Family Office Asset Management: Technology Solutions for Complex Holdings

Managing a family office’s diverse portfolio of non-financial assets requires family office asset management technology solutions. From multi-million-dollar real estate holdings to priceless art collections, traditional wealth management approaches fall short. Furthermore, today’s family offices oversee increasingly complex asset portfolios. As a result, they need sophisticated technology to maintain operational efficiency, ensure accurate valuations, and provide transparency that stakeholders expect.

The challenge goes beyond simple record-keeping. For instance, risk managers need real-time visibility into asset conditions. Similarly, wealth managers require integrated financial oversight. Meanwhile, directors of residence must coordinate maintenance across multiple properties while preserving asset values. Moreover, these operational complexities reflect broader trends in family office evolution as the industry matures. Unfortunately, without the right technology infrastructure, even experienced teams struggle. Consequently, data inconsistencies, operational inefficiencies, and compliance gaps can impact both performance and risk management.

The Evolution of Family Office Asset Management Technology Solutions

Family office asset management has changed dramatically over the past decade. In the past, spreadsheets and personal relationships were enough. However, today’s complex holdings require integrated technology solutions. These systems handle everything from estate management operations to advanced financial reporting.

Consider the scope of assets under management. First, luxury residences span multiple time zones. Additionally, art collections require climate-controlled storage. Furthermore, vintage car portfolios need specialized maintenance. Also, commercial real estate investments demand continuous performance monitoring. Each asset class presents unique management requirements. However, all must integrate into a cohesive operational framework.

Professional asset managers working with family offices report the biggest challenges. Specifically, these come from the inability to coordinate management across diverse holdings. As a result, this coordination gap creates inefficiencies. Furthermore, it increases costs and introduces risks that smart families cannot accept.

Tailored Strategies for Managing Non-Financial Assets

Effective family office asset management begins with understanding that each family’s portfolio reflects unique values, goals, and operational preferences. Instead of applying generic solutions, successful strategies focus on customization and integration.

Complete Asset Intelligence Modern asset management goes beyond basic inventory tracking. Instead, advanced systems maintain detailed records. These include buying history, condition checks, maintenance schedules, and performance metrics. According to Deloitte research, 77% of family offices consider complete asset tracking critical to their operations. However, many still rely on fragmented systems that limit visibility and decision-making.

Smart Maintenance Planning Estate maintenance cost control becomes more effective with smart scheduling and performance tracking. Instead of following rigid calendar-based maintenance, smart systems analyze usage patterns. Additionally, they study environmental conditions and asset performance to optimize maintenance timing and resource use.

Integrated Risk Review Family office asset management must address risks that traditional investment management overlooks. For example, environmental threats to real estate exist. Similarly, market changes affect collectibles. Additionally, operational risks come from vendor dependencies. All require special attention. Therefore, Physical asset risk management for family offices demands technology that can identify, assess, and monitor these diverse risk factors in real time.

Strategic Performance Analysis Beyond preservation, family offices increasingly focus on improving asset performance relative to family goals. For instance, this might involve analyzing rental income improvement for real estate holdings. Alternatively, it could mean evaluating growth trends for art collections. Or it might assess operational efficiency across multiple residences.

Overcoming Operational Complexity in Family Office Asset Management

The challenges facing family offices go beyond what traditional wealth management tools address. On one hand, managing director-level executives need systems that provide strategic oversight without overwhelming detail. On the other hand, operational staff require detailed functionality for day-to-day management.

Technology Integration Challenges

Most family offices operate with a patchwork of different systems. For example, property management software for real estate. Also, collection management for art. Additionally, separate financial systems for reporting. Finally, various vendor portals for service coordination. As a result, this fragmentation creates several critical problems:

- Data Inconsistencies: Information exists in multiple systems with no single source of truth. This leads to conflicting reports and decision-making delays.

- Operational Inefficiencies: Staff spend excessive time reconciling data across systems. They focus less on strategic activities. McKinsey research indicates 60% of organizations report productivity losses due to separate data systems.

- Compliance Gaps: Regulatory reporting becomes complex when information must be gathered from multiple sources. This increases the risk of errors or omissions.

- Limited Visibility: Senior stakeholders lack real-time insights into asset performance. This makes proactive management difficult.

Specialized Asset Requirements

Different asset classes within family office portfolios require specialized management approaches. Generic software cannot address them effectively:

Residential Properties: Managing luxury residences involves coordinating household staff and overseeing maintenance projects. It includes managing vendor relationships and ensuring security protocols. All this happens while the family may be traveling internationally.

