The Crisis Wealth Managers Don’t See Coming

Private asset management services face an unprecedented challenge. Most asset managers are accidentally entering a logistics nightmare as their ultra-high-net-worth clients accumulate decades of physical wealth—art collections, wine cellars, heirlooms, multiple properties—that no longer fit traditional portfolio management models.

With 85 million North Americans over age 60, and 1% qualifying as UHNW, the next 20 years will trigger massive asset disposition decisions. As a result, these decisions require coordination capabilities most wealth managers currently lack. According to a 2024 survey by Art Basel and UBS, wealthy individuals with a net worth of more than $50 million report a 25% allocation to art, while just over one-third of family offices are allocating capital to collectibles as part of their investment strategy. Nevertheless, fewer than 10% of wealth advisors believe collectors understand the true value of their collections or do a good job managing these valuable assets.

The operational reality: Clients age past the ability to manage these collections themselves. Consequently, they increasingly turn to their trusted asset managers for help with valuation, storage, liquidation, and strategic disposition of non-traditional assets. However, most firms aren’t equipped to handle these complex private asset management services.

Four Hidden Challenges in Modern Private Asset Management Services

1. Asset Diversity Explosion

Your clients’ wealth now spans traditional investments plus artwork, wine collections, collectibles, and personal interest collections requiring warehouse storage and specialized handling.

The scale: One family office may manage 50+ asset categories across 12 properties and 8 storage facilities—each requiring different insurance, maintenance protocols, and disposition strategies. Therefore, comprehensive coordination becomes essential for protecting asset value.

2. Geographic Distribution Demands

Managing collections spread across multiple properties, storage facilities, and jurisdictions requires coordination capabilities traditional asset management frameworks weren’t designed to handle. Furthermore, cross-border logistics add layers of regulatory complexity.

Real example: Coordinating the disposition of a $2M wine collection across three climate-controlled storage facilities in different states while simultaneously managing insurance renewals, inventory audits, and family allocation decisions. Moreover, each jurisdiction may have different tax implications affecting the overall strategy.

3. Family Succession Complexity

Multiple family members with different interests in various collections create “who gets what” and “when do we downsize” coordination challenges that directly impact overall wealth strategies. Additionally, emotional attachments often complicate purely financial decisions.

What this looks like: Three adult children debating the disposition of a 200-piece art collection while managing tax implications, market timing considerations, and emotional attachments—all requiring sophisticated facilitation. Family offices must navigate these conversations proactively to prevent relationship strain and suboptimal financial outcomes. In fact, these discussions often determine whether generational wealth transfers succeed or fail.

4. Liquidation Timeline Pressures

The UHNW demographic is approaching major asset disposition decisions that will require sophisticated logistics coordination over the next 20-25 years. Consequently, the window for proactive planning is narrowing.

The urgency: Families waiting too long face crisis liquidations, suboptimal pricing, and relationship strain when disposition becomes emergency-driven rather than strategically planned. Indeed, the hidden costs of reactive asset management can erode 15-20% more value than necessary. Therefore, early planning becomes critical for preserving wealth.

Essential Components of Modern Private Asset Management Services

Traditional portfolio management covered investments. However, modern wealth coordination must address the complete spectrum of client wealth—including items that may not appear on balance sheets but represent significant value and emotional importance. Moreover, these assets often require specialized expertise beyond traditional financial planning.

Comprehensive Asset Inventory and Valuation for Private Wealth Management

Effective private asset management services require sophisticated tracking capabilities documenting all family holdings within integrated management frameworks. In addition, modern estate asset tracking platforms eliminate the spreadsheet chaos that plagues traditional approaches.

What this includes:

- Securities portfolios and alternative investments

- Art collections with provenance and condition documentation

- Vehicles (aviation, yachts, exotic cars)

- Wine cellars with storage location and valuation tracking

- Jewelry and watches with appraisals and insurance documentation

- Personal property across multiple residences

The documentation standard: Photos, provenance records, insurance valuations, disposition preferences, and family allocation notes—all tracked within one secure system rather than scattered across spreadsheets and binders. Furthermore, this centralized approach enables real-time decision-making and reduces risk exposure.

