If you’re overseeing estates worth tens of millions, you need an AI estate management platform that eliminates operational chaos. Yet most family offices still rely on spreadsheets for tracking yachts, managing multiple residences, and coordinating insurance renewals—an approach that fails when critical information lives scattered across email threads and departing employees’ heads.

It’s not a staffing problem. It’s a structural reality: while financial assets benefit from sophisticated technology, physical asset management remains trapped in manual processes and fragmented systems that erode value and create risk.

The question family offices keep asking: What happens to everything we know when the people who know it leave?

The Unstructured Data Problem Estate Management Technology Hasn’t Solved

Here’s what makes physical asset management uniquely challenging: every document looks different. Purchase agreements, maintenance logs, appraisals, inspection reports, vendor contacts—they arrive as PDFs, scanned images, emails, photos. No two properties organize information the same way.

Traditional software requires manual data entry, but a purpose-built AI estate management platform eliminates this bottleneck entirely. Someone previously sat there transcribing details from disparate sources into rigid fields for months. By the time onboarding finished, the information was already outdated.

According to research on family office trends, organizations face distinctive operational challenges stemming from fragmented systems and heavily manual processes—challenges that create inherent risks including missed maintenance requirements and inadequate asset documentation. Four Family Office Trends to Watch in 2025

This isn’t sustainable when you’re managing diverse holdings across multiple properties.

Purpose-Built AI Platform for Complex Estate Holdings

EstateSpace was founded by professionals who spent 16 years actually managing ultra-high-net-worth estates—building luxury properties, coordinating vendors, preventing emergencies at 2 AM. We didn’t start with software and try to understand estates. We started with estates and built the technology they desperately needed.

The AI estate management platform handles what financial software never could: jets, yachts, art collections, multiple residences, livestock, infrastructure projects. Everything from acquisition through ongoing management to eventual ownership transfer.

But here’s what matters most: AI workflows that understand your unstructured reality.

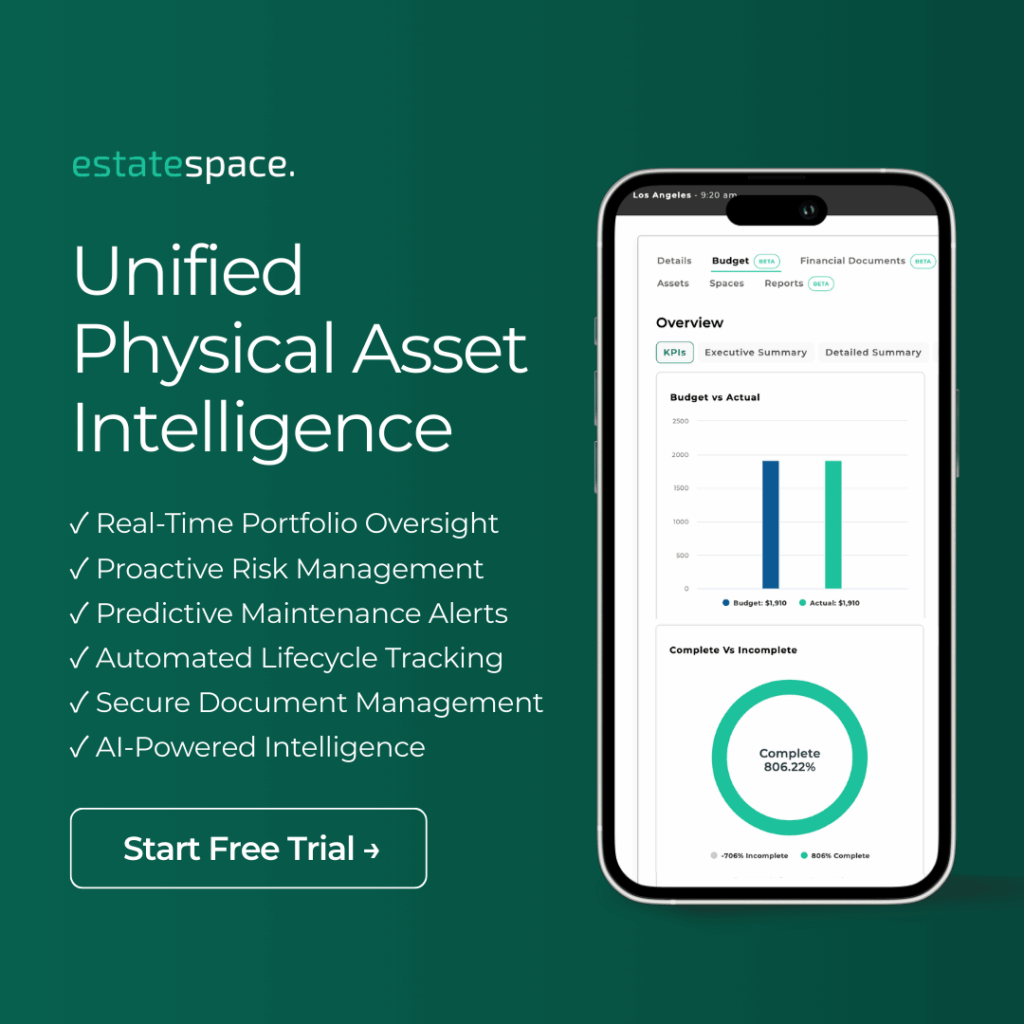

How AI-Powered Estate Management Transforms Operations

1. Intelligent Data Import Drop in purchase agreements, inspection reports, warranties, vendor contacts—in any format, any language. The AI extracts relevant details, structures the information, and populates your asset records. What used to take months now happens in hours.

