Picture this scenario: You’re sitting across from your principal, who asks a seemingly simple question about the HVAC system’s last maintenance date. Meanwhile, you’re scrambling through emails, calling contractors, and realizing your maintenance vendor knows more about your estate than you do. Consequently, this uncomfortable moment reveals a harsh truth—without complete estate management control, you’re not managing your portfolio; it’s managing you.

Sound familiar? You’re facing one of the most common challenges in modern estate management. Furthermore, establishing true estate management control has become the defining factor between reactive managers and strategic leaders who protect and enhance asset value.

Whether you’re managing assets for family offices, serving as an asset manager, or coordinating projects across multiple properties, the principles of comprehensive control remain the same—yet the execution requires sophisticated, purpose-built solutions.

The Foundation of Estate Management Control: Knowledge Is Power

True estate management control begins with comprehensive knowledge of your entire portfolio. However, many estate professionals find themselves operating with incomplete information, thereby creating dangerous knowledge gaps that expose assets to risk and undermine professional credibility.

Consider these critical questions about your estate:

Essential Systems Knowledge

- First, do you understand each property’s mechanical systems and their interconnections?

- Additionally, can you quickly access maintenance histories and service records for all major equipment?

- Moreover, are you aware of equipment lifecycles and upcoming replacement timelines?

- Finally, do you know the operational budgets and projected capital expenditures for the next 24 months?

Operational Oversight

- Similarly, can you confidently navigate and analyze service requests across all properties?

- Furthermore, are you familiar with vendor performance metrics and contract terms?

- Additionally, do you understand the maintenance schedules for each system and amenity?

- Lastly, can you quickly identify potential compliance issues before they become problems?

Without clear answers to these questions, consequently, you’re operating with partial estate management control at best. Therefore, this knowledge gap creates vulnerabilities that skilled vendors and contractors can exploit, potentially costing thousands in unnecessary expenses.

Why Estate Management Control Breaks Down

Modern estate portfolios have grown increasingly complex, yet many professionals still rely on outdated management approaches. According to Ciminelli Real Estate’s 2024 property management analysis, smart buildings and real-time data collection have become standard requirements, thus making traditional spreadsheet-based management obsolete.

Common Control Challenges

Fragmented Information Systems Additionally, critical data lives scattered across multiple platforms—maintenance records in one system, financial data in another, and vendor information in yet another location.

Lack of Historical Context Furthermore, when inheriting estate management responsibilities, professionals often discover missing maintenance records, incomplete equipment histories, and unclear vendor relationships.

Reactive Management Mode Moreover, without real-time insights, managers constantly respond to problems rather than preventing them, thereby eroding both asset value and professional credibility.

Knowledge Dependency Risks Meanwhile, too much institutional knowledge often resides with individual staff members or long-term vendors, creating dangerous vulnerabilities when personnel changes occur.

This challenge is particularly acute for project managers who must maintain continuity from construction through ongoing operations, ensuring that critical information doesn’t disappear when project teams transition.

Building Comprehensive Estate Management Control

Establishing true estate management control requires a systematic approach that addresses both immediate operational needs and long-term strategic oversight. To understand the full scope of effective estate management, explore our comprehensive guide on Understanding Estate Management: Beyond Household Operations.

Phase 1: Information Gathering and Assessment

Connect with Key Stakeholders First, identify and engage with critical personnel who possess institutional knowledge:

- Technical Service Providers: Subsequently, request comprehensive service records, equipment specifications, and maintenance histories from all contractors and vendors.

- Financial Record Keepers: Next, gather complete financial documentation, including contractor agreements, warranty information, and budget allocations.

- On-Site Operational Staff: Finally, conduct detailed interviews to capture daily operational insights and undocumented procedures.

Conduct Comprehensive Property Audits Subsequently, perform thorough assessments of each property component:

- Utility Systems: Document maintenance schedules, inspection histories, and upgrade timelines

- Essential Equipment: Similarly, catalog generators, HVAC systems, security infrastructure, and their operational status

- Residential Amenities: Additionally, inventory all amenities with their maintenance requirements and usage patterns

- Structural Elements: Lastly, assess building integrity, maintenance needs, and compliance status