Strategic Asset Disposition Planning for High-Net-Worth Clients

Advanced wealth management helps clients navigate critical decisions about extensive collections before they become crisis situations. Specifically, this involves coordinating multiple stakeholders and complex timelines.

Key coordination areas:

- Donation strategies – Tax-optimized charitable giving aligned with family values

- Family allocation planning – Facilitating “who gets what” conversations before they become contentious

- Market timing for valuable pieces – Coordinating with auction houses and dealers for optimal disposition

- Logistics coordination – Managing large-scale asset transitions across jurisdictions

Real scenario: A family office managing the transition of a $5M art collection through coordinated donations (40%), family allocations (35%), and strategic sales (25%)—each requiring different timelines, documentation, and professional partnerships. Ultimately, this comprehensive approach preserved both family harmony and asset value.

Secure Storage and Asset Logistics Coordination

Modern private asset management services must coordinate secure storage solutions ensuring proper environmental controls, insurance coverage, and access management for family members and trusted advisors. In particular, physical asset risk management becomes critical when coordinating high-value collections across multiple locations.

What this involves:

- Working with specialized storage facilities for climate-sensitive collections

- Coordinating transportation services for high-value items

- Managing security providers and access protocols

- Maintaining comprehensive oversight and reporting capabilities

Additionally, effective coordination requires integrating multiple service providers while maintaining a single source of truth for asset location and condition. As a result, families gain confidence that their valuable collections are properly protected and accessible when needed.

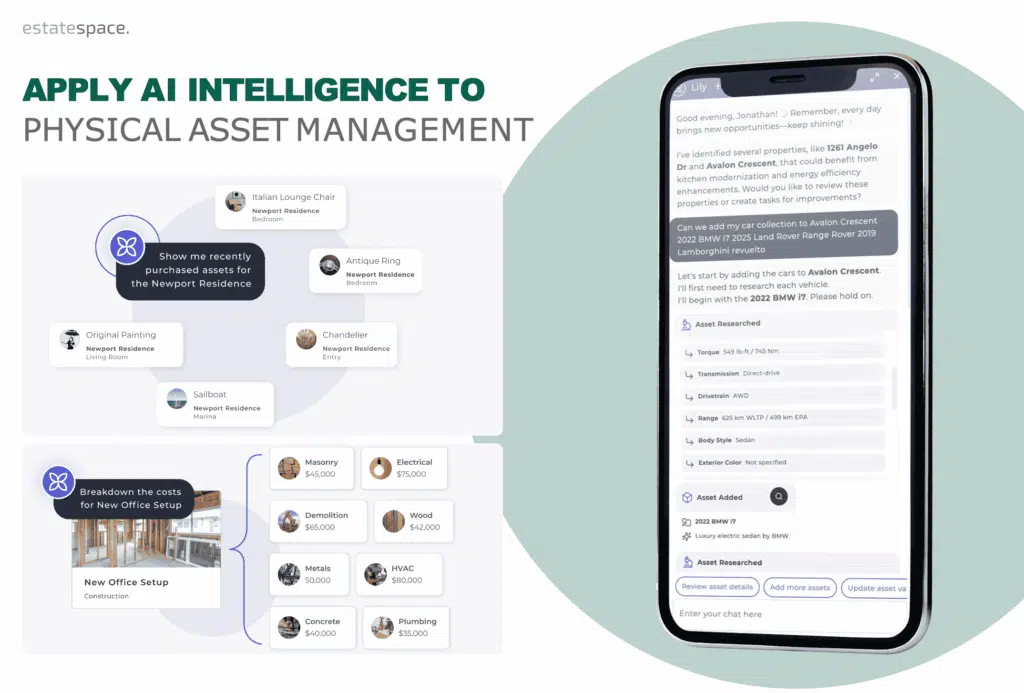

How AI Transforms Private Asset Management Services

The next generation of asset management incorporates artificial intelligence automating routine asset tracking, providing valuation insights, and enhancing decision-making capabilities across all asset categories. Specifically, asset management automation eliminates the manual chaos that consumes 60% of traditional asset managers’ time. Moreover, AI-powered platforms deliver capabilities that were previously impossible with manual processes.

