Physical asset portfolio management innovations revolutionize how wealth managers coordinate complex client property operations, streamline communications, and deliver exceptional service through AI-powered automation and intelligent oversight capabilities.

Modern family offices and wealth management practices demand sophisticated technology solutions. These must match the complexity of today’s ultra-high-net-worth client physical asset portfolios. Traditional approaches to property management fall short when coordinating multiple real estate holdings, luxury assets, and art collections. Managing vendor relationships across global operations also creates challenges.

Recent innovations in physical asset portfolio management platforms address these challenges. They use intelligent automation and streamlined operational capabilities. These technological advances enable wealth managers to deliver exceptional client service. They also reduce administrative burden and operational risks that plague traditional property management approaches.

Physical Asset Portfolio Management Innovations: Transforming Advisory Operations

Wealth managers overseeing complex client physical asset portfolios encounter recurring operational challenges. These require sophisticated technological solutions. Modern physical asset portfolio management innovations provide strategic advantages for addressing property coordination complexities. They also ensure seamless service delivery.

Without proper platform innovations, wealth advisory practices struggle with operational inefficiencies across property portfolios. Moreover, client satisfaction suffers when communications about real estate holdings, art collections, and luxury assets become fragmented. Consider these frequent obstacles affecting your physical asset portfolio management operations:

- Property Information Fragmentation: Critical real estate data, art valuations, and luxury asset records scattered across multiple systems prevents comprehensive portfolio oversight

- Asset Management Complexities: Coordinating property maintenance, art conservation, and luxury asset care across diverse holdings becomes overwhelming without centralized tracking

- Vendor Permission Management: Controlling contractor access to property information while maintaining operational efficiency requires sophisticated user management systems

- Property Communication Inefficiencies: Missed maintenance updates, delayed vendor notifications, and poor information flow compromise asset care quality and portfolio performance

- Asset Data Quality Issues: Inconsistent property records and asset documentation create errors and reduce portfolio management reliability

- Portfolio Search Difficulties: Locating specific property records, art provenance, or luxury asset information quickly becomes time-consuming without intelligent search capabilities

AI-Powered Physical Asset Portfolio Management Innovations

Modern wealth management leverages cutting-edge AI technology to enhance physical asset portfolio operations. This happens through intelligent automation and predictive capabilities. These innovations transform how advisors coordinate complex property portfolios, art collections, and luxury asset holdings. They also maintain exceptional service standards.

Advanced search capabilities powered by AI enable instant information retrieval across entire property and asset databases. Type-ahead filtering and intelligent categorization help wealth managers locate critical information quickly. This includes real estate records, art documentation, and luxury asset information.

Intelligent task management systems track property maintenance, art conservation, and luxury asset care. They use automated monitoring and predictive analytics. AI-driven insights identify potential issues with physical assets before they impact portfolio value. This enables proactive intervention.

Smart communication platforms capture institutional knowledge about property management decisions, art care protocols, and luxury asset maintenance. This knowledge traditionally gets lost. AI-powered message routing ensures critical asset information reaches appropriate team members. It also maintains comprehensive documentation.

Automated notification systems use machine learning to prioritize alerts about property conditions, art valuations, and luxury asset performance. Deep-linked notifications direct team members to specific assets or maintenance tasks. This reduces administrative overhead while maintaining focus on portfolio optimization.

Strategic Implementation of Physical Asset Portfolio Management Innovations

Experienced wealth managers recognize that successful physical asset portfolio management requires systematic platform adoption. This should enhance rather than disrupt existing client property relationships. Rather than wholesale technology replacement, effective platform innovations focus on gradual integration. They also include measurable portfolio improvement tracking.

Comprehensive Property Search Integration: Implement intelligent search capabilities that span all real estate records, art documentation, and luxury asset information. Enable wealth managers to locate property deeds, art provenance records, maintenance contracts, and asset valuations instantly. This happens through AI-powered search algorithms.

Advanced Asset Performance Monitoring: Deploy sophisticated task management systems that track property maintenance schedules, art conservation requirements, and luxury asset care protocols. Use predictive analytics to identify potential issues before they impact asset values. Also optimize resource allocation across diverse portfolios.

Intelligent Vendor Permission Management: Establish role-based access control systems that protect sensitive property information. These should also enable efficient contractor coordination. Customize permission levels based on vendor responsibilities, property access requirements, and client security preferences. Do this through automated administration.

Streamlined Asset Communication Workflows: Create integrated messaging systems that capture all property-related communications, art care decisions, and luxury asset management discussions. Store these in centralized, searchable formats. Implement automated alerting for urgent property matters while reducing information overload.

Portfolio Quality Assurance Automation: Implement form validation and data quality controls that ensure consistent information standards. This applies across all property records, art documentation, and luxury asset files. Use AI-powered verification to prevent errors and maintain portfolio management reliability.

For more details about these innovative platform capabilities and their impact on physical asset portfolio management operations, industry leaders recently highlighted how modern technology transforms traditional wealth management approaches.