Phase 2: Systematic Documentation and Organization

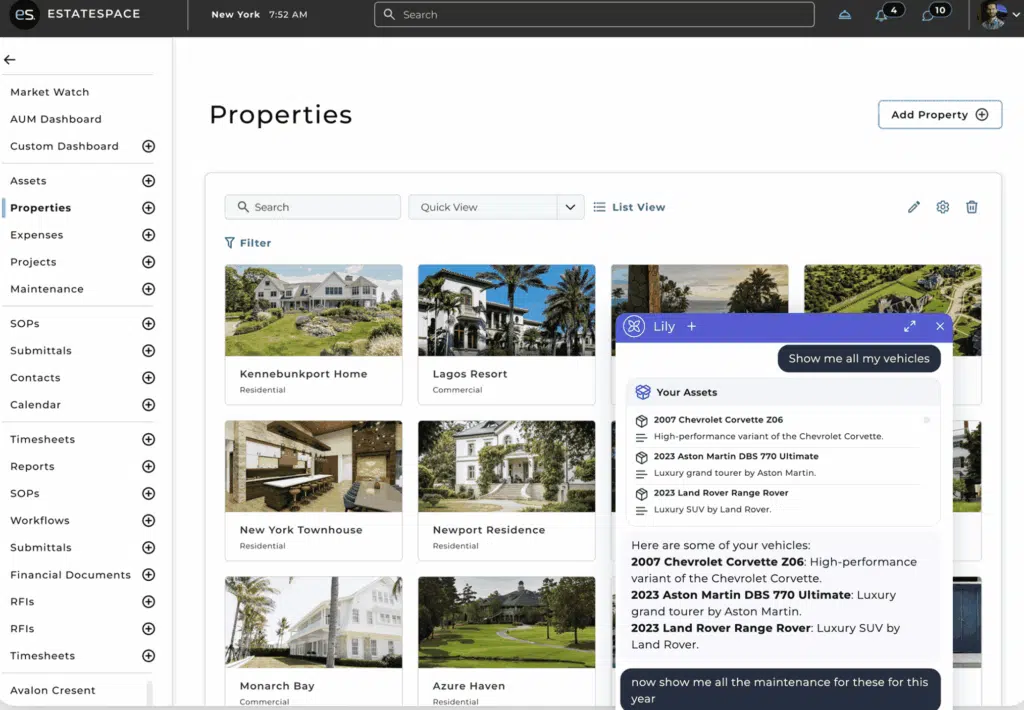

Create Centralized Information Repositories Meanwhile, establish unified systems that consolidate all property information into accessible formats. EstateSpace’s comprehensive platform automatically structures disparate data sources, thus creating comprehensive property profiles that eliminate information silos while providing role-based access controls essential for family office discretion.

Standardize Operating Procedures Furthermore, develop consistent protocols for maintenance scheduling, vendor management, and emergency response across all properties.

Implement Predictive Maintenance Programs Additionally, move beyond reactive maintenance to proactive scheduling based on equipment lifecycles, usage patterns, and manufacturer recommendations.

The Technology Advantage in Estate Management Control

Modern estate management control demands sophisticated technology solutions that can handle complex, multi-asset portfolios. These operational challenges often expose underlying risk management vulnerabilities that require comprehensive strategies. Consequently, learn more about protecting your portfolio in our detailed analysis of Physical Asset Risk Management for Family Offices.

AI-Driven Estate Management Solutions

Intelligent Data Integration Consequently, AI workflows automatically import and structure information from multiple sources, thereby creating unified asset profiles that provide complete operational visibility.

Predictive Analytics Moreover, advanced algorithms analyze usage patterns, maintenance histories, and environmental factors to predict equipment failures and optimize maintenance schedules.

Automated Reporting Additionally, generate comprehensive portfolio reports instantly, ensuring stakeholders receive current, actionable insights rather than outdated summaries.

Vendor Performance Tracking Furthermore, monitor contractor performance, costs, and compliance automatically, maintaining institutional knowledge regardless of staff changes.

For asset managers, this automated tracking becomes essential for justifying management fees and demonstrating measurable value to clients through detailed performance metrics and cost optimization.

For specific examples of how AI technology addresses common estate management challenges, therefore, explore our analysis of Private Property Management Challenges: 5 AI Workflows That Work.

Strategic Relationship Management for Control

True estate management control extends beyond systems and data—it requires building and maintaining strategic relationships with all stakeholders involved in property operations.

Contractor and Vendor Relationships

Establish Clear Performance Standards Set specific expectations for response times, quality standards, and communication protocols. Document these requirements in formal agreements that protect your interests.

Implement Regular Performance Reviews Conduct quarterly assessments of vendor performance, including cost analysis, quality metrics, and compliance tracking.

Maintain Competitive Alternatives Always have backup vendors qualified and ready to ensure continuous service delivery and competitive pricing.

Building Long-Term Client Relationships

Successfully managing estate operations often extends well beyond initial project completion. For project managers transitioning to ongoing estate management, building lasting client relationships is crucial—learn more about this approach in our guide to Post Construction Management: Client Relationships That Last.

Measuring and Maintaining Control

Estate management control isn’t a one-time achievement—it requires continuous monitoring and improvement to maintain effectiveness.

Key Performance Indicators

Operational Efficiency Metrics

- Response time to maintenance requests

- Similarly, preventive maintenance completion rates

- Additionally, emergency repair frequency and costs

- Moreover, vendor performance scores

Financial Control Measures

- Budget variance tracking

- Furthermore, cost per square foot analysis

- Additionally, energy efficiency improvements

- Finally, return on maintenance investments

Risk Management Indicators

- Compliance audit results

- Similarly, insurance claim frequencies

- Moreover, safety incident reports

- Lastly, asset condition assessments

Continuous Improvement Strategies

Regular System Updates Continuously refine processes based on performance data and stakeholder feedback.

Technology Integration Subsequently, stay current with estate management technology that can enhance operational efficiency and oversight capabilities.

Professional Development Finally, invest in ongoing education to understand emerging trends, regulations, and best practices in estate management.