AI Enhancements for Private Asset Management

| AI Capability | Traditional Approach | AI-Powered Approach |

|---|---|---|

| Asset Documentation | Manual spreadsheet entry, 6–8 weeks | Drop files, AI auto-configures in minutes |

| Valuation Tracking | Quarterly manual updates | Continuous market monitoring with alerts |

| Insurance Management | Reactive renewals, coverage gaps | Proactive alerts 90 days before expiration |

| Maintenance Scheduling | Manual calendar tracking | AI-generated schedules based on asset type |

| Risk Assessment | Annual reviews | Real-time monitoring with predictive alerts |

The operational impact: What used to take months of manual data entry now takes minutes. Furthermore, EstateSpace clients report 60% reduction in administrative time, allowing asset managers to focus on strategic client relationships rather than operational logistics. As a result, they can serve more clients while delivering superior service quality.

Automated Asset Documentation for Wealth Managers

AI-powered platforms can process diverse file types—spreadsheets, PDFs, photos—and automatically extract relevant data to create asset records with full documentation. In addition, these platforms continuously improve their accuracy through machine learning.

Example: A photo of a painting triggers AI analysis identifying artist, estimated value range, insurance requirements, and optimal storage conditions—eliminating hours of manual research and data entry. Subsequently, the system automatically schedules condition assessments and insurance reviews based on the asset type and value.

Enhanced Client Communication Through Private Asset Management

Effective private asset management services facilitate transparent communication among family members about extensive collections and future planning decisions. In fact, these conversations often prove more valuable than the technical asset management itself.

Critical conversations wealth managers must facilitate:

- Who gets what and when?

- What items should families keep versus donate or sell?

- How long will they manage certain collections internally?

- Which organizations should receive charitable donations?

- What professional services do they need for asset transitions?

The planning imperative: Most clients ignore these inevitable decisions until they become crisis situations. Therefore, proactive planning through comprehensive wealth management ensures family harmony and optimal financial outcomes. Moreover, documented conversations prevent future disputes and misunderstandings among family members.

Implementation Strategy for Expanded Private Asset Management Services

Phase 1: Comprehensive Asset Assessment for Wealth Management

Evaluate all client holdings—not just traditional investments—to understand the full scope of wealth management requirements. Initially, this assessment reveals the true complexity of client portfolios.

Discovery questions:

- What physical assets exist beyond investment portfolios?

- Where are these assets located and how are they currently tracked?

- What disposition plans exist and what family conversations are needed?

- What insurance coverage exists and when do policies renew?

Subsequently, this comprehensive assessment informs the strategic approach for each client relationship. As a result, asset managers can prioritize the most critical risks and opportunities.

Phase 2: Specialized Partnerships for Asset Management

Create relationships with storage facilities, auction houses, appraisers, and logistics providers who understand unique requirements of ultra-high-net-worth families. Furthermore, these partnerships extend your firm’s capabilities without requiring internal expertise in every asset category.

Partnership categories:

- Climate-controlled storage for art, wine, collectibles

- Specialty insurance providers for high-value collections

- Auction houses and dealers for strategic disposition

- Transportation and security services for valuable items

In addition, maintaining a curated network of trusted partners enables rapid response when clients need specialized services. Therefore, these relationships become a competitive advantage in attracting and retaining UHNW clients.

Phase 3: Secure Documentation Systems for Private Assets

Choose platforms handling diverse asset types with appropriate security protocols and family access controls. Specifically, breaking data silos across asset management creates the unified visibility ultra-high-net-worth families require.