The EstateSpace Solution: Leading Physical Asset Portfolio Management Innovations

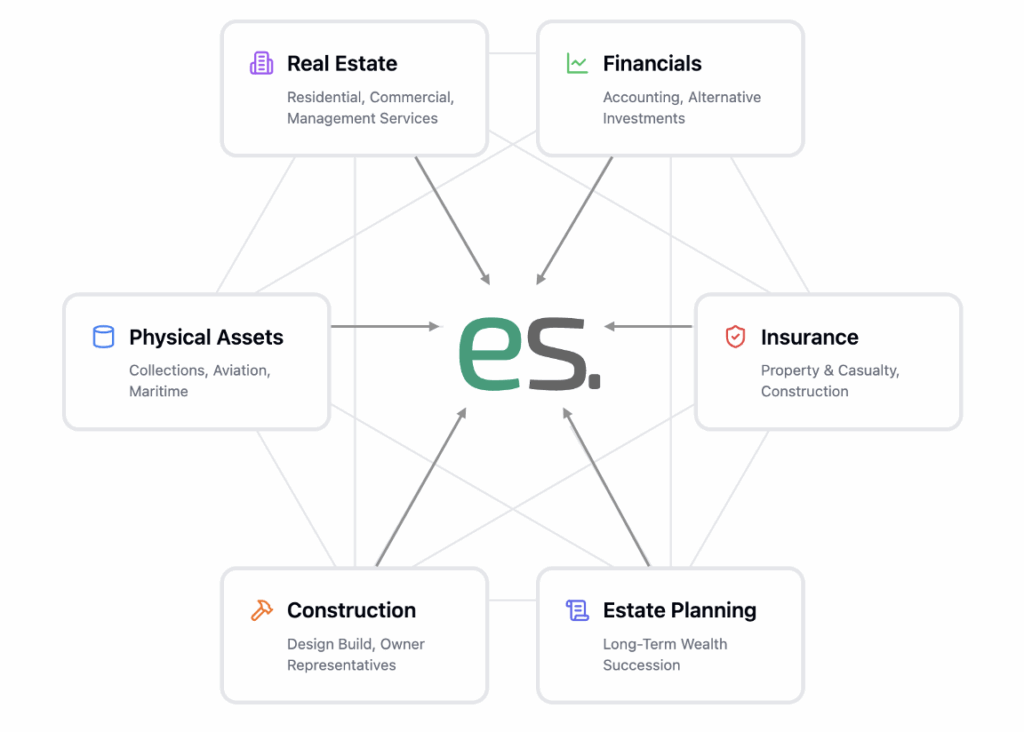

EstateSpace delivers comprehensive platform innovations designed specifically for wealth managers coordinating sophisticated client physical asset portfolios. Built by professionals who understand complex property management challenges, our AI-powered platform empowers advisors to deliver exceptional service through intelligent automation and streamlined portfolio operations.

Intelligent Portfolio Coordination

EstateSpace’s AI intelligence provides advanced search capabilities across property records, art documentation, and luxury asset files. Our platform enables wealth managers to coordinate complex portfolio operations efficiently while maintaining the highest service standards through predictive analytics and automated optimization of property maintenance, art conservation, and asset care protocols.

Enhanced Asset Communication & Documentation

AI-powered messaging systems capture institutional knowledge about property management decisions, art care protocols, and luxury asset maintenance while providing real-time notifications focused on portfolio priorities. Our platform streamlines asset communication workflows while maintaining comprehensive documentation for regulatory compliance and operational continuity.

Comprehensive Portfolio Performance Monitoring

Real-time AI dashboards track operational performance across all physical asset touchpoints while identifying optimization opportunities for property values, art conservation, and luxury asset care. Machine learning algorithms ensure consistent service quality while enabling proactive issue resolution before problems impact portfolio performance.

Implementing Advanced Physical Asset Portfolio Management Innovations

Transform your physical asset portfolio management capabilities with these strategic actions:

- Assess Current Portfolio Technology Gaps: First, evaluate where existing systems create operational inefficiencies in property management, art care, and luxury asset oversight

- Prioritize Asset Integration Opportunities: Next, identify platform innovations that provide immediate portfolio management improvements with minimal disruption

- Deploy AI-Powered Portfolio Solutions: Then, implement intelligent automation that enhances property oversight, art conservation tracking, and luxury asset monitoring

- Monitor Portfolio Performance Improvements: Finally, track measurable outcomes that demonstrate enhanced asset values and operational efficiency

Wealth managers who adopt comprehensive physical asset portfolio management innovations today deliver superior client service while reducing property management complexity. Moreover, they position their practices for continued growth through scalable technology solutions that adapt to evolving portfolio needs.

Ready to transform your physical asset portfolio management operations through platform innovations? Discover how EstateSpace’s AI intelligence empowers exceptional portfolio service delivery through comprehensive operational coordination.

Schedule a consultation to experience advanced platform capabilities that strengthen both portfolio performance and client relationships.

Key Takeaway: AI-powered physical asset portfolio management innovations enable wealth managers to coordinate complex property operations seamlessly while delivering exceptional client service through intelligent automation and streamlined portfolio workflows.