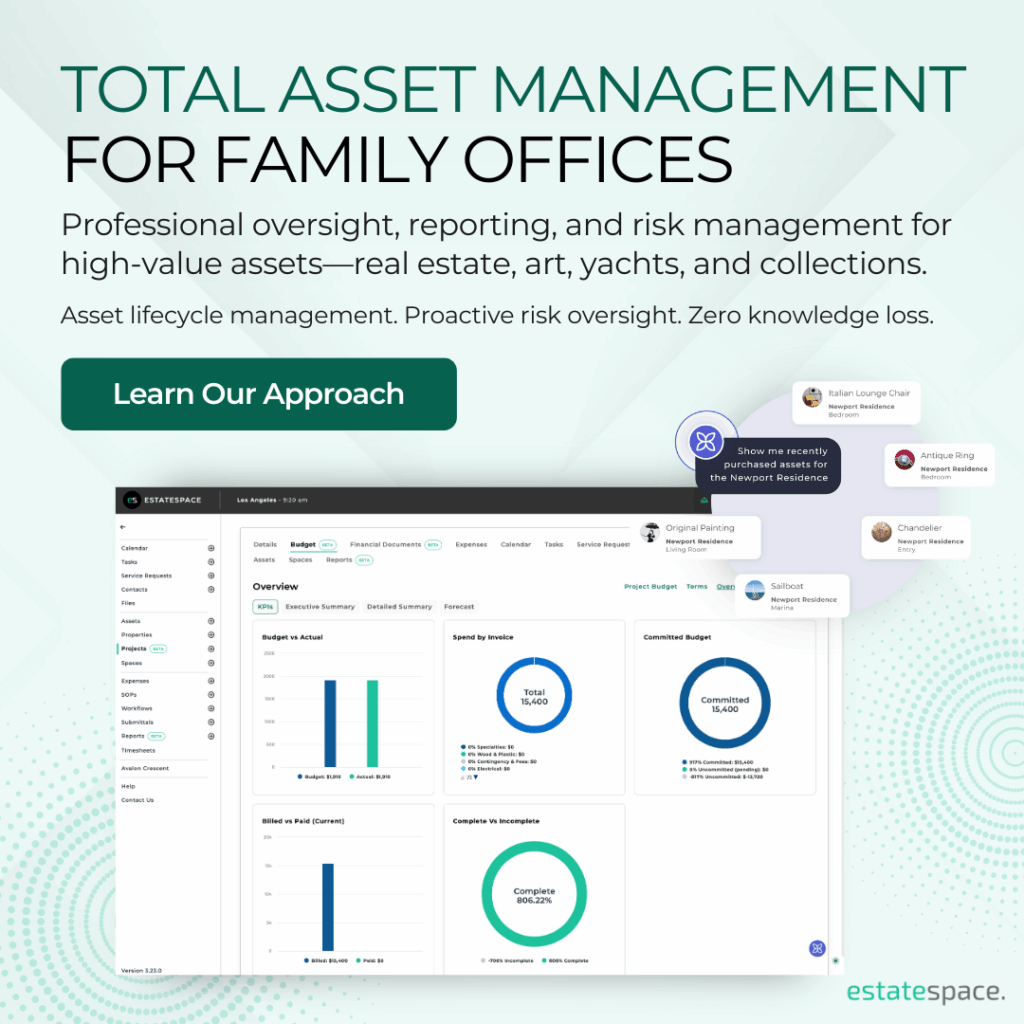

AI Estate Management Platform for Family Offices: Smart Solutions & Luxury Property Technology

An AI estate management platform for family offices has become essential for managing today’s complex luxury property operations. Moreover, estate management has evolved far beyond simple property care. Today’s family offices, asset managers, and project professionals face tough challenges managing multi-million-dollar properties across global portfolios. Furthermore, what happens when your seasoned estate manager retires and takes decades of knowledge with them? Additionally, how do you keep great operations while controlling rising costs that can easily consume 15-20% more than needed?

The answer lies in smart automation. Therefore, AI estate management platforms for family offices are changing how luxury properties are managed. As a result, these platforms offer wealthy families the same real-time oversight they expect from their financial portfolios.

The Hidden Costs of Traditional Family Office Estate Management

Managing luxury estates traditionally relies on human expertise, spreadsheets, and broken communication systems. Additionally, consider the typical challenges: A family office overseeing five properties across three countries struggles with vendor coordination, maintenance scheduling, and budget oversight. Furthermore, critical information lives in someone’s head or buried in email chains. Consequently, when staff turnover occurs, knowledge walks out the door.

The financial impact is huge. Therefore, most family offices spend 15-20% more than needed on property carrying costs due to poor operations. For example, for a family managing $50 million in real estate assets, this represents $7.5-10 million in unnecessary expenses annually.

As a result, modern estate management operations require a different approach—one that combines human expertise with AI technology.

How AI Estate Management Platforms Transform Family Office Operations

Artificial intelligence brings new abilities to luxury property management. Moreover, unlike basic property management software, AI estate management platforms for family offices understand the unique needs of high-value assets and wealthy families.

Smart Maintenance Revolution

AI systems analyze past maintenance data, weather patterns, and equipment performance to predict when issues will occur before they become costly emergencies. Moreover, rather than reactive repairs, predictive maintenance strategies enable early interventions that extend asset life while reducing costs by up to 40%.

For instance, AI monitoring detected small HVAC efficiency drops in a Manhattan penthouse that would have resulted in a $75,000 system replacement. However, early intervention with a $3,000 maintenance service extended the system’s life by five years while improving energy efficiency by 20%.