2. Proactive Maintenance Orchestration The system doesn’t just remind you about scheduled maintenance. It analyzes asset histories, identifies patterns, predicts issues before they become expensive emergencies, and coordinates vendor scheduling. This transforms maintenance from reactive to strategic.

3. Insurance Gap Analysis AI cross-references your asset portfolio against policy coverage, identifying uninsured exposure. When that art collection appreciates or you acquire a new property, you know immediately what needs updating—before renewal deadlines pass.

4. Succession-Ready Documentation Every decision, every vendor relationship, every maintenance protocol gets captured and contextualized. When staff transitions happen, institutional knowledge transfers seamlessly through the AI estate management platform. The new estate manager inherits clarity, not chaos.

The UBS Global Family Office Report 2025 found that just over half of family offices globally have wealth succession plans in place, with many delaying action because they believe they have plenty of time—underscoring the critical need for systematic knowledge preservation. UBS Global Family Office Report 2025: all eyes on the global trade war | UBS Global

Real Outcomes from AI Estate Platforms: The 33% Cost Reduction

How does an AI estate management platform reduce carrying costs by a third? By eliminating inefficiencies that stem from fragmented information:

- Preventive maintenance replaces emergency repairs (30-40% reduction in crisis costs)

- Vendor optimization through performance tracking and consolidated relationships

- Insurance precision eliminates over-coverage and closes gaps

- Time recapture when your team stops hunting for information and starts managing strategically

One client managing 15,000 square feet across multiple properties condensed weekly coordination from hours to minutes. Not by cutting corners—by automating the administrative complexity that consumed their days.

Beyond Property: Complete Portfolio Visibility

Starting Q1 2026, the platform expands into private investments—venture capital, private equity, direct real estate, natural resources, private credit. The same AI-driven approach that organizes physical assets will roll up valuations and distributions across your entire alternative portfolio.

Questions like “What are projected distributions over the next six months?” or “What’s the current valuation of this illiquid holding?” become answerable in real-time, not after weeks of Excel reconciliation. This integrated AI estate management platform approach matters because wealth management requires visibility across everything you own, not just what trades on public markets.

Built Alongside Leading Family Offices

Every feature emerged from real operational needs. The platform development includes collaboration with leading family offices, asset managers at Geller & Co., Manhattan Venture Partners, Bloomberg—professionals managing complex portfolios who needed technology that actually understood their work.

We maintain SOC 2 Type 2, HIPAA, and GDPR compliance. Our churn rate dropped to 1.8% once we achieved product-market fit because the AI estate management platform solves problems people didn’t think were solvable.

Seamless Integration with Existing Systems

EstateSpace doesn’t try to be your accounting system or wealth reporting platform. Instead, it plugs into your existing stack—whether that’s SAGE, Bill.com, or institutional-grade systems used by multi-family offices. The goal isn’t replacing what works; it’s connecting what’s disconnected.

This matters when you’re transitioning from construction to ongoing maintenance or coordinating between your tax team, legal counsel, and estate staff.

Who Benefits from Intelligent Estate Management

Family Offices: When succession planning keeps you up at night because critical knowledge lives in people’s heads, not systems. When you suspect you’re spending 15-20% more than necessary but can’t pinpoint where. When the next generation expects technology sophistication that didn’t exist before.

Asset Managers: When clients demand transparency you can’t deliver efficiently. When you’re competing against firms who’ve embraced modern tools. When 60% of your time goes to administrative work instead of strategic advisory.

Project Managers: When you complete a $50 million construction project but have no seamless path to ongoing operations. When vendor relationships and project specifications evaporate after handoff. When you want recurring client relationships, not one-time engagements.

What Changes with This Approach

Your morning shifts from chasing information to reviewing insights. Vendors coordinate themselves within established protocols. Maintenance happens before things break. Insurance coverage matches actual risk. When someone asks about an asset, you have answers immediately—not after hours of research.

Most importantly: you stop wondering what happens if key people leave. The institutional knowledge that protects and optimizes wealth lives in the AI estate management platform, accessible to whoever needs it, whenever they need it.

Start with Clarity

We’re not selling software as much as offering a different operational reality. One where transparency and efficiency replace guesswork and fragmentation.

If you’re managing physical assets worth millions and feeling like there should be a better way—there is.

Talk to our team about your specific situation →

Or explore what purpose-built AI estate management looks like in practice. No generic demos—we’ll discuss your actual portfolio complexity and how intelligent workflows address it.

Related Resources: