AI Estate Management Workflows Are Changing How Family Offices Operate

Managing properties, collections, and high-value assets through AI estate management workflows eliminates the chaos of spreadsheets and email chains. Moreover, these automated systems preserve the institutional knowledge that traditionally walks out the door when key personnel leave.

Here’s what most family office leaders don’t realize: the operational approach you’re using was designed for a pre-AI world. Furthermore, the same technology transforming financial portfolios is now available for your physical assets.

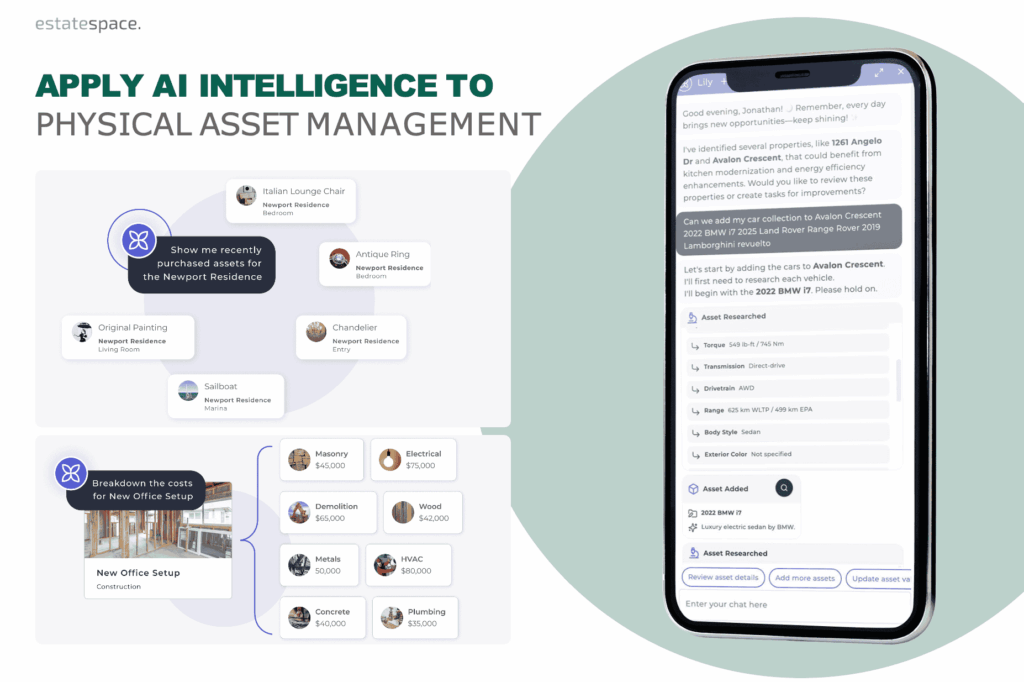

What AI Estate Management Workflows Actually Do

Traditional estate operations rely on people remembering things—maintenance schedules, vendor preferences, asset histories. Consequently, when someone leaves, that knowledge disappears.

However, AI estate management workflows flip this entirely.

EstateSpace is purpose-built with AI-native workflows that learn from your operations. Additionally, these workflows automate what currently requires constant human coordination. Instead of your team managing tasks, the platform manages workflows while your team focuses on strategy.

Here’s a practical example:

A maintenance issue gets reported at one of your properties. In traditional systems, someone must review asset history, check maintenance schedules, identify the right vendor, coordinate timing, track work, update documentation, and process invoices.

With AI estate management workflows, the system automatically identifies the asset and maintenance history, determines if this is scheduled or emergency work, suggests the appropriate vendor based on past performance, coordinates scheduling, tracks completion with photos, and flags budget variances.

Your team approves decisions. Meanwhile, the AI handles coordination.

The Knowledge Gap Problem

A family office executive recently told us: “Our estate manager retired after 18 years. We thought we had systems. What we really had was one very organized person holding everything together.”

That’s the institutional knowledge gap—the invisible operational intelligence that makes estates run smoothly. Which contractors deliver quality work? Why is maintenance scheduled at specific times? What preferences define exceptional service?

According to recent industry research on AI agents in family offices, AI-powered agents are essential for managing workflows independently. In fact, the research shows AI can analyze vast datasets in real-time while continuously monitoring operations and initiating preventive measures.

AI estate management platforms solve this by encoding knowledge into automated workflows:

Vendor Intelligence: Every interaction builds a performance database. Therefore, the AI learns which contractors deliver on time, provide quality work, and handle emergencies well. This intelligence persists regardless of personnel changes.

Maintenance Patterns: The system identifies optimal maintenance timing based on asset lifecycles, seasonal factors, and historical outcomes. As a result, preventive maintenance becomes predictive and automated.

Operational Context: Preferences and protocols get embedded into workflows. Consequently, new team members inherit institutional intelligence rather than starting from scratch.

One CFO described the transformation: “We went from hoping our manager remembered everything to having a system that remembers for us.”

Real Results from AI Estate Management Workflows

Family offices using estate management software with AI workflows report clear improvements:

33% reduction in operational costs through better vendor management and maintenance cost control. Specifically, the AI identifies inefficiencies humans miss—duplicate services, reactive maintenance, vendor performance issues.

