Family office establishment strategies enable wealth advisors to guide ultra-high-net-worth families through complex organizational transitions while addressing governance, succession planning, and multi-generational coordination challenges.

For many ultra-high-net-worth families, there comes a critical point where family office establishment becomes essential for long-term wealth preservation. This transition represents a fundamental shift from wealth creation to wealth stewardship. This distinction is evidenced by famous fortunes throughout history that have disappeared within few generations.

Successful family office establishment requires specialized knowledge around investments, tax laws, and governance structures. This expertise extends far beyond individual capabilities. Additionally, family office establishment helps address the emotional components of managing family finances. This includes navigating relationships among relatives with strained dynamics or opposing ideologies. An objective governing structure can help families sidestep potential conflicts while fostering inclusiveness that ensures proper succession planning.

Family Office Establishment Strategies: Critical Success Factors

Wealth advisors serving ultra-high-net-worth families encounter unique challenges when guiding family office establishment processes. Modern families face the critical problem of ensuring proper stewardship across diverse asset portfolios. They must maintain fiduciary standards and privacy. Disconnected systems create liability exposure, compliance gaps, and inefficiencies. These problems impact both costs and family satisfaction.

Modern family office establishment strategies provide systematic approaches for addressing governance complexities. They also ensure sustainable organizational structures. Consider these critical elements affecting organizational success:

- Clear Mission Development: Families need articulated vision statements reflecting goals, values, and multi-generational perspectives

- Governance Structure Design: Effective family offices require formal decision-making processes. These must balance authority with inclusiveness across family members

- Succession Planning Integration: Long-term sustainability depends on comprehensive succession strategies that address leadership transitions and wealth transfer protocols

- Risk Management & Compliance: Family offices need proactive systems that reduce liability exposure while maintaining institutional-grade oversight standards

- Technology Integration Planning: Modern family offices need unified platforms that eliminate disconnected systems while providing institutional-grade stewardship capabilities

AI-Powered Family Office Establishment Solutions

Modern wealth advisory practices leverage advanced technology to enhance family office establishment. These innovations transform how advisors guide complex organizational development while maintaining family unity and operational efficiency.

Advanced Governance Analytics: AI-powered platforms analyze family dynamics and communication patterns. They suggest optimal governance structures that balance authority with participation across generations.

Intelligent Mission Development: Machine learning algorithms help families identify common values and interests. They also highlight potential conflict areas that require structured resolution approaches.

Automated Succession Planning: AI systems track family member development and capabilities while suggesting succession scenarios that align with individual strengths and family objectives.

Performance Monitoring Systems: Advanced analytics track family office operational effectiveness while identifying optimization opportunities that enhance both financial performance and family satisfaction.

Strategic Family Office Establishment Implementation

Experienced advisors recognize that family office establishment strategies require systematic approaches. These should address both organizational complexity and family relationship dynamics. Rather than focusing solely on financial structures, effective establishment processes emphasize governance development and sustainable communication protocols.

Comprehensive Mission Development: Guide families through structured discussions that identify shared values. For example, younger generations often support organizations advocating systemic reform such as health equality and environmental protection. Older family members prefer traditional causes like disease research. Create frameworks that accommodate diverse interests while maintaining family unity.

Governance Framework Development: Establish formal decision-making processes that provide structure while remaining flexible enough to accommodate changing family circumstances. Create protocols for addressing disagreements constructively while ensuring all family members feel heard and valued.

Technology Platform Implementation: Deploy unified platforms with AI Agents that eliminate disconnected systems while providing institutional-grade stewardship and bank-level security. Modern solutions should deliver 60% administrative time reduction while maintaining proper oversight and reducing vendor complexity.

The EstateSpace Solution: Advanced Family Office Technology

EstateSpace delivers comprehensive family office establishment support through unified platforms with AI Agents that provide institutional-grade stewardship and bank-level security. Built by professionals who understand sophisticated governance challenges, our intelligent systems empower advisors to guide successful organizational transitions while addressing the core problems families face.