Platform requirements:

- SOC 2 Type 2, HIPAA, GDPR compliance for sensitive wealth data

- Role-based permissions (principals, staff, vendors see different data)

- Complete data ownership and portability

- Integration with existing accounting and reporting systems

Moreover, the right platform eliminates the technical burden while providing institutional-grade security and privacy controls. Consequently, asset managers can focus on client relationships rather than technology management.

Phase 4: Proactive Communication Frameworks for Wealth Families

Establish regular family meetings addressing asset disposition planning before decisions become urgent. In particular, these structured conversations prevent crisis decision-making.

Meeting cadence: Quarterly reviews covering insurance renewals, maintenance requirements, valuation updates, and disposition opportunities—preventing crisis decision-making. Additionally, documented meeting notes create an institutional memory that survives team transitions and generational wealth transfers.

Critical Questions Before Expanding Private Asset Management Capabilities

Before expanding private asset management services, consider:

1. How will you coordinate traditional investment management with personal property oversight?

- Can your current systems handle diverse asset documentation?

- What workflows ensure nothing falls through the cracks?

- How will asset intelligence inform strategic decisions?

Additionally, consider whether your team has the operational expertise to manage physical assets or if you need external partnerships.

2. What partnerships are needed for comprehensive asset storage and logistics?

- Which specialized providers serve your client base?

- How will you maintain oversight across multiple service providers?

Furthermore, evaluate the financial implications of these partnerships and how you’ll structure fee arrangements with clients.

3. Can your current systems handle diverse asset documentation and valuation tracking?

- What happens when a client uploads 500 photos of a wine collection?

- How do you track provenance, insurance, and condition over decades?

Moreover, consider whether your technology infrastructure can scale as client portfolios grow in complexity.

4. How will you facilitate family communication about complex asset disposition decisions?

- What tools enable transparent, documented conversations?

- How do you track preferences and decisions across years?

In addition, determine what role your firm will play in mediating family discussions and how you’ll remain neutral while providing expert guidance.

5. What expertise is required for different types of collectibles and personal property?

- Do you have in-house expertise or need external partnerships?

- How do you stay current on market conditions across asset categories?

Consequently, you may need to develop a network of specialists or invest in training your existing team on new asset classes.

