Portfolio Management Software Real Estate: Transforming Complex Portfolios for Modern Executives

Portfolio management software real estate has become vital for managing complex assets beyond old spreadsheets and emails. For family offices and large real estate firms running multimillion-dollar properties, the right portfolio management software real estate platform gives clear ROI through better efficiency, stronger security, and smart asset growth. However, this change requires knowing why old tools fail and how portfolio management software real estate drives long-term success.

Why Traditional Methods Fail Portfolio Management Software Real Estate Users

The Spreadsheet Risk

For years, spreadsheets served as the default tool for tracking portfolios. However, as real estate portfolios grow, so do key limits that portfolio management software real estate fixes. Asset values change often, yet spreadsheets show yesterday’s numbers, leading to poor choices. Furthermore, manual data entry creates costly errors—a single mistake can result in bad math and missed chances. Moreover, when you’re managing large portfolios across different places, having data locked in hard-to-reach spreadsheets slows decisions down.

In the high-stakes world of real estate, relying on spreadsheets isn’t just slow—it’s a real risk. Therefore, moving to modern platforms removes these problems through live updates, automated steps, and better access that spreadsheets simply can’t give.

Email: Where Key Information Gets Lost

While email stays vital for talking with teams, using it to manage high-value assets brings big challenges. Important information often gets buried in daily email floods, leading to missed details that matter for good management. Additionally, sending private financial data over email leaves your firm open to data breaks and unwanted access. Email management eats up huge amounts of time—time better spent on smart choices. As a result, the mess of daily emails not only lowers output but also raises the risk of missing important tasks.

By bringing together talks and asset information into secure systems, firms cut these slow-downs and greatly reduce security weak spots. Understanding estate management beyond household operations means seeing that pro-grade systems must replace makeshift tools.

Strategic Value of Real Estate Portfolio Software Solutions

According to GrowthFactor.ai’s complete guide, effective portfolio management in real estate requires smart oversight of multiple real estate assets to boost returns while cutting risk. In fact, the guide stresses that unlike managing a single property, advanced software enables a broader view where you must think about how each property adds to the overall portfolio’s results, risk profile, and fit with investment goals.

This complete approach separates winning real estate investors from those fighting with poor assets. Therefore, using strong technology becomes key for getting this wide-ranging oversight. Notably, the property portfolio management market is set to reach $11.4 billion USD by 2027, showing the growing need for expert oversight and smart tech platforms in this space.

ROI Benefits of Portfolio Management Software Real Estate

For executive leaders, tech success is measured by real returns. Therefore, using advanced platforms leads to clear, measurable gains across key work areas.

Better Work Flow Through Real Estate Management Platforms

One of the biggest benefits of using modern platforms is automating routine tasks, freeing up valuable time and resources. Specifically, automating workflows—from upkeep planning to asset tracking—cuts manual work and drives speed:

- 30% cut in admin tasks related to property management

- Faster choices through live updates on property status and money data

- Better workflows that let teams manage more properties with fewer people

These work gains not only cut costs but also let teams focus on high-value tasks, raising both output and profit. Consequently, for project managers running multiple estates, this speed change directly affects bottom-line results.

Stronger Security with Portfolio Software for Real Estate

For groups dealing with high-value real estate assets, security breaks can have terrible money results. Therefore, strong platforms greatly cut these risks:

- End-to-end encryption protects data both moving and stored, keeping private financial information safe

- Role-based access controls limit key data to approved people, cutting internal security threats

- Complete audit trails give full histories of data access and changes, ensuring clear records and responsibility

Cutting human error and data breaks not only protects group assets but also builds trust with clients, partners, and stakeholders. In addition, the savings from avoided security problems and reduced legal risk further add to platform ROI. Meanwhile, family offices particularly benefit from these security features when managing private portfolios.

Better Asset View Using Real Estate Portfolio Tools

Seeing across your entire portfolio is key for smart choices. With modern systems, you can watch results, spot poor assets, and improve investments—all from a single platform:

- 10-15% gain in asset results through live insights and active management

- Active upkeep planning that extends asset life and cuts costly emergency fixes

- Complete portfolio clarity enabling better choices around buying, selling, and money plans

These gains not only improve asset results but also add to long-term money growth. Indeed, understanding estate maintenance cost control becomes much easier when data flows on its own through connected systems.

Implementing Portfolio Management Software Real Estate Successfully

Successful setup requires smart planning and input from both internal teams and clients. Following these best steps ensures smooth adoption and lasting value from your investment.

Internal Team Setup

Engage key people early. First, involve leadership and work teams in the choice and setup process. Their buy-in is critical for company-wide use. Furthermore, give thorough training to ensure your team knows how the platform works and how it helps their daily tasks. Specifically, focus on automating repeat tasks to free up their time for smart work.

Stress security steps. Make sure your team knows the platform’s security features, including encryption and access controls. Additionally, put in place best steps for data security, such as strong password management and secure data sharing. Meanwhile, asset managers need clear rules on keeping data quality across the platform.

