Managing a family office requires juggling multiple complex responsibilities across diverse asset portfolios. You’re not just tracking financials—instead, you’re overseeing multimillion-dollar properties, valuable collections, and intricate investment portfolios. Moreover, the sheer breadth and depth of these responsibilities demand family office productivity solutions far more advanced than traditional tools like spreadsheets and emails.

The Hidden Costs of Traditional Family Office Management

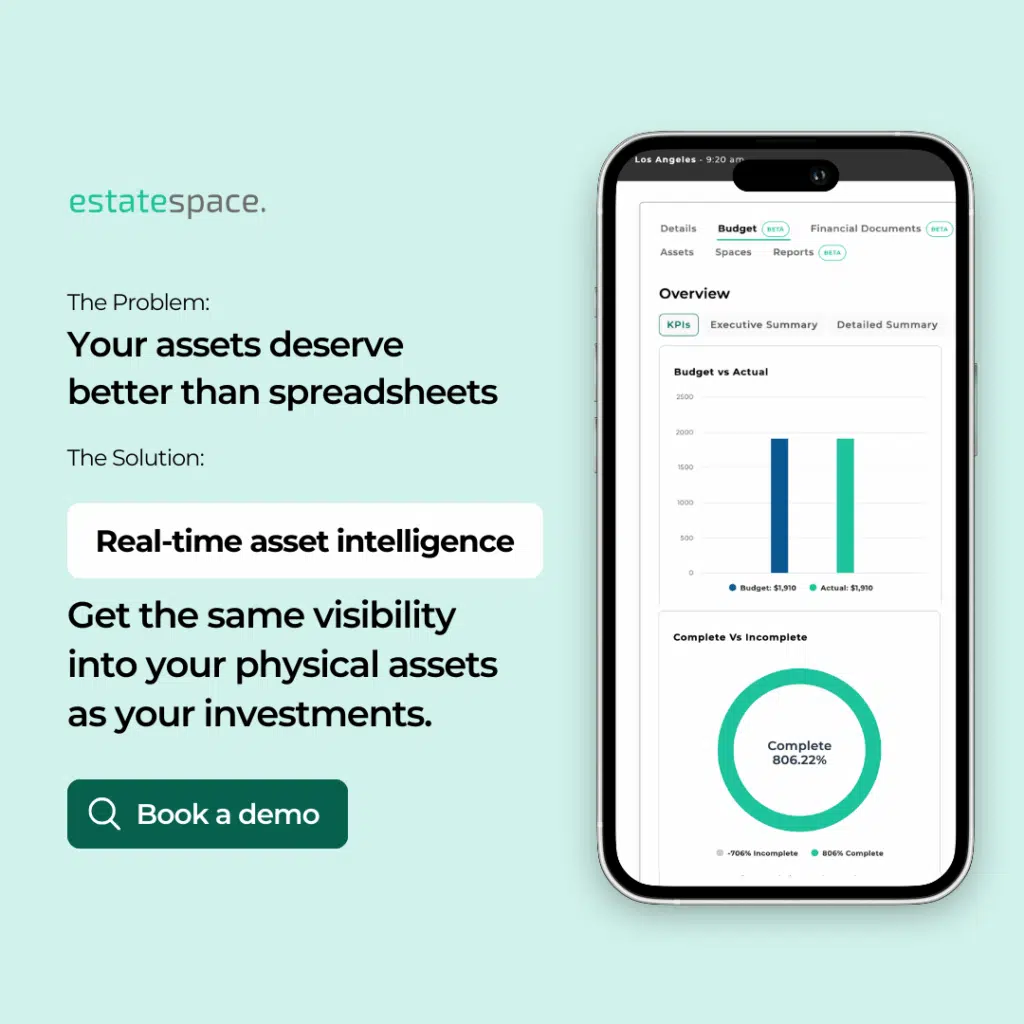

Spreadsheet Limitations in Modern Estate Management

Spreadsheets were revolutionary for their time. However, are they really up to the task for today’s modern family office productivity requirements?