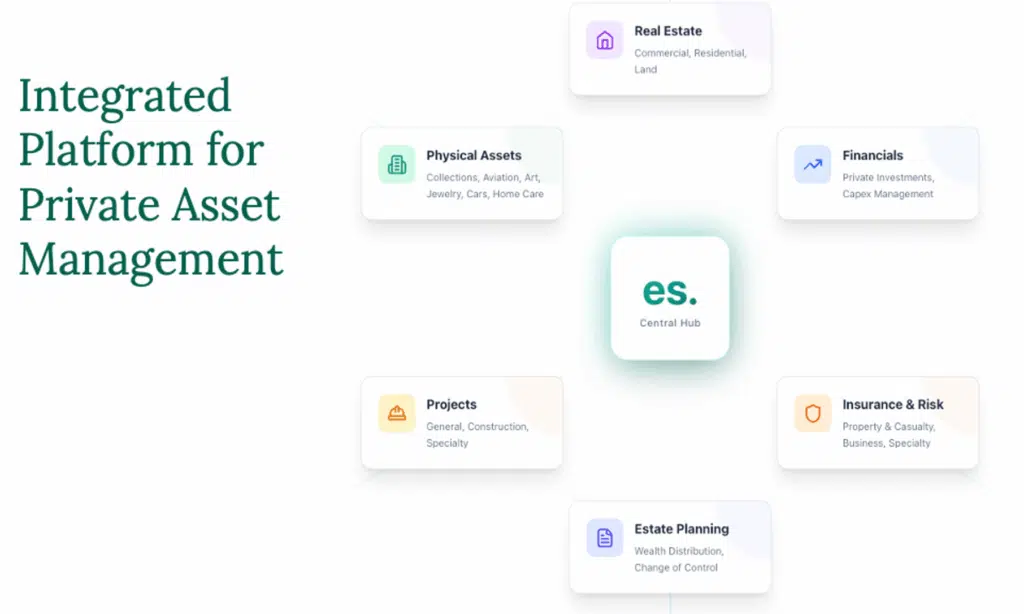

EstateSpace: Comprehensive Private Asset Management Services Platform

EstateSpace transforms asset management through AI-powered platforms handling the full spectrum of client wealth—from traditional investments to personal collections. Specifically, we’re the AI-powered system that family offices choose over heroics. Moreover, our platform consolidates what traditionally required 7-10 different software tools.

What Makes EstateSpace Different

We lived the problem for 16 years before building the solution. Not software people who think they understand estates—we’re estate people who built software because nothing else worked. In fact, project managers use EstateSpace to extend construction relationships into long-term asset management partnerships.

Our AI eliminates work, not just organizes it:

- Drop a spreadsheet → AI maps everything automatically

- Take a photo of an asset → AI creates full documentation

- Add a property → AI generates maintenance schedules

- Upload documents → AI extracts data and creates assets, vendors, tasks

Complete lifecycle coverage: From acquisition through decades of operations to transfer—maintaining all history, vendor relationships, and specifications. Nothing gets lost in transitions. Furthermore, see how our platform works to understand the full capabilities available to your firm.

Key Private Asset Management Services Features

| Capability | Business Impact |

|---|---|

| Integrated asset documentation | All traditional and personal property holdings in one secure system |

| Secure family communication | Asset planning and disposition decisions with documented preferences |

| Automated valuation tracking | Continuous monitoring across diverse asset categories |

| Predictive analytics | Optimal timing recommendations for asset transitions |

| Comprehensive reporting | Complete wealth visibility for principals and advisors |

| Enterprise security | SOC 2 Type 2, HIPAA, GDPR with role-based privacy controls |

The bottom line: As client wealth becomes more complex and asset disposition decisions become more urgent, asset managers need comprehensive platforms addressing the full spectrum of family wealth management requirements. Therefore, adopting AI-powered private asset management services becomes not just an advantage but a necessity for remaining competitive.

Key Takeaways for Modern Private Asset Management Services

- The UHNW demographic is entering a 20-25 year period of major asset disposition decisions requiring coordination capabilities beyond traditional portfolio management. Consequently, asset managers who adapt now will capture this growing market opportunity.

- Clients expect their trusted asset managers to help with personal property, collectibles, and lifestyle assets—not just investment portfolios. Furthermore, these expectations will only intensify as younger generations inherit wealth and demand integrated digital solutions.

- AI-powered platforms eliminate 60% of administrative burden while providing real-time oversight across all asset categories. As a result, firms can scale their operations without proportionally increasing headcount.

- Family succession planning requires proactive facilitation—waiting until decisions become urgent causes suboptimal outcomes and relationship strain. Therefore, initiating these conversations early becomes a competitive differentiator for forward-thinking firms.

- Enterprise-grade security and role-based permissions are essential for managing sensitive wealth data across family members, staff, and service providers. Moreover, compliance with SOC 2, HIPAA, and GDPR standards protects both clients and firms from regulatory risk.

Ready to Expand Your Asset Management Capabilities?

EstateSpace‘s AI-driven platform delivers comprehensive private asset management services enhancing client relationships while streamlining operational complexity.

Schedule a conversation to see how AI-powered platforms transform scattered information into institutional knowledge.

About EstateSpace

EstateSpace is the AI concierge for private assets. Built by estate operators who spent 16 years managing complex portfolios, we turn scattered information into complete visibility with one AI-powered platform that reduces costs and risk to preserve and grow value. SOC 2 Type 2, HIPAA, and GDPR certified.