As a manager of high-value physical assets, you’re likely hemorrhaging money without realizing it. Physical asset management costs often hide in plain sight, silently eroding the portfolios you’re entrusted to protect. While you diligently track every financial transaction, however, these operational inefficiencies compound over time, ultimately destroying the very value you’re working to preserve.

The harsh reality? Most organizations spend 15-20% more than necessary on physical asset carrying costs. Moreover, these aren’t line items on a budget—they’re hidden expenses that traditional management approaches can’t address.

The Invisible Physical Asset Management Costs in Your Portfolio

Physical asset management differs fundamentally from financial asset oversight. Unlike stocks or bonds that trade electronically with transparent pricing, physical assets—real estate, aircraft, yachts, art collections—require hands-on coordination across multiple vendors, schedules, and compliance requirements.

Consequently, this complexity creates hidden cost centers that traditional management approaches can’t address:

Administrative Inefficiencies

- Manual coordination consumes 25+ hours weekly per manager

- Furthermore, redundant data entry across multiple systems

- Additionally, communication delays between vendors and teams

- Finally, missing maintenance windows due to scheduling conflicts

Reactive Maintenance Penalties

- Emergency repairs cost 3-5x more than preventive maintenance

- Similarly, asset depreciation accelerates without proper care schedules

- Meanwhile, insurance claims from preventable incidents

- In addition, vendor premium charges for urgent requests

Knowledge Loss Risks

- Critical asset information lives in individual heads, not systems

- Subsequently, vendor relationships and pricing histories disappear with staff turnover

- As a result, maintenance specifications get lost between projects

- Therefore, compliance requirements missed due to poor documentation

Data Fragmentation

- Scattered information across emails, spreadsheets, and filing cabinets

- Consequently, inability to track true asset performance metrics

- Furthermore, poor visibility into vendor costs and effectiveness

- Thus, missing opportunities for bulk purchasing or contract negotiations

Property Enhancement Projects: Where Physical Asset Management Costs Multiply

For property managers and project managers, capital improvements and renovations create a perfect storm of hidden costs. Moreover, every enhancement project—whether it’s an HVAC upgrade, kitchen renovation, or landscape redesign—becomes an expensive learning experience when critical information lives in scattered systems and individual memories.

The Project Handoff Black Hole

The most devastating hidden cost occurs when construction teams finish their work and disappear. Subsequently, property operations teams suddenly inherit new systems they didn’t install, maintenance requirements they don’t understand, and vendor relationships they’ve never managed.

Consider a recent HVAC system replacement:

- Installation specifications buried in contractor emails

- Additionally, warranty information scattered across multiple vendor files

- Meanwhile, maintenance schedules never transferred to operations staff

- Finally, preferred service providers known only to the departed project manager

As a result? Operations teams learn through expensive emergency service calls, warranties get voided through improper maintenance, and Year 1 costs typically run 20-30% higher than necessary.

Project-to-Operations Knowledge Transfer

Unfortunately, this institutional knowledge gap repeats with every enhancement project. For instance, bathroom renovations, security system upgrades, pool equipment installations—each creates its own information silo that operations teams must decode independently.

While traditional project management tools track tasks and timelines, they fail to capture the operational intelligence that property teams need long-term. Therefore, the result is a cycle of expensive rediscovery with each new project and staff transition.

How Hidden Physical Asset Management Costs Compound

These hidden costs don’t just add up—instead, they multiply. For example, a missed maintenance schedule on a yacht’s engine doesn’t just cost the immediate repair; it accelerates depreciation, voids warranties, and creates safety liabilities. Similarly, poor vendor coordination doesn’t just waste time; it damages relationships and eliminates future negotiating power.

For family offices managing diverse portfolios, consequently, these inefficiencies can represent millions in unnecessary annual expenses. Meanwhile, for asset management firms, they erode the margins that justify premium fees.

