Digital estate planning solutions transform traditional succession strategies, enabling wealth managers to bridge generational communication gaps while ensuring seamless physical asset transitions and portfolio management for client families.

Technology has revolutionized control across numerous life areas, from health management to instant travel planning. However, financial services professionals managing physical asset portfolios have lagged in adopting digital tools. They also haven’t encouraged client adoption. This reluctance has intensified existing estate planning challenges. The communication gap between older principals and their millennial or GenX heirs is particularly problematic. These heirs will inherit significant physical asset portfolios.

Younger generations process information about real estate holdings, art collections, and luxury assets differently. Additionally, they prefer alternative communication methods for asset management updates. If you’re still providing clients with traditional paper reports about their physical asset performance, consider this reality. Their children and grandchildren will eventually use digital platforms to manage inherited portfolios. This includes property portfolios, art collections, and valuable assets. Meeting these next-generation heirs where they are today helps them avoid future asset management pitfalls. It also prevents potential portfolio disasters.

Digital Estate Planning Solutions: Bridging Generational Communication Gaps

Wealth managers and financial advisors overseeing significant physical asset portfolios encounter recurring challenges. These arise when facilitating succession planning for luxury properties, art collections, and valuable holdings. Digital platforms offer strategic advantages for addressing these communication barriers. They also ensure proper asset stewardship transitions.

Without proper digital estate planning solutions, client families struggle with physical asset transparency issues. Moreover, younger heirs feel disconnected from property management decisions and asset care protocols. Consider these frequent obstacles affecting your physical asset succession planning efforts:

- Generational Communication Gaps: Older principals prefer traditional property reports. Meanwhile, younger heirs expect real-time digital access to asset performance and maintenance updates

- Asset Management Complexity: Millennials and GenX heirs need visual dashboards. These should show property conditions, art valuations, and luxury asset performance rather than lengthy written assessments

- Physical Asset Transparency Issues: Limited visibility into property management decisions creates problems. This includes maintenance schedules and asset care, which creates suspicion among family members

- Technology Adoption for Asset Oversight: Traditional estate planning methods fail to engage tech-savvy heirs. They don’t understand complex physical asset management responsibilities

- Real-Time Asset Monitoring Limitations: Static reports prevent families from understanding dynamic changes. This includes property values, maintenance needs, and asset performance changes

- Physical Asset Documentation Challenges: Property deeds, art provenance records, and asset care instructions create problems. They become difficult to locate, verify, or share among dispersed family members

Technology-Driven Platforms for Modern Succession Planning

Modern wealth management leverages AI-powered platforms to enhance family communication about physical asset oversight. These systems also improve succession transparency. AI-driven platforms provide real-time visibility into property conditions, art valuations, and luxury asset performance. This strengthens multi-generational relationships through intelligent automation.

All-in-one digital solutions powered by AI enable wealth managers to monitor client property portfolios in real-time. They also manage physical asset maintenance globally through predictive algorithms. Family members gain appropriate access levels to property performance data. This creates intelligent communication hubs that facilitate asset stewardship information sharing across generations.

Transparent physical asset tracking allows principals to share property management decisions and asset care strategies with heirs. AI-enhanced digital platforms promote understanding of real estate management, art conservation, and luxury asset stewardship. They also build confidence in succession planning approaches through data-driven insights.

Real-time asset monitoring powered by AI encourages regular estate plan reviews for physical holdings. Automated reminders ensure property portfolios, art collections, and luxury assets remain properly documented. This happens despite changing valuations, insurance requirements, or family dynamics through intelligent tracking.

Interactive AI dashboards help younger heirs understand property management complexities and asset care rationale. Educational components build stewardship literacy through personalized learning paths. They also foster appreciation for physical asset preservation responsibilities across generations.

Implementing Digital Estate Planning Solutions Effectively

Smart wealth managers and financial advisors recognize that successful physical asset succession requires systematic digital integration approaches. Rather than forcing technology adoption, effective digital estate planning solutions focus on gradual education about property stewardship and progressive access to asset management platforms.

Gradual Technology Integration for Asset Management: Introduce digital property monitoring tools progressively, starting with simple real estate dashboards before advancing to complex art valuation and luxury asset tracking platforms. This approach builds comfort among less tech-savvy family members while maintaining asset oversight quality.

Customized Access Levels for Physical Assets: Provide different platform access based on family member roles in asset stewardship. Younger heirs might receive property maintenance modules while older principals maintain full administrative control over asset management decisions.

Enhanced Communication Channels for Asset Decisions: Create secure messaging systems within platforms that facilitate ongoing family discussions about property management, art conservation, and luxury asset care decisions. Digital communication builds relationships while maintaining detailed asset stewardship records.

Educational Content Integration for Asset Stewardship: Embed learning modules that help heirs understand property management strategies, art preservation principles, and luxury asset care responsibilities. Knowledge transfer happens organically through platform engagement with real asset data.

Physical Asset Documentation Digitization: Convert traditional property deeds, art provenance records, and asset care instructions into searchable, accessible digital formats. Cloud-based storage ensures availability while maintaining security and version control for critical asset documentation.