Art and Collectibles: These assets require specialized storage conditions and insurance management. They need loan tracking for exhibitions and detailed provenance documentation. Standard systems cannot handle these requirements.

Commercial Real Estate: Investment properties need lease management and tenant coordination. They require capital improvement tracking and financial performance analysis. All must integrate with overall portfolio reporting.

Specialty Assets: Vintage cars, yachts, aircraft, and other unique holdings each require specialized maintenance tracking. They need regulatory compliance and performance monitoring.

Technology Solutions for Modern Family Office Asset Management

Selecting appropriate technology for family office asset management requires understanding both operational complexities and strategic objectives. Essential software for family office operations must address granular management needs and executive-level reporting requirements. Family office asset management technology solutions deliver the integration and visibility that modern portfolios demand.

Key Technology Capabilities

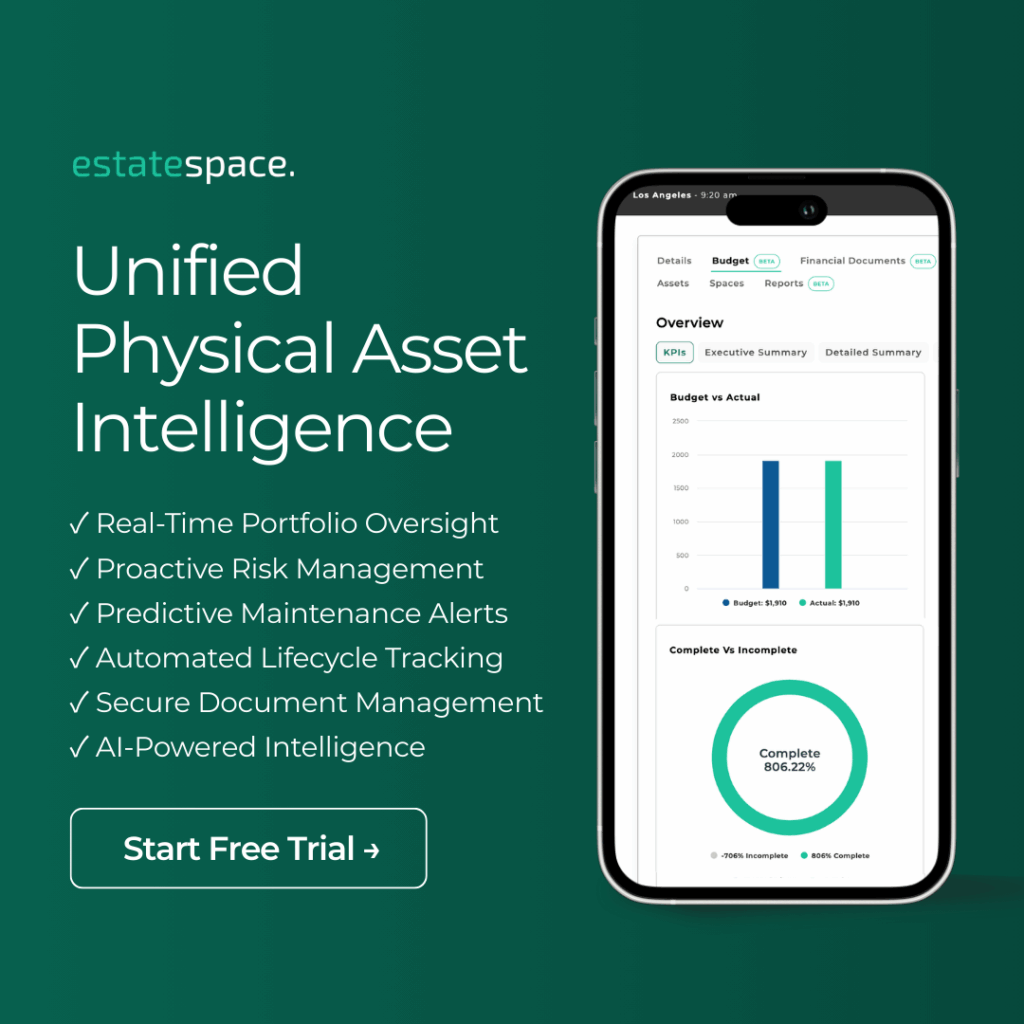

- Unified Asset Intelligence: Systems that consolidate all asset information into a single platform, providing comprehensive visibility while maintaining the detailed functionality each asset class requires.

