Task Management Software for Luxury Property Maintenance

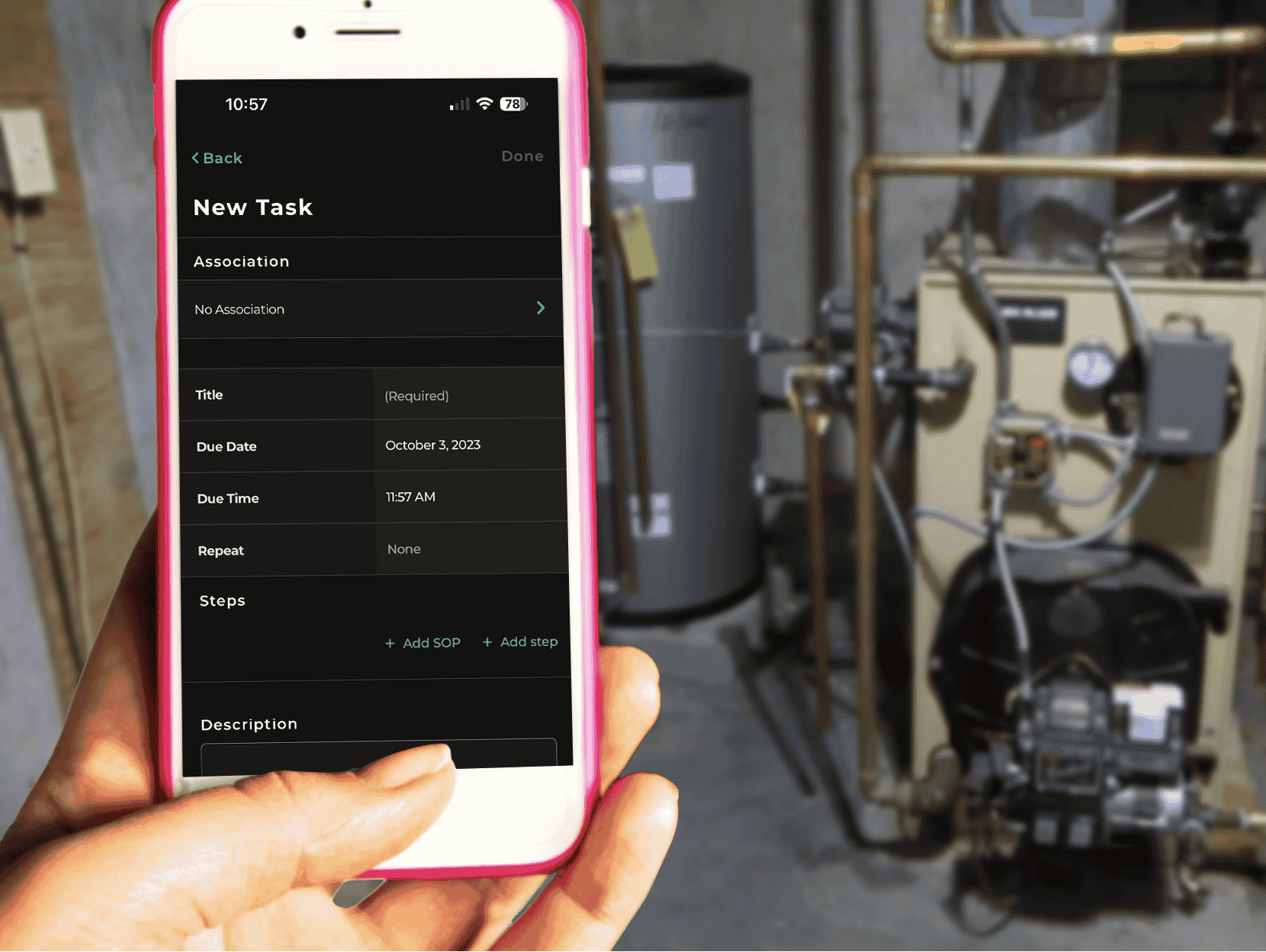

Luxury properties carry more than beauty—they carry responsibility. From maintaining pristine grounds to coordinating vendors across multiple estates, managing property maintenance tasks can feel like an endless balancing act. However, task management software offers clarity, structure, and peace of mind in an otherwise complex world. Furthermore, estate managers understand that the right technology transforms daily chaos into organized excellence. Meanwhile, the weight of maintaining luxury properties extends far beyond routine upkeep. Additionally, these responsibilities impact family comfort, asset value, and operational efficiency in ways that traditional management methods simply cannot handle effectively. The Unique Demands of Luxury Property Operations In contrast to typical property care, estate task management presents challenges that extend far beyond standard maintenance. Moreover, luxury property operations require precision, timing, and coordination that standard approaches cannot deliver consistently. Research shows that luxury…