Asset lifecycle management for high-value portfolios isn’t just about making smart acquisitions—it’s about stewarding assets through every phase of their journey. Whether you’re overseeing a family’s generational wealth, managing institutional portfolios, or coordinating complex real estate projects, understanding the complete process can mean the difference between preserving value and watching it erode.

Most approaches focus heavily on the acquisition phase while treating everything afterward as maintenance. However, here’s what we’ve learned from working with family offices, asset managers, and project managers across diverse portfolios: the real value creation—or destruction—happens during the management years between purchase and sale.

The Hidden Costs of Fragmented Asset Lifecycle Management

Think about the last major asset transition you managed. How many spreadsheets were involved? Moreover, how many phone calls to track down maintenance records, warranty information, or compliance documentation?

These aren’t just operational inefficiencies—they’re value destroyers. Furthermore, when critical information lives in silos, when maintenance histories are incomplete, when compliance gaps go unnoticed, assets deteriorate faster than they should. Consequently, when it comes time for ownership transfer, these gaps translate directly into reduced valuations and extended transaction timelines.

A Smarter Approach to Portfolio Management

Leading family offices and asset managers treat this as a continuous, integrated process rather than discrete phases. Here’s how they think about it:

1. Strategic Acquisition Planning

Before any purchase, they establish comprehensive data capture protocols for effective asset lifecycle management. Specifically, this means:

- Defining what information will be critical for future decision-making

- Setting up systems to track performance metrics from day one

- Planning for eventual disposition scenarios, even at acquisition

2. Active Asset Management Phase

This is where most value is created or lost in asset lifecycle management. Therefore, successful stewardship requires:

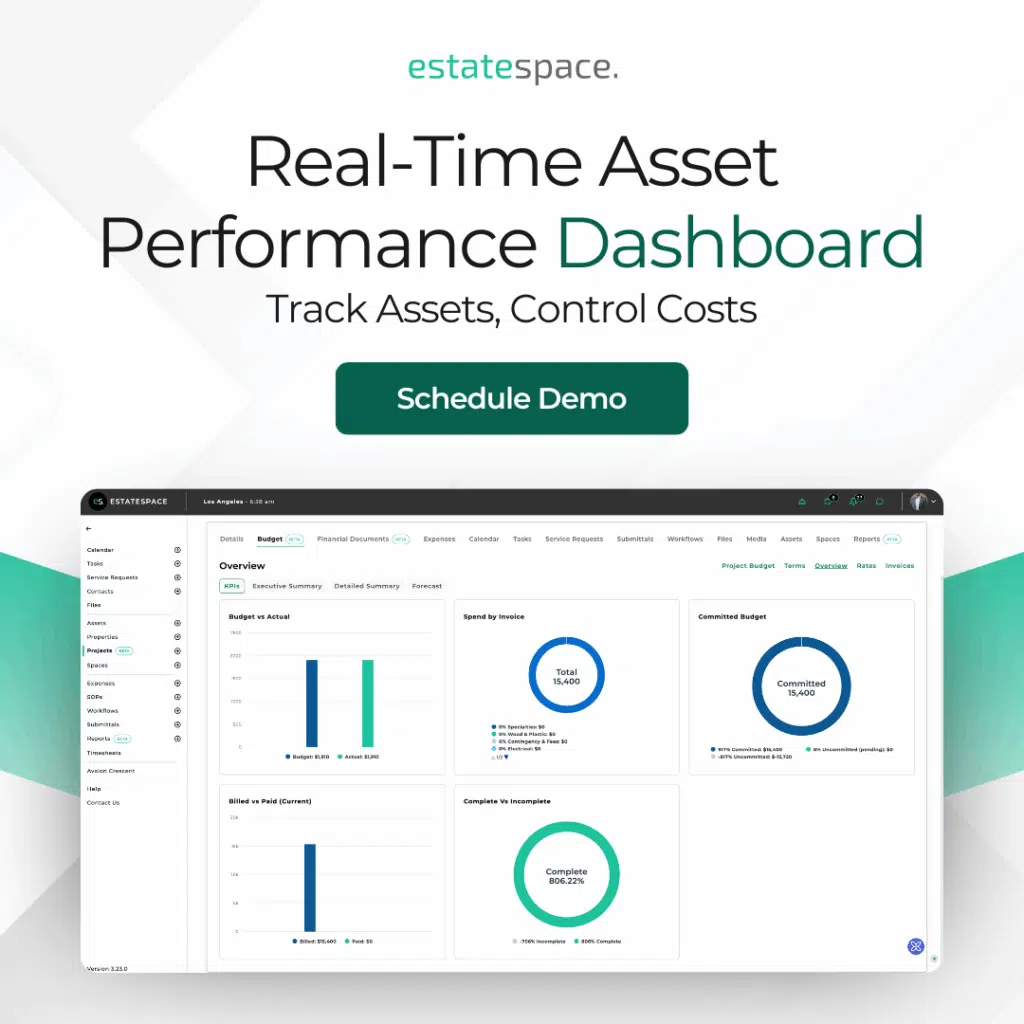

- Real-time performance monitoring that goes beyond basic financials

- Predictive maintenance strategies that extend asset life and optimize costs

- Continuous compliance tracking that prevents costly violations

- Stakeholder coordination that keeps all parties aligned on objectives

Our recent analysis in Predictive Asset Maintenance for High-Value Portfolios demonstrates how AI-driven maintenance strategies can reduce unexpected repairs by up to 40% while extending asset lifespans significantly as part of comprehensive lifecycle management.

3. Transition and Asset Disposition Planning

The most valuable assets maintain their worth through ownership changes because their stewards plan for transitions long before they happen. In particular, effective asset lifecycle management in this phase includes key elements:

- Comprehensive documentation that tells the asset’s complete lifecycle story

- Performance data that demonstrates value-creation efforts

- Compliance records that eliminate due diligence delays

- Maintenance protocols that can be seamlessly transferred

AI in Modern Asset Lifecycle Management

Artificial intelligence isn’t replacing human judgment in asset management—instead, it’s augmenting it. Furthermore, the most effective AI applications we’re seeing help project managers and asset stewards by:

Pattern Recognition: AI identifies maintenance needs, compliance risks, and performance trends that human oversight might miss, especially across large portfolios with complex lifecycle requirements.

Predictive Analytics: Rather than reactive responses, AI enables proactive decision-making. Additionally, it forecasts everything from maintenance needs to market timing for dispositions.

Data Integration: AI synthesizes information from multiple sources—financial reports, maintenance logs, market data, compliance records—into actionable insights for better portfolio management.

Automated Documentation: Similarly, AI ensures that critical knowledge is captured and organized systematically, preventing the loss of institutional memory during transitions.

This shift from manual tracking methods to AI-driven systems represents a fundamental evolution in portfolio management capabilities. As IBM’s research on asset lifecycle management demonstrates, “recent technological leaps in asset management software capabilities have added new dimensions to ALM best practices, making manual tools like Excel insufficient.”

Building Asset Lifecycle Management Systems That Create Value

The families and institutions that consistently outperform share one characteristic: they view technology as an enabler of better stewardship throughout the asset lifecycle, not just operational efficiency. Similarly, they understand that purpose-built solutions designed specifically for complex, high-value portfolios deliver better outcomes than general-purpose tools.

EstateSpace was purpose-built for the unique challenges of managing diverse, high-value asset lifecycles. In contrast, generic property management software or basic project management tools simply can’t handle the complexity, compliance requirements, and coordination needs of institutional-quality portfolios.

Your Next Steps

Every day without comprehensive asset lifecycle management is a day of potential value erosion. However, implementing the right approach doesn’t have to be overwhelming.

The most successful implementations start with a clear assessment of current gaps. Subsequently, they use a phased approach to closing them. Whether you’re managing your first major acquisition or optimizing asset management processes across a mature portfolio, the key is beginning with systems designed for your specific challenges.

If you’re looking to strengthen your asset lifecycle management approach, we’d welcome the opportunity to discuss your specific challenges and share insights from how other leading family offices and asset managers are evolving their stewardship practices.

When you’re managing assets that represent generations of wealth creation or institutional capital, getting the lifecycle management process right isn’t just good practice—it’s essential stewardship.