20% more than necessary on carrying costs due to reactive management

- Exploring integrated solutions: Research platforms designed specifically for high-value asset management, not generic property management tools

The Future of Asset Management Is Here

The families and institutions winning in today’s market aren’t just managing assets—they’re leveraging AI-powered asset management to protect and optimize them proactively. They’re preventing problems instead of reacting to them, and they’re doing it all with unprecedented efficiency.

Your assets deserve the same sophisticated oversight you expect for financial portfolios. The question isn’t whether to modernize—it’s whether you’ll lead the transformation or follow others who do.

Ready to Transform Your Asset Management?

Every day of reactive management is another day of hidden costs and unnecessary risk. See how EstateSpace’s AI-powered asset management platform can reduce your administrative burden while enhancing asset protection.

Schedule a personalized consultation to discover how leading family offices and asset managers are achieving 33% cost reductions while delivering superior client outcomes.

Because your assets—and your peace of mind—deserve better than scattered spreadsheets and reactive management.