AI Eliminates Physical Asset Management Costs

Modern AI technology finally enables the same real-time precision for physical assets that we’ve long enjoyed with financial portfolios. Instead of reactive management based on incomplete information, AI-powered platforms provide:

Predictive Maintenance Intelligence

- Automated scheduling based on usage patterns and manufacturer specifications

- Moreover, early warning systems for potential issues

- Additionally, optimized vendor coordination reducing emergency calls

Operational Workflow Automation

- Intelligent task routing and assignment

- Furthermore, automated documentation and compliance tracking

- Also, streamlined communication across all stakeholders

Data-Driven Cost Optimization

- Real-time visibility into all asset-related expenses

- Similarly, vendor performance analytics and cost benchmarking

- In addition, portfolio-wide insights for strategic decision-making

The Purpose-Built Solution

EstateSpace represents the first platform designed specifically for high-value physical asset management, powered by AI that understands the unique complexities of managing real estate, aircraft, yachts, and collectibles.

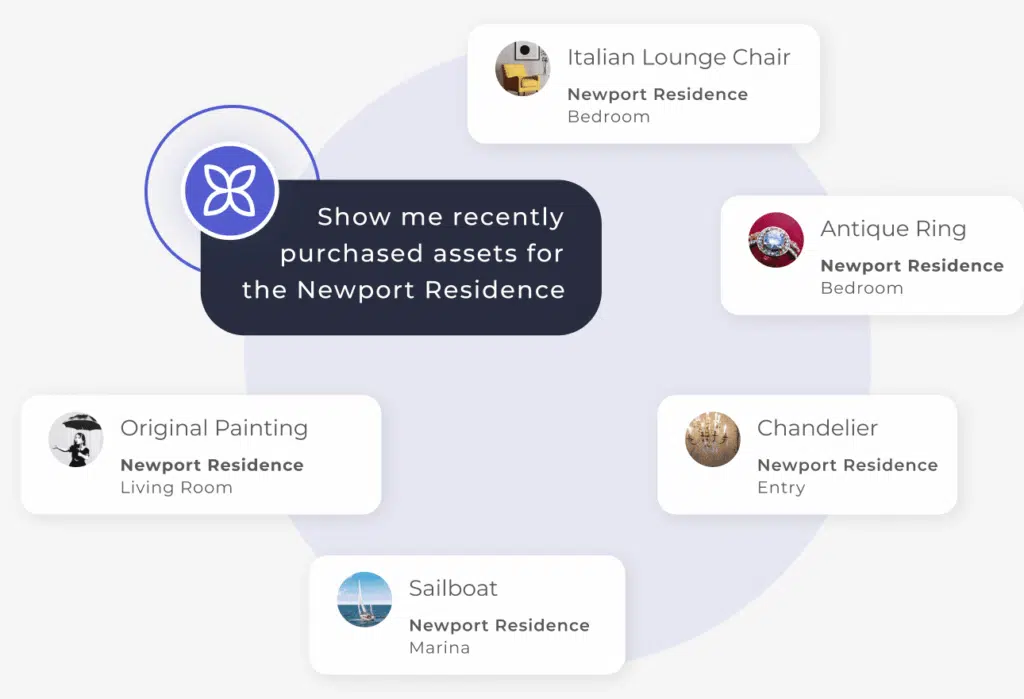

Unlike generic project management tools or basic maintenance software, however, EstateSpace addresses the full lifecycle of physical asset oversight—from acquisition planning through daily operations to eventual disposition. Furthermore, our AI assistant, Lily, eliminates the manual coordination that typically consumes your team’s time, while providing the institutional-grade oversight and documentation that sophisticated clients demand.

The platform’s asset intelligence capabilities transform scattered data into actionable insights, enabling proactive management that extends asset life while reducing physical asset management costs by up to 33%.

Your Next Move

The question isn’t whether these hidden costs exist in your operations—rather, it’s how much they’re costing you and what you’re prepared to do about it. Organizations that continue managing physical assets with manual processes and fragmented data will fall further behind as AI-powered solutions become the industry standard.

The families and institutions you serve expect the same level of sophistication for their physical assets as they receive for their financial portfolios. Therefore, meeting that expectation requires technology that was purpose-built for this challenge.

Ready to uncover what these hidden costs are costing your portfolio?

Learn our approach to eliminating operational inefficiencies and discover how AI-powered physical asset management can transform your operations.

Your assets—and your clients—deserve better than spreadsheets and hope.