Traditional spreadsheet management creates several critical challenges:

- Lack of real-time updates – Asset valuations change constantly, yet spreadsheets remain static

- Data integrity issues – Human error is always one click away from creating costly mistakes

- Limited accessibility – Complex Excel sheets become nearly impossible to use on mobile devices

- Version control problems – Multiple versions lead to confusion and outdated information

According to a comprehensive study published in Frontiers of Computer Science, 94% of spreadsheets used in business decision-making contain errors. Furthermore, this isn’t just an inconvenience—it’s a risk you can’t afford when managing substantial family wealth.

The Email Communication Challenge

Meanwhile, email has been the standard method for communication. Nevertheless, it becomes a significant drain on family office productivity:

Data Overload Issues: Important details get buried under daily correspondence, making critical information hard to find when needed. Consequently, this leads to missed deadlines and delayed decision-making.

Security Risks: Financial data and confidential information are often just one wrong click away from being sent to unintended recipients. Additionally, email lacks the encryption and access controls necessary for sensitive family office communications.

Time Management Problems: McKinsey reports that 28% of an employee’s time is spent managing emails. As a result, that’s time not spent on making strategic decisions that drive family office success.

Technology Solutions for Enhanced Family Office Productivity

The Power of Integrated Platforms

Imagine if you could consolidate every spreadsheet, email, and sticky note into one single platform. Subsequently, your family office productivity wouldn’t just increase—it would multiply exponentially.

Modern family offices require integrated technology solutions that address multiple operational challenges simultaneously. Therefore, the most successful offices are moving away from fragmented tools toward comprehensive platforms designed specifically for complex asset management.

EstateSpace: Your Complete Family Office Solution

The future of family office productivity lies in leveraging technology designed specifically for managing physical assets and complex portfolios. Consequently, EstateSpace provides the unified approach that modern family offices need.

Key Productivity Features:

- Real-time updates – Immediate access to valuation changes, asset statuses, and financial movements

- Secure environment – Your data isn’t floating in emails; instead, it’s protected in a secure, encrypted platform

- Easy access – Whether you’re in the boardroom or traveling, you can access key data through a user-friendly interface

- Automated workflows – Like having a digital assistant, but better, automating routine tasks so you can focus on strategy

For family offices looking to implement systematic approaches, our guide on Building Repeatable Systems for Estate Teams provides detailed strategies for creating scalable operational frameworks.

Advanced Family Office Productivity Through AI-Powered Management

Streamlining Complex Operations

EstateSpace’s AI-powered platform transforms how family offices manage their diverse responsibilities. Furthermore, by consolidating property management, asset tracking, and vendor coordination into one ecosystem, the platform eliminates the inefficiencies that plague traditional approaches.

In addition, the platform’s intelligent automation learns from your operational patterns. Thus, it can predict maintenance needs, optimize vendor scheduling, and alert you to potential issues before they become costly problems.

Productivity Benefits Include:

- Unified asset oversight across real estate, art, jewelry, vehicles, and other valuables

- Predictive maintenance scheduling that prevents costly emergency repairs

- Automated vendor coordination preserving relationships and performance history

- Institutional-grade reporting providing transparency across all assets

- Succession planning support ensuring knowledge transfer and continuity

Measuring Productivity Improvements

According to research by Accenture, implementing specialized software can boost family office productivity by up to 30%. However, EstateSpace clients often see even greater improvements when they fully leverage the platform’s integrated capabilities.

Key Performance Indicators:

- Time savings – Reducing administrative tasks by up to 60%

- Cost reduction – Lowering carrying costs by 33% through better asset management

- Error reduction – Eliminating spreadsheet-related mistakes through automated data management

- Response time – Faster decision-making through real-time access to critical information

Best Practices for Maximizing Family Office Productivity

Creating Systematic Workflows

The most productive family offices establish clear, repeatable processes for managing their complex operations. Additionally, these systematic approaches ensure consistency while reducing the cognitive load on team members.