- Automated Workflow Management: AI-powered asset management for family offices can automate routine tasks, optimize scheduling, and provide predictive insights that improve both efficiency and outcomes.

- Advanced Financial Integration: Beyond simple expense tracking, sophisticated systems integrate asset management with broader financial planning, providing insights into asset performance relative to overall wealth management strategies.

- Collaborative Project Management: Project managers overseeing renovations, acquisitions, or major maintenance projects need tools that coordinate complex timelines while maintaining visibility for all stakeholders.

- Predictive Maintenance Capabilities: Predictive maintenance for high-value asset portfolios uses data analytics to optimize maintenance timing, reduce unexpected failures, and extend asset life.

Implementation Strategies

Successfully implementing new technology in family office environments requires careful attention to both technical and organizational factors:

Stakeholder Engagement: Risk managers, wealth managers, and operational staff all have different perspectives. They need different things from technology. Early engagement ensures the selected solution addresses everyone’s needs while maintaining operational efficiency.

Phased Deployment: Rather than attempting to digitize all assets at once, successful implementations typically begin with one asset class. They demonstrate value, then expand systematically.

Integration Planning: New systems must integrate with existing financial reporting, compliance systems, and vendor management processes to avoid creating additional operational silos.

Training and Change Management: Even the most sophisticated technology fails without proper user adoption. Comprehensive training and ongoing support ensure teams can leverage new capabilities effectively.

Advanced Features for Complex Asset Portfolios

Modern family office asset management platforms go beyond basic tracking to provide sophisticated capabilities that address the unique challenges of managing diverse, high-value portfolios.

Multi-Property Coordination: Families with multiple residences need systems that can coordinate maintenance, staff scheduling, and vendor management across properties while maintaining separate budgets and reporting for each location.

Vendor Ecosystem Management: Managing relationships with dozens of specialized service providers—from art handlers to yacht maintenance specialists—requires sophisticated vendor credentialing, performance tracking, and communication management.

Compliance Automation: Whether dealing with international property regulations, art import/export requirements, or financial reporting standards, automated compliance tracking reduces risk and administrative burden.

Mobile Operations Support: Asset managers and service providers need mobile access to work orders, documentation, and communication tools, especially when managing geographically dispersed assets.

Measuring Success in Family Office Asset Management

Effective technology implementation delivers measurable improvements across multiple dimensions of family office operations:

- Operational Efficiency: Leading family offices report 40-60% reduction in administrative time spent on asset coordination after implementing integrated management platforms.

- Cost Optimization: Better maintenance scheduling and vendor management typically result in 15-25% reduction in operational expenses without compromising service quality.

- Risk Reduction: Comprehensive asset monitoring and automated compliance tracking significantly reduce the likelihood of regulatory issues, insurance claims, and unexpected maintenance emergencies.

- Decision-Making Speed: Real-time access to asset performance data enables faster, more informed decisions about acquisitions, disposals, and capital improvements.

Understanding traditional asset oversight limitations helps family offices appreciate the value that modern technology brings to both operational efficiency and strategic decision-making.

