The call every risk manager dreads: “We have an insurance claim denial.” Last month, a family office faced a $280,000 claim rejection when their insurer found a wine storage system running outside required settings for months, voiding coverage for a $150,000 collection loss. Predictive asset maintenance would have spotted the temperature changes and stopped both loss and coverage lapse.

Research shows that predictive maintenance reduces downtime by 35-50% while extending asset lifespan by up to 40%. Yet most families operate reactively—waiting for system failures before addressing problems that predictive intelligence could identify months in advance.

The True Cost of Reactive Versus Predictive Asset Maintenance

Managing multiple homes, art collections, recreational assets, and valuable holdings requires smart oversight used for family office financial portfolios. Unlike investment portfolios with real-time view, physical asset management often relies on old approaches creating operational, financial, and compliance risks.

You’re managing maintenance across multiple properties without central view, each with unique systems, vendor relationships, and failure patterns. Predictive intelligence handles these connections while managing scattered documentation creating audit gaps.

Three Critical Problems Traditional Maintenance Creates

- Insurance Coverage Gaps Reactive maintenance creates gaps insurers exploit while untracked costs lead to budget overruns. Environmental monitoring failures void policies after the fact, and poor insurance management adds to financial risk.

- Cascading Risk and Asset Value Drift System failures trigger multiple risk events while poor maintenance records create value drift. A wine storage problem voids coverage, triggers compliance issues, and hurts expense forecasting when documentation is poor. Hidden costs destroying physical asset value compound over time, often invisibly until major damage occurs.

- Compliance Documentation Risk Critical indicators remain spread across systems, creating poor audit trails. Poor record-keeping creates gaps during personnel changes, especially with weak succession docs.

How Predictive Asset Maintenance Works

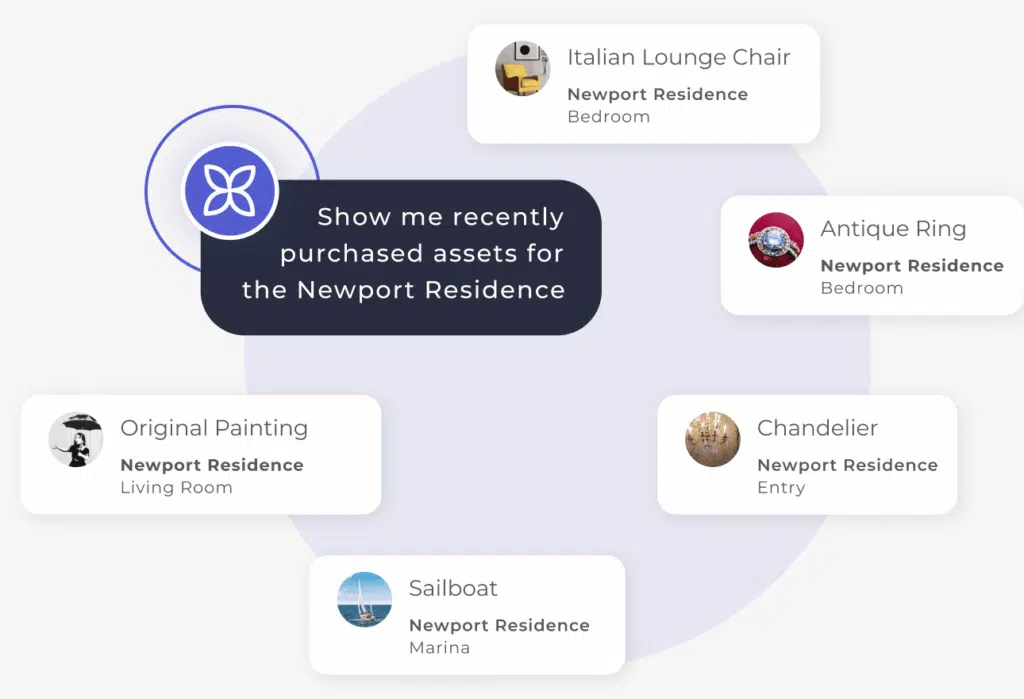

Modern predictive maintenance uses AI to analyze temperature changes, vibration patterns, energy use, and usage cycles. EstateSpace’s purpose-built intelligence learns from your assets, building predictive models that become more accurate over time.