Client Adoption Strategy

Improve client clarity. Show clients how modern platforms give them live view into their assets, letting them track results and value more easily. Moreover, assure clients that their private data is protected by strong security features. In fact, role-based access and encryption protect money information and build confidence in your services.

Start with staged setup. Rather than rolling out the system across the entire group at once, consider starting with a small pilot group. This lets you address possible problems early, refine steps, and ensure smoother change for the rest of the team and clients.

Security Priorities in Real Estate Management Software

For groups managing multimillion-dollar real estate assets, security isn’t just about work—it’s key for long-term success. Choosing the right platform must make strong security features a top goal:

- Data encryption cuts break chances during sending and storage

- Access controls limit who can view or edit key information through role-based permissions

- Detailed audit logs keep clear records of information access and changes

These features not only protect firm data but also show commitment to keeping client information safe, boosting your reputation as a trusted advisor. Similarly, understanding property management budgeting becomes more secure when money data flows through encrypted channels.

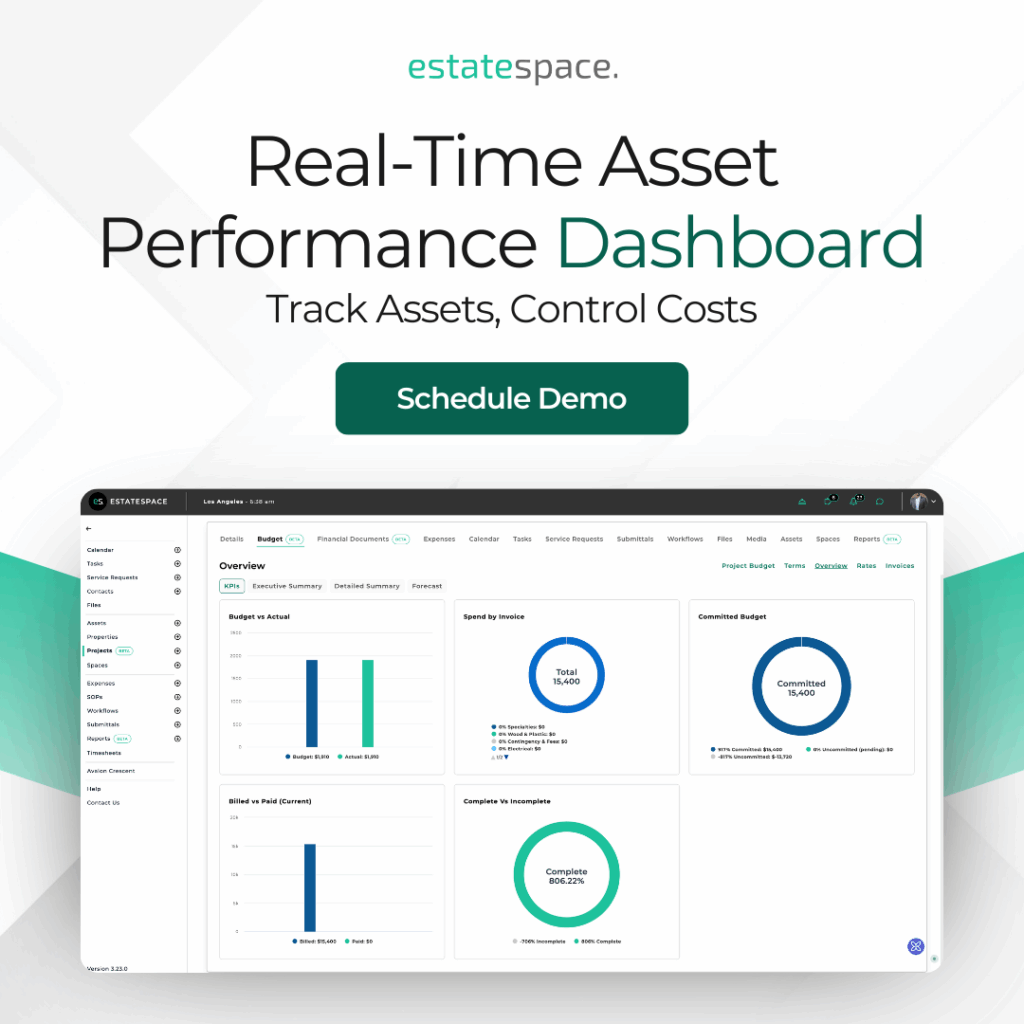

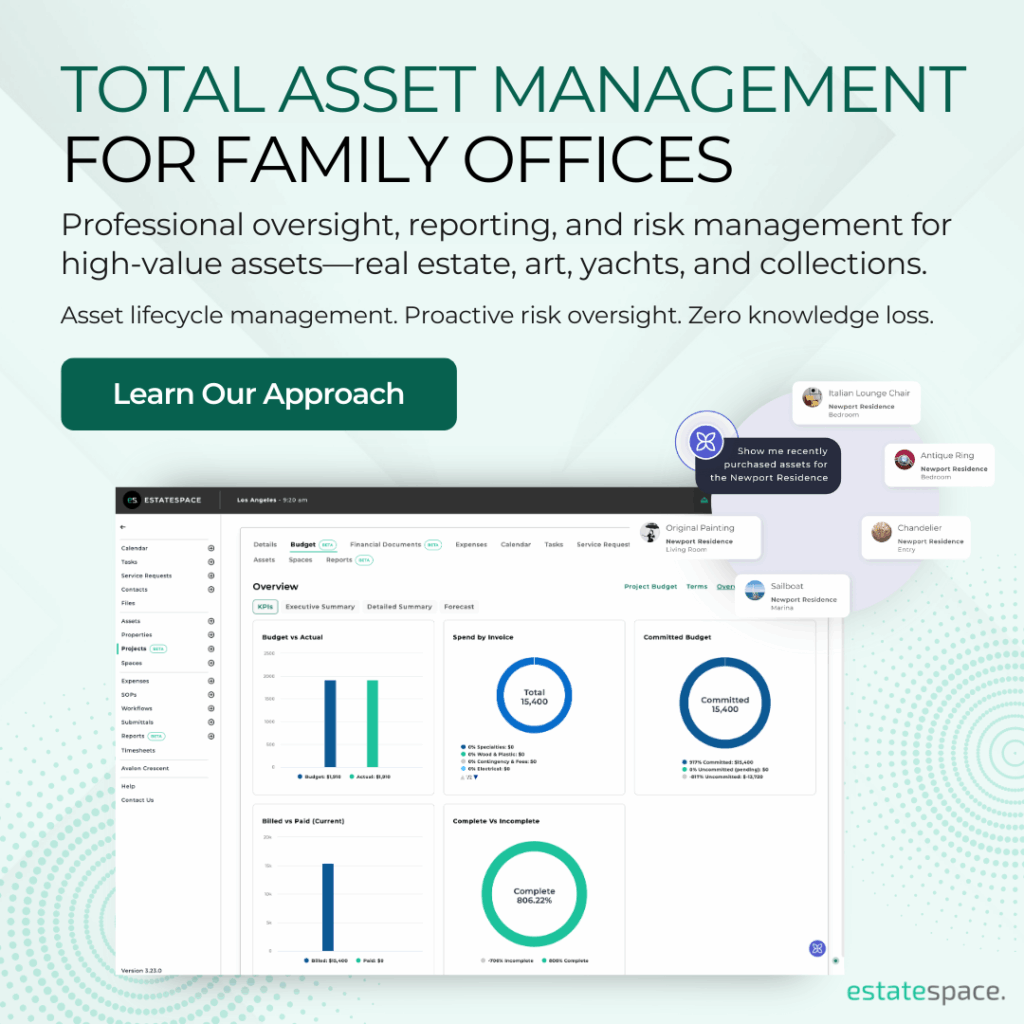

Driving Success with EstateSpace

When managing large, complex real estate portfolios, old tool limits become painfully clear. The risks of outdated information, human error, and security breaks are too big to ignore. EstateSpace, a leading solution, purpose-built and powered by AI, tackles these challenges head-on by streamlining work, boosting security, and giving live data for better choices.

How AI Workflows Change Portfolio Management

EstateSpace uses AI workflows to automate routine work, keep institutional knowledge, and create predictive insights. With EstateSpace, you can expect:

- Live access to data giving instant insights into property values, asset conditions, and money updates

- Advanced security features using end-to-end encryption and role-based access controls to protect private data