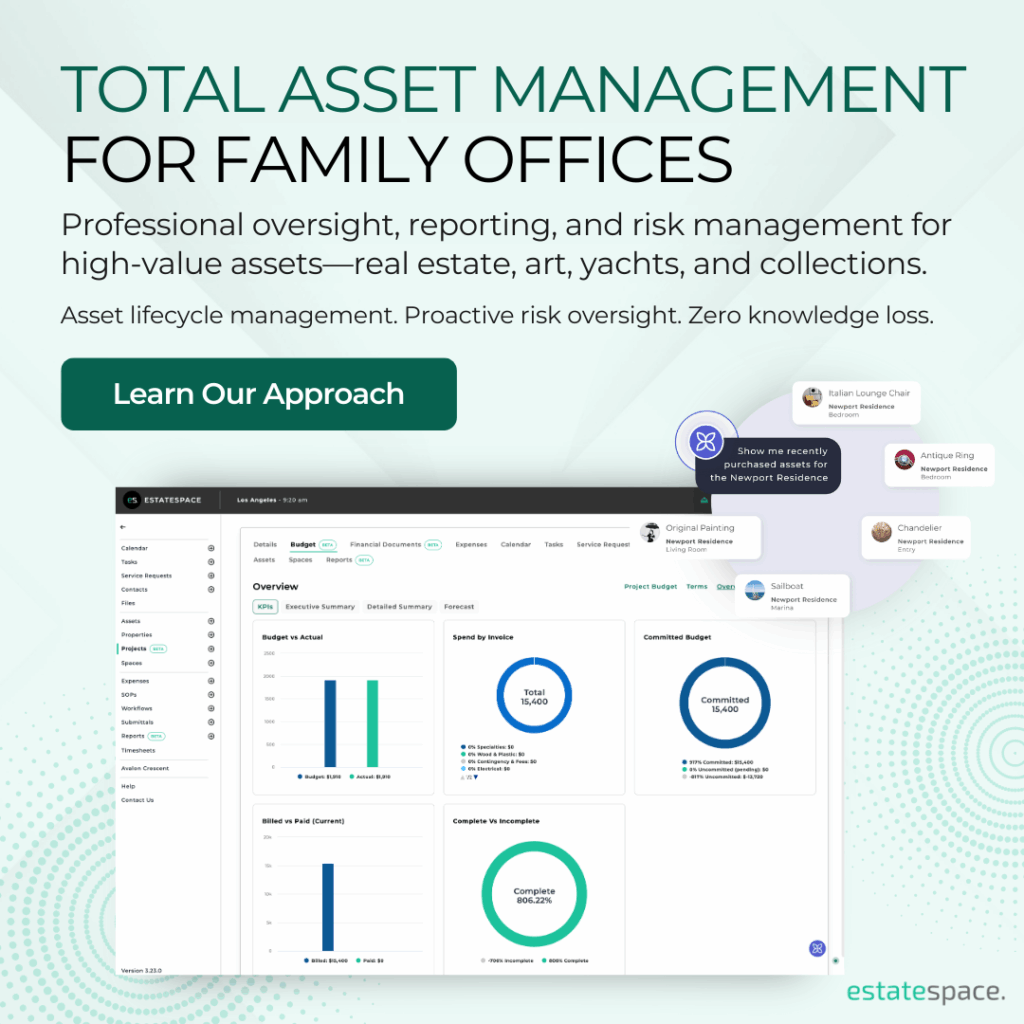

EstateSpace: Purpose-Built for Complex Family Office Assets

EstateSpace addresses the unique challenges of family office asset management through a platform designed specifically for complex, high-value portfolios. Unlike generic property management software, EstateSpace integrates the specialized functionality that family offices need with the enterprise-grade security and reporting capabilities that stakeholders expect.

Our product overview demonstrates how integrated asset management eliminates the inefficiencies and risks that come from managing complex portfolios through multiple disconnected systems. By consolidating asset intelligence, financial oversight, and operational coordination into a single platform, EstateSpace enables family offices to achieve both operational excellence and strategic clarity.

The platform addresses private property management challenges through AI-powered workflows that automate routine tasks while providing the detailed functionality that specialized asset management requires.

What distinguishes EstateSpace is our deep understanding of family office operations, developed through extensive experience managing complex asset portfolios. This background ensures that our platform addresses real operational challenges rather than simply digitizing existing inefficient processes.

Implementation Best Practices for Family Office Technology

Successfully implementing new asset management technology requires careful attention to both technical capabilities and organizational dynamics:

Start with Strategic Assessment: Before evaluating technology options, clearly define what success looks like for your family office. Consider factors such as operational efficiency goals, reporting requirements, and integration needs with existing systems.

Prioritize Integration Capabilities: The most sophisticated features become liabilities if they cannot integrate with existing financial systems, vendor networks, and reporting processes. Evaluate integration capabilities early in the selection process.

Plan for Scalability: Family office asset portfolios tend to grow and evolve over time. Choose technology that can scale with your needs rather than requiring replacement as complexity increases.

Invest in Change Management: Even the best technology fails without proper user adoption. Allocate adequate resources for training, support, and ongoing optimization to ensure teams can leverage new capabilities effectively.

The Future of Family Office Asset Management

Technology-enabled family office asset management represents more than operational improvement—it’s a strategic advantage that enables families to preserve and grow their wealth more effectively while reducing the operational burden on their teams.

The benefits extend beyond immediate efficiency gains. Professional asset management supported by sophisticated technology demonstrates institutional-quality operations that support long-term wealth preservation goals while providing the transparency and oversight that modern family governance requires.

For family offices managing complex asset portfolios, investing in purpose-built technology platforms like EstateSpace becomes essential for maintaining competitive advantage while ensuring that valuable assets receive the professional management they deserve.

Ready to transform your family office asset management operations?

Contact EstateSpace to discover how integrated technology solutions designed specifically for complex asset portfolios can streamline your operations while providing the security, oversight, and performance optimization that your family’s wealth management strategy requires.