What Our Predictive Asset Maintenance AI Monitors

Environmental Compliance and Risk Monitoring:

- Temperature/humidity limits for insurance validity

- Real-time environmental threats with geographic mapping

- Weather-related alerts across multiple locations

- Emergency response plans with disaster prep

Insurance and Asset Value Management:

- Automated renewal tracking with coverage gap analysis

- Integration with appraisal schedules and value services

- Market analysis and performance tracking

- Claims docs with complete audit trails

Project and Maintenance Coordination:

- Central oversight with budget variance analysis

- Automated scheduling and vendor coordination

- Quality control for warranty/insurance compliance

- Timeline management across concurrent projects

Meeting Next-Generation Expectations

The next generation expects tech sophistication matching financial portfolio experience. They check investment performance in real-time and ask: “Why can’t I have the same view for our physical assets?”

Modern asset managers recognize this shift, understanding complete management requires high-level intelligence for physical assets matching financial investments.

Building Institutional Knowledge Through Predictive Asset Maintenance

Smart family offices understand predictive asset maintenance builds helpful risk intelligence surviving personnel changes and creating operational strength.

When risk managers transition, critical compliance knowledge disappears. Insurance requirements, environmental limits, and coverage conditions vanish overnight, creating gaps insurers exploit.

Our complete platform transforms operational risk knowledge from personal dependency into company asset. Every compliance event and risk limit becomes part of growing intelligence for future decisions.

The Institutional Knowledge Framework

Insurance Compliance Intelligence: Our system tracks policy requirements across coverage types, building understanding of renewal cycles, coverage gaps, and compliance conditions.

Risk Limit Monitoring: We establish monitoring baselines while integrating with appraisal schedules, tracking how conditions affect compliance status and asset values.

Project Management Integration: The platform codes insurance requirements and compliance rules while maintaining central docs, ensuring new team members understand risk limits.

Risk Management and Financial Impact

Predictive asset maintenance transforms risk management from reactive insurance coverage to proactive asset protection. When managing hundreds of millions in physical assets, risk reduction stops problems before impacting values or experiences.

Comprehensive Risk Mitigation

Beyond Insurance Coverage: Traditional risk management focuses on coverage after problems occur. Predictive asset maintenance stops conditions that trigger coverage lapses and claim denials, protecting immediate financial risk and long-term insurability.

Risk Intelligence: Early detection stops cascading risk events when system failures create multiple problems. Real-time monitoring provides early warning systems for environmental threats while geographic mapping enables coordinated emergency response.

Continuous Compliance: Predictive intelligence maintains operational limits insurers require while providing automated value tracking, ensuring coverage remains valid and current values support estate planning.

Financial Value Creation

- Insurance Cost Optimization: Proactive compliance monitoring reduces premiums by 15-30% while preventing coverage lapses through centralized policy management.

- Asset Value Preservation: Predictive maintenance prevents value drift while providing current values supporting estate planning and professional appraisals.

- Operational Risk Reduction: Comprehensive monitoring enables strategic risk management while preventing untracked costs through standardized processes.

- Project Management Risk Mitigation: Continuous monitoring prevents regulatory violations creating liability exposure while ensuring quality control documentation.

Technology That Respects Privacy

Family office operations require technology that enhances privacy rather than hurting it. EstateSpace operates on private cloud infrastructure with enterprise-grade security protocols designed for ultra-high net worth families.

Predictive asset maintenance visibility maintains compliance documentation insurers require while preserving privacy and confidentiality smart families need.

Implementation: A Thoughtful Predictive Asset Maintenance Approach

Successful implementations begin with focused monitoring of highest-value assets and failure modes. We start with systems representing greatest financial risk—primary residence HVAC, security systems, and preservation equipment protecting valuable collections.

Predictive asset maintenance monitoring expands to cover the full portfolio, building intelligence while demonstrating value at each phase. This allows families to validate effectiveness while maintaining deliberate pace complex operational changes require.

The Future of Asset Management

Predictive asset maintenance represents a fundamental shift from reactive problem-solving to proactive stewardship. Families establishing predictive infrastructure today gain significant operational advantages tomorrow.

Predictive asset maintenance protects insurance coverage and risk management frameworks safeguarding your family’s legacy. When you predict and prevent conditions triggering coverage lapses rather than react to claim denials, you ensure both valued assets and protection systems remain optimal for generations.

Learn Our Approach to discover how predictive asset maintenance can transform your family’s asset portfolio management while respecting the privacy, security, and operational excellence that your family deserves.