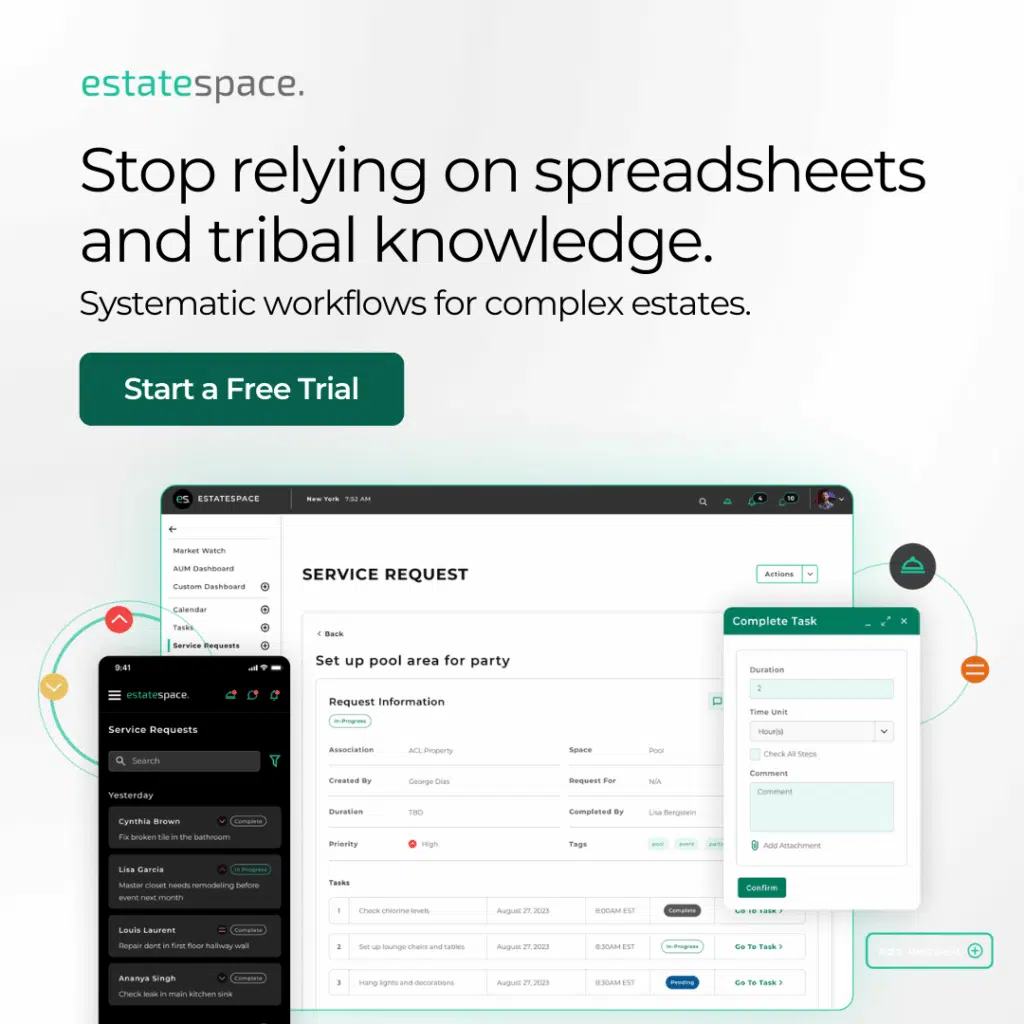

The EstateSpace Advantage: Complete Control, Simplified

EstateSpace transforms estate management control through purpose-built AI workflows designed specifically for high-value asset portfolios. Unlike generic property management software, our comprehensive platform provides solutions tailored to the unique needs of family offices, asset managers, and project managers:

Comprehensive Asset Visibility

Real-time dashboards that consolidate all property information, maintenance schedules, vendor relationships, and financial data into a single, accessible interface.

Predictive Management Capabilities

AI-driven insights that identify potential issues before they become costly problems, thus enabling truly proactive estate management.

Automated Compliance Tracking

Continuous monitoring of regulatory requirements, warranty obligations, and maintenance schedules to prevent costly oversights.

Institutional Knowledge Preservation

Complete documentation of all operational procedures, vendor relationships, and property histories that survive staff transitions.

Ready to Take Control of Your Estate Management?

Stop accepting incomplete information and reactive management as “just how things work.” The technology and strategies exist to achieve complete estate management control while reducing operational costs and enhancing asset value.

EstateSpace clients consistently achieve:

- Complete operational transparency across all properties and assets

- Additionally, 33% reduction in maintenance and operational costs

- Furthermore, proactive management that prevents problems rather than reacting to them

- Finally, enhanced professional credibility through comprehensive property knowledge

Your principals expect institutional-grade oversight. Similarly, your assets deserve proactive protection. Moreover, you deserve the confidence that comes with complete control.

Contact us today to discover how EstateSpace can help you establish comprehensive estate management control and transform your operational approach.

EstateSpace provides complete estate management control through AI-powered workflows that consolidate information, predict maintenance needs, and preserve institutional knowledge across complex property portfolios.