The weight of managing a high-value estate never really leaves your shoulders. After all, you’re juggling multiple properties, coordinating dozens of vendors, tracking maintenance schedules, and somehow expected to know the exact status of every asset at any moment. Furthermore, the traditional approach feels increasingly outdated when you consider that an estate management AI platform could automate these workflows and provide the real-time oversight you need.

Nevertheless, you’re not alone in feeling overwhelmed. In fact, the reality is that $250 trillion in physical assets worldwide are managed through manual, disconnected processes—a stark contrast to the sophisticated platforms available for financial assets. Therefore, this inefficiency isn’t just frustrating; it’s costing serious money, which is why more executives are turning to estate management AI platforms for solutions.

The Hidden Cost of Fragmented Estate Operations

Most estate managers and family office executives don’t realize they’re spending 15-20% more than necessary on asset carrying costs. Specifically, these hidden expenses accumulate through:

- Reactive maintenance instead of predictive care

- Vendor coordination inefficiencies

- Missed optimization opportunities

- Knowledge loss during staff transitions

- Duplicate systems that don’t communicate

Moreover, the frustration compounds when you consider that these same inefficiencies would be unthinkable in managing financial portfolios. As Property Manager Insider notes, “Property management is a time-consuming job that requires a great deal of attention to detail”—yet the industry has been managing these details with outdated manual processes for far too long.

How Estate Management AI Platforms are Transforming Operations

Meanwhile, the emergence of AI-powered platforms is revolutionizing how high-value physical assets are managed. Today, modern estate management AI platforms can now provide the same level of real-time oversight, predictive analytics, and automated workflows for physical assets that we’ve long expected for financial portfolios.

Consequently, this technological shift empowers professionals to:

- Anticipate needs before they become urgent problems

- Coordinate seamlessly across multiple properties and vendors

- Make data-driven decisions about asset maintenance and improvements

- Maintain institutional knowledge regardless of staff changes

Specifically, for family offices, this means transforming from reactive management to strategic asset stewardship. Similarly, asset managers can now deliver the transparency and sophistication their clients expect, while project managers can maintain continuity from construction through ongoing operations.

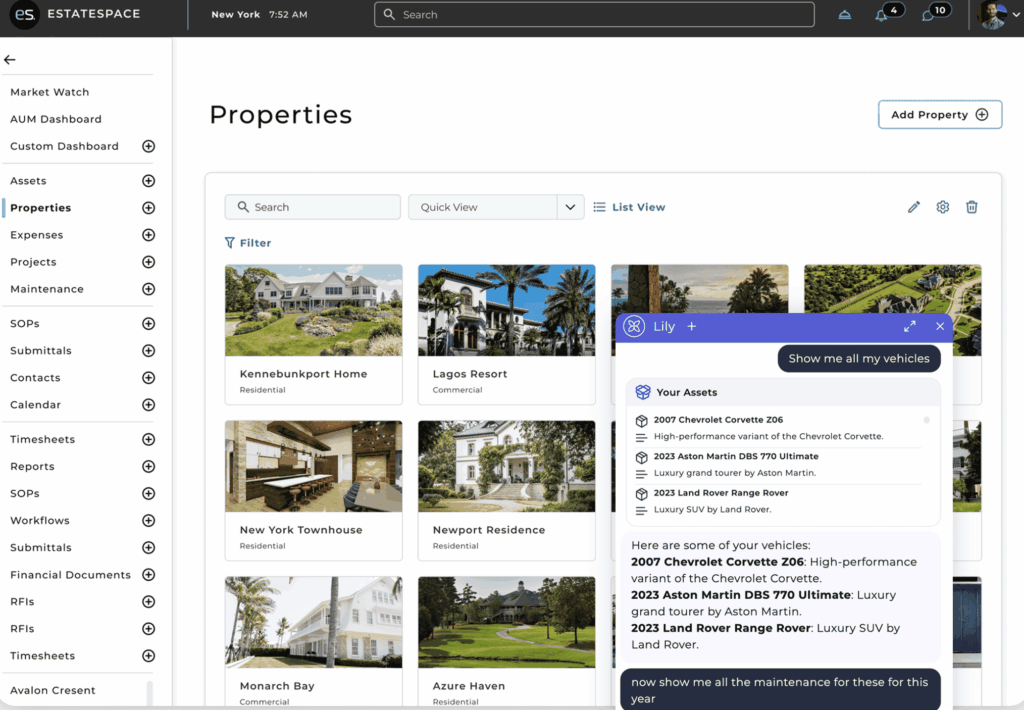

The EstateSpace Approach: Leading Estate Management AI Platform

Meanwhile, EstateSpace represents the first comprehensive estate management AI platform designed specifically for high-value physical asset management. Rather than forcing you to piece together multiple systems, our unified platform handles everything from acquisition to ownership transfer.