Smart Vendor Management

Furthermore, coordinating contractors across multiple properties requires smart organization. Therefore, AI platforms automatically track vendor certifications, insurance status, and performance history while managing scheduling conflicts and resource allocation. As a result, this prevents scenarios like having the same high-demand specialist double-booked across properties.

Real-Time Financial Control

Additionally, AI provides data-driven cost control strategies by analyzing spending patterns, identifying budget changes before they become significant, and recommending ways to improve.

Smart Solutions for Each Family Office Professional

Family Office Directors and Managing Directors

You oversee complex operations spanning multiple generations and properties. Therefore, AI estate management platforms for family offices provide high-grade transparency with role-based access controls, ensuring sensitive information remains appropriate while enabling efficient operations.

Additionally, key benefits include succession planning automation, where AI documents knowledge and creates searchable repositories of vendor relationships and property preferences. Furthermore, family office operations benefit from AI’s ability to maintain privacy while providing transparency.

Asset and Property Managers

Your success depends on delivering great service while showing clear value. Moreover, AI transforms you from a reactive administrator into a strategic advisor by providing smart reporting and early insights.

Professional asset managers using AI platforms report 60% reduction in admin time, allowing focus on strategic planning and relationship building. Additionally, clients receive detailed reports showing cost savings and asset improvement recommendations—justifying premium service fees.

Project Managers and Owner’s Representatives

Managing luxury property projects involves coordinating multiple specialists while ensuring quality standards. Therefore, AI platforms provide complete project oversight that smoothly transitions from construction to ongoing operations.

Furthermore, rather than losing project history when construction ends, AI systems maintain complete records of specifications, vendor performance, and warranty information—enabling ongoing client relationships.

Family Office Risk Management with AI Estate Management Platforms

Wealthy families rightly focus on security and privacy. Therefore, AI estate management platforms for family offices designed for high-net-worth clients include strong security measures including encrypted data transmission, role-based access controls, and complete audit trails.

Moreover, physical asset risk management extends beyond cybersecurity to include operational risks like vendor reliability and regulatory compliance. Additionally, AI systems provide continuous monitoring and alerts for potential issues before they impact operations.

Easy Implementation Strategy

Successful AI implementation needs careful planning. Therefore, leading families start with pilot programs covering single properties before expanding to full portfolio management.

- Phase 1: Foundation Building – Data consolidation and system integration

- Phase 2: Process Improvement – AI-driven workflows for routine activities

- Phase 3: Strategic Integration – Advanced analytics and strategic planning support

Additionally, essential software for family offices requires customization to match specific family preferences and operational needs.

Measuring Success: ROI and Performance Results

AI estate management platforms for family offices deliver measurable improvements:

- Cost Reduction: 25-35% reduction in operational expenses

- Time Savings: 50-70% reduction in admin tasks

- Asset Care: Extended lifecycles through early maintenance

- Risk Prevention: Prevention of costly emergencies and service disruptions

Overcoming Traditional Family Office Estate Management Limits

Traditional estate management faces five key limits that AI addresses:

- Information Gaps – Therefore, AI centralizes all property information

- Reactive Maintenance – Moreover, predictive analytics enable early intervention

- Manual Coordination – Additionally, automated workflows streamline operations

- Limited Visibility – Furthermore, real-time dashboards provide portfolio-wide insights

- Knowledge Loss – Finally, AI systems preserve knowledge

Additionally, private property management challenges require smart coordination across time zones and seasonal patterns, which AI handles through smart scheduling.

Advanced AI Estate Management Platform Features

According to the Family Office Exchange’s 2024 technology report, “AI and machine learning algorithms can assist in identifying trends, predicting market movements, and optimizing investment strategies, providing family offices with a competitive edge.” Therefore, this industry recognition validates the strategic importance of AI adoption for wealthy family management operations.

Modern AI estate management platforms for family offices integrate multiple technologies:

- Machine Learning continuously improves recommendations by analyzing patterns

- Natural Language Processing enables conversational information retrieval

- Predictive Analytics forecast maintenance needs and budget requirements

- IoT Integration provides real-time data from connected property systems

Additionally, AI-powered asset management represents complete evolution in luxury property operations, applying asset oversight principles to physical portfolios.

Financial Benefits

For a family with $25 million in property assets:

- Maintenance Improvement: $500,000-750,000 annual savings

- Admin Efficiency: 2-3x portfolio management capacity

- Vendor Management: 15-25% service cost reduction

- Energy Management: 20-30% utility cost savings

Getting Started with AI Estate Management Platforms

Look for AI estate management platforms for family offices specifically designed for luxury properties rather than basic software. Therefore, key criteria include strong security, customization ability, integration features, and dedicated support.

Moreover, EstateSpace represents the leading AI estate management platform for family offices designed specifically for luxury estate management, offering complete capabilities within a secure, family-office-appropriate environment.

The Strategic Need

AI estate management platforms for family offices are essential tools for modern family office operations. Therefore, families who act now gain competitive advantages through reduced operating expenses, enhanced asset care, and improved efficiency.

Moreover, the wealthy families who built great wealth did so through strategic adoption of tools that provided long-term advantages. Additionally, AI estate management represents the next evolution in luxury property oversight—delivering the same precision families expect from financial portfolio management to their physical assets.

Ready to transform your estate management approach? Furthermore, Contact EstateSpace to discover how AI can change your family’s operations while keeping the privacy and excellence your family deserves.