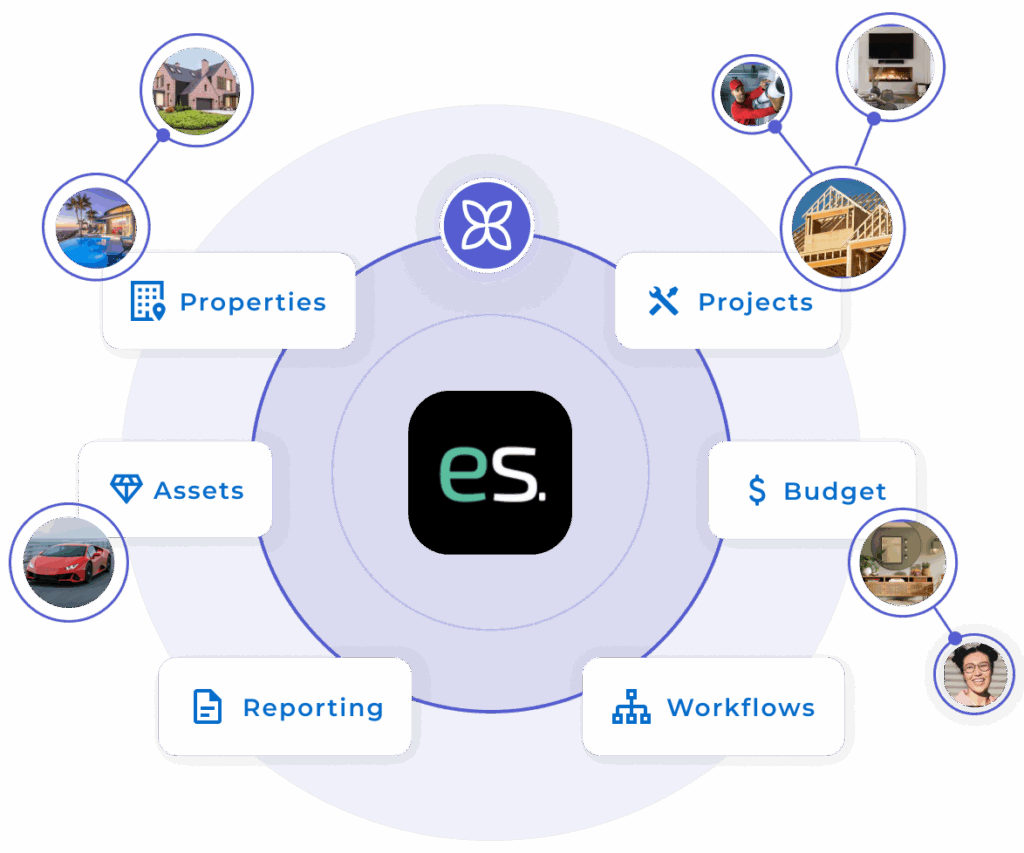

Unified Platform with AI Agents

EstateSpace’s technology eliminates disconnected systems that create liability exposure and compliance gaps. Our AI Agents deliver institutional-grade stewardship across diverse asset portfolios while maintaining the fiduciary standards and privacy that single family offices require. Digital asset histories ensure smooth generational transitions with comprehensive audit trails for liability protection.

Seamless Integration & Risk Management

Our platform integrates seamlessly with existing family office management systems while providing proactive risk management capabilities. Advanced analytics identify potential compliance issues before they become problems, ensuring families maintain proper oversight standards while reducing administrative complexity.

Measurable Value Creation

Family offices implementing EstateSpace experience 60% administrative time reduction through intelligent automation. The platform preserves institutional knowledge for succession planning while reducing vendor complexity and maintaining oversight standards. These improvements deliver significant annual cost savings while improving asset preservation and reducing operational risk.

Implementing Effective Family Office Establishment

Transform your family office advisory approach:

- Assess Family Readiness: Evaluate family dynamics and communication patterns to determine optimal timing and structure for family office establishment

- Develop Governance Frameworks: Create formal decision-making processes that balance authority with inclusiveness while addressing potential conflict areas proactively

- Integrate Technology Solutions: Implement comprehensive platforms that facilitate communication and information sharing among all family members

- Monitor Ongoing Success: Track both financial performance and family satisfaction metrics to ensure sustainable operations

Family office establishment strategies continue evolving as families recognize the importance of structured governance and professional coordination. The complexity of modern wealth management requires sophisticated organizational approaches that address both financial optimization and family relationship preservation.

Ready to guide successful family office establishment processes? Discover how EstateSpace’s AI-powered solutions enable comprehensive organizational development and family coordination.

Key Takeaway: Family office establishment strategies require balancing sophisticated governance structures with family relationship preservation while ensuring sustainable wealth stewardship across multiple generations through professional coordination and advanced technology integration.

Schedule a consultation to experience comprehensive platforms that support successful family office establishment and ongoing organizational excellence.