The EstateSpace Advantage: AI Intelligence Empowers Excellence

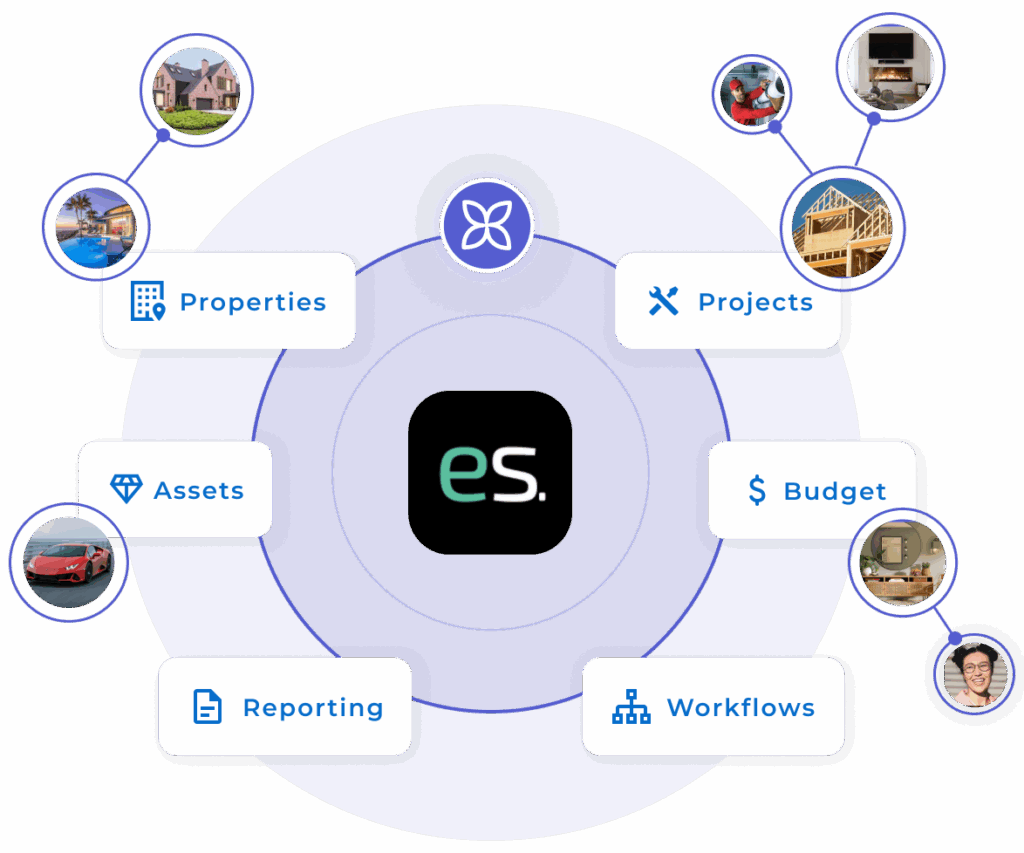

EstateSpace’s AI intelligence transforms how wealth managers handle physical asset succession planning for sophisticated client families. Built by professionals who understand these complex challenges, our AI-powered platform empowers advisors to eliminate traditional oversight failures that compromise client relationships.

Predictive Asset Management

EstateSpace’s AI intelligence continuously monitors property conditions, art valuations, and luxury asset performance through predictive analytics. Our platform identifies potential issues before they impact client portfolios. AI-driven maintenance scheduling optimizes care timing while reducing unexpected costs. Intelligent monitoring protects asset values while providing families with proactive stewardship confidence.

Seamless Multi-Generational Communication

AI-powered communication tools automatically tailor information delivery to each family member’s preferences and comprehension level. Younger heirs receive interactive dashboards and visual learning modules. Meanwhile, older principals access traditional reports enhanced with AI insights. Our platform bridges generational gaps through intelligent adaptation to individual communication styles.

Comprehensive Intelligence & Transparency

Real-time AI dashboards provide instant visibility into all client physical asset activities across properties, collections, and luxury holdings. Machine learning algorithms track performance metrics continuously while identifying patterns and optimization opportunities. AI-driven oversight maintains quality standards consistently, ensuring the excellence families expect through intelligent automation and predictive insights.

Implementing Comprehensive Digital Estate Planning Solutions

Transform your client physical asset succession planning with these strategic actions:

- Assess Family Technology Readiness for Asset Management: First, evaluate each family member’s digital comfort level with property monitoring platforms and customize implementation approaches accordingly

- Establish Progressive Access Plans for Physical Assets: Next, create phased rollouts that gradually introduce property management features, art tracking capabilities, and luxury asset monitoring while building user confidence

- Integrate Educational Components for Asset Stewardship: Then, embed learning modules that help heirs understand property management principles, art conservation requirements, and luxury asset care responsibilities

- Ensure Security Protocols for Asset Data: Finally, implement robust protection measures that safeguard sensitive property information, art valuations, and luxury asset details while maintaining necessary accessibility

Wealth managers and financial advisors who adopt comprehensive digital estate planning solutions today facilitate smoother physical asset successions for client families. Moreover, they strengthen multi-generational relationships around property stewardship while ensuring asset preservation across transitions. From real estate portfolio transparency to art collection management, successful asset succession becomes achievable through strategic technology integration.

Ready to modernize your physical asset succession planning with AI-powered digital solutions? Discover how EstateSpace’s AI intelligence empowers exceptional property management and asset stewardship outcomes for client families. Additionally, Schedule a consultation to experience comprehensive AI-driven tools that strengthen both physical asset preservation and multi-generational family relationships.

Key Takeaway: AI-powered digital estate planning solutions bridge generational communication gaps about physical asset management while ensuring transparent, predictive property and luxury asset transitions that strengthen family stewardship relationships.