- Automated workflows that handle property upkeep, money reporting, and asset tracking

By using EstateSpace, groups see real gains in asset results, lower work costs, and better data security—key factors adding directly to long-term success. For those managing estate construction project management alongside ongoing work, this unified approach removes system breaks.

Organizations navigating private property management challenges find that AI-driven systems see needs ahead of time rather than simply reacting to problems. This forward-thinking approach changes portfolio management from admin burden into smart advantage.

Real-World Applications Across Property Types

Different portfolio types benefit uniquely from modern platforms. For estate renovation project coordination, tracking multiple projects at once becomes doable through central dashboards. Commercial portfolios gain view into lease endings and tenant results. Residential portfolios benefit from upkeep planning and vendor management automation.

Understanding project management for estates means seeing that different asset classes require flexible yet complete management approaches. EstateSpace’s platform adapts to diverse portfolio mixes while keeping consistent work standards.

Moving Forward with Portfolio Management Software Real Estate

In a tough real estate landscape, using cutting-edge tech is no longer optional—it’s vital. Advanced platforms like EstateSpace offer the tools needed to change work, cut risks, and deliver real ROI.

Schedule a conversation to explore how EstateSpace can improve your portfolio management, boost security steps, and drive clear work gains. No sales pressure—just a real conversation about changing your approach.

Final Thoughts

The shift from spreadsheets and emails to complete portfolio management software real estate represents more than tech upgrade—it’s a basic change in how groups manage wealth. For family offices and real estate firms managing complex portfolios, this change delivers edge through work speed, security, and smart insight.

Your portfolio deserves management as smart as the assets it contains. That’s the promise of modern solutions. That’s what EstateSpace delivers.