Key capabilities include:

- Intelligent Automation – Our AI concierge handles routine coordination while alerting you to what requires attention

- Predictive Maintenance – Prevent costly emergency repairs through proactive asset care

- Real-Time Portfolio Oversight – Access accurate, current data on all assets from anywhere

- Seamless Succession Planning – Maintain institutional knowledge through staff transitions

As a result, clients typically see 33% reduction in administrative costs while extending asset life and improving service quality.

What This Means for Your Operations

Instead of managing through crisis and reaction, imagine having complete visibility into your estate’s performance. Picture receiving alerts before problems develop, rather than discovering issues during inspections. Consider the peace of mind that comes from knowing your team can maintain excellence whether you’re onsite or traveling with principals.

This isn’t about replacing human expertise—it’s about amplifying it. The same way financial advisors use sophisticated platforms to deliver superior investment management, estate professionals can now leverage AI to provide institutional-grade oversight for physical assets.

For a deeper understanding of how modern estate management extends beyond traditional household operations, explore our comprehensive guide on estate management operations.

Evaluating Estate Management AI Platform Features: What to Look For

Not all estate management platforms are created equal. Many solutions address only pieces of the puzzle—property management here, vendor coordination there—leaving you to bridge the gaps manually. When evaluating an estate management AI platform, focus on these critical capabilities:

Integration Depth: Does the platform unify asset tracking, vendor management, maintenance scheduling, and financial oversight in one system? Piecing together multiple tools often creates more complexity, not less.

AI-Powered Intelligence: Look for platforms that don’t just store data but actively help you make decisions. Predictive maintenance alerts, automated workflow suggestions, and intelligent reporting can transform your operations from reactive to proactive.

Scalability Across Properties: Whether managing one estate or dozens, the platform should handle complexity without requiring additional training or resources. Your needs will evolve—ensure your technology can grow with you.

Security Considerations: Protecting High-Value Data

When managing estates worth tens or hundreds of millions, security isn’t optional—it’s paramount. Your software platform becomes a repository of incredibly sensitive information: property locations, asset valuations, travel schedules, and operational patterns that could compromise principal safety if exposed.

Essential security features include:

- Role-based access controls that limit data visibility to appropriate team members

- End-to-end encryption for all data transmission and storage

- Multi-factor authentication and single sign-on capabilities

- Audit trails that track every system interaction

- Data residency controls ensuring information stays in approved jurisdictions

Red flags to avoid:

- Platforms that store data in unsecured cloud environments

- Solutions without granular privacy controls for family office discretion

- Systems that can’t demonstrate compliance with financial industry standards

- Vendors unwilling to sign comprehensive data protection agreements

The stakes are too high to compromise on security. Your platform should meet the same standards you’d expect for financial portfolio management.

Why Generic Solutions Fall Short for Estate Management

Many executives initially consider adapting CRM systems or project management tools for estate operations. While these platforms excel in their designed domains, they lack the specialized features essential for high-value asset management:

- No asset lifecycle tracking from acquisition through disposal

- Limited vendor performance analytics and relationship management

- Insufficient privacy controls for discretionary family office operations

- No predictive maintenance capabilities for physical assets

Estate management requires purpose-built technology that understands the unique complexities of managing physical assets worth millions of dollars.

Moving Forward: From Reactive to Strategic

The choice isn’t whether technology will transform estate management—it’s whether you’ll lead the transformation or be forced to catch up later. Early adopters are already experiencing the competitive advantages of AI-powered operations: reduced costs, improved client satisfaction, and the ability to take on more complex assignments with confidence.

The principals you serve expect the same level of sophistication in managing their physical assets as they receive for their financial portfolios. The technology now exists to deliver that expectation.

Ready to discover how AI can transform your estate operations? Connect with our team to explore what’s possible for your specific situation. We’ll show you exactly how EstateSpace can reduce your operational costs while elevating your service delivery.