Essential Workflow Components:

- Asset monitoring protocols that provide regular updates on property conditions and valuations

- Vendor management systems that track performance and maintain preferred contractor relationships

- Financial reporting processes that consolidate information across multiple asset classes

- Communication standards that ensure all stakeholders receive timely, relevant updates

Technology Integration Strategies

For comprehensive guidance on selecting and implementing the right tools, explore our detailed analysis in Essential Software for Family Office Operations. This resource covers everything from basic requirements to advanced integration strategies.

Integration Considerations:

- Compatibility with existing financial systems and reporting requirements

- Scalability to accommodate growing portfolios and expanding operations

- Security features that protect sensitive family and financial information

- User experience that encourages adoption across all team members

Moreover, successful integration requires careful planning and phased implementation. First, assess your current systems and identify the most critical pain points. Next, prioritize which processes would benefit most from automation. Finally, implement changes gradually to ensure smooth adoption across your team.

The Strategic Impact of Enhanced Family Office Productivity

Competitive Advantages

Family offices that prioritize family office productivity through modern technology solutions gain significant advantages over those relying on traditional methods. Moreover, these advantages compound over time as operations become more efficient and decision-making improves.

Long-term Benefits:

- Better asset preservation through proactive maintenance and monitoring

- Improved investment decisions based on comprehensive, real-time data

- Enhanced client satisfaction through responsive, professional service delivery

- Reduced operational risk through better documentation and process standardization

Supporting Multi-Generational Success

Enhanced family office productivity creates the foundation for successful wealth transfer across generations. When younger family members see sophisticated, technology-enabled operations, they develop confidence in the family office’s ability to manage complex responsibilities effectively.

Furthermore, systematic approaches to asset management ensure that institutional knowledge is preserved and transferred efficiently, regardless of staff changes or leadership transitions. Similarly, well-documented processes make it easier to onboard new team members and maintain consistency during periods of change.

Building a Culture of Continuous Improvement

Embracing Technology Adoption

Successful family office productivity transformation requires more than just implementing new software. Rather, it demands a cultural shift toward embracing technology as an enabler of better service delivery.

Start by identifying champions within your organization who are enthusiastic about technology improvements. Then, provide comprehensive training to ensure all team members feel confident using new systems. Additionally, establish feedback loops to continuously improve processes based on user experience.

Measuring and Monitoring Progress

Regular assessment of your family office productivity improvements helps ensure you’re getting the maximum value from technology investments. Therefore, establish baseline metrics before implementation and track progress monthly.

Key metrics to monitor include:

- Time spent on administrative tasks versus strategic activities

- Response times to client requests and vendor communications

- Accuracy of financial reporting and asset valuations

- Overall client satisfaction scores and feedback

The Future of Family Office Productivity

The challenges of family office management in the 21st century cannot be solved by 20th-century tools. Therefore, EstateSpace represents more than just an upgrade—it’s a fundamental shift toward treating physical assets with the same sophistication as financial portfolios.

By replacing fragmented spreadsheets and eliminating email bottlenecks, you’re not just improving daily operations—instead, you’re elevating your entire approach to wealth management. Consequently, it’s time to solve the efficiency equation once and for all with technology designed specifically for modern family office productivity.

In the world of asset management, time saved translates directly to better outcomes and preserved wealth. Moreover, the families that embrace comprehensive productivity solutions position themselves for sustained success across multiple generations. Ultimately, those who invest in modern technology today will be the family offices that thrive tomorrow.

Ready to multiply your family office productivity? Discover how EstateSpace’s integrated platform can transform your operations while reducing costs by up to 33%. Schedule a consultation to explore solutions tailored for your specific portfolio needs.

Learn more about comprehensive solutions for family offices, asset managers, and project managers managing complex physical asset portfolios.