60% reduction in admin time because repeatable systems replace manual coordination. Staff focus on oversight and strategic decisions rather than scheduling and tracking.

Zero knowledge loss during transitions because institutional intelligence lives in the platform. Therefore, new managers inherit complete operational context from day one.

How AI Workflows Differ from Traditional Software

Most property management tools are digital filing cabinets—they store information but require humans to do the thinking. In contrast, AI estate management workflows actually automate the decision-making process.

Traditional approach: You track maintenance in software, but someone still needs to review schedules, coordinate vendors, follow up on completion, and update records.

AI workflow approach: The system monitors asset conditions, predicts maintenance needs, coordinates vendor scheduling based on availability and performance history, tracks completion automatically, and flags issues requiring human attention.

The platform doesn’t just document operations—it runs them.

This AI property maintenance assistant approach transforms estate operations from reactive coordination to proactive oversight. You’re notified about decisions, not burdened with executing them.

What This Means for Your Operations

Consider your current approach to estate operations. How much time does your team spend on coordination versus strategic planning? Moreover, how confident are you in operational continuity if key personnel leave?

EstateSpace’s AI workflows address both challenges:

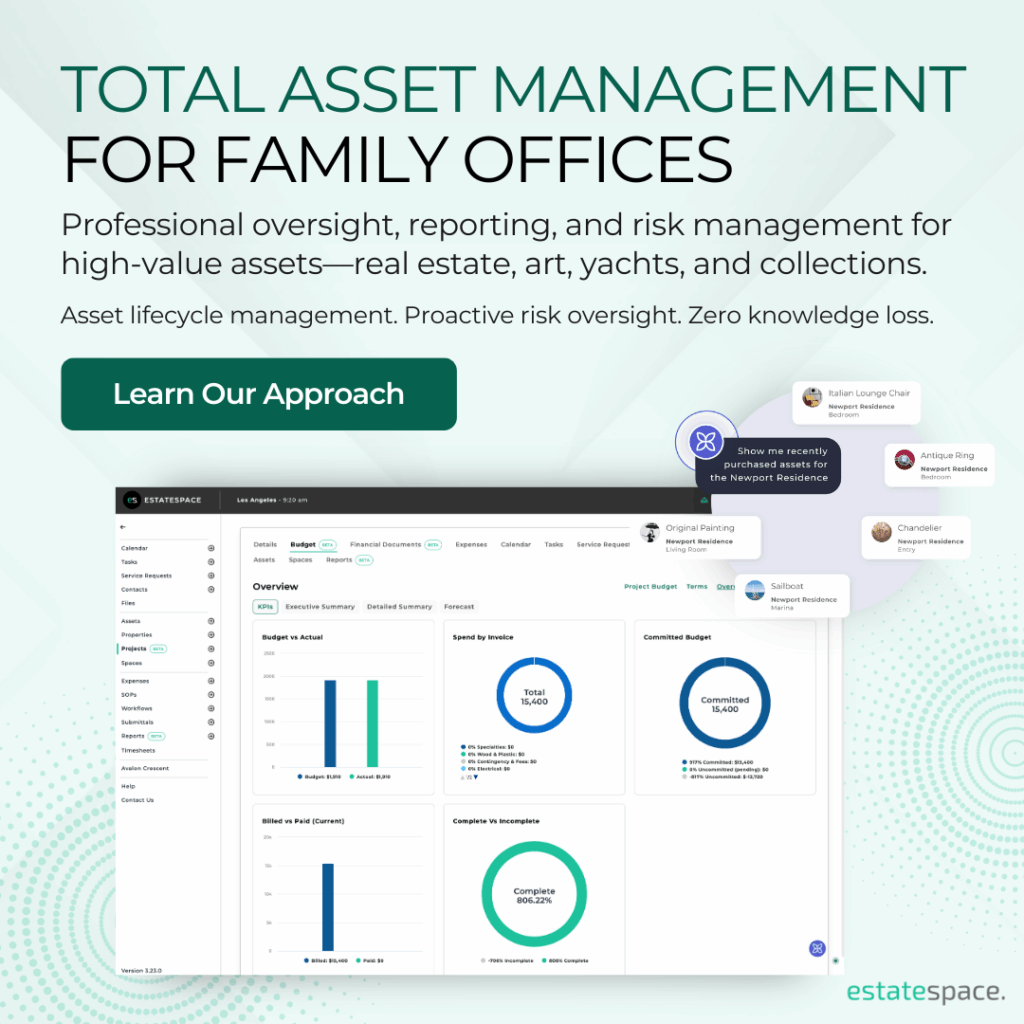

For multi-property portfolios: The AI maintains visibility across all locations. Additionally, it coordinates maintenance schedules, vendor relationships, and budget tracking without manual consolidation.

For budget management: Predictive analytics identify cost trends and flag variances automatically. Therefore, you get the financial oversight you expect from investment portfolios.

For succession planning: Complete operational context transfers instantly because workflows capture not just what happened, but why decisions were made.

For next-generation expectations: Real-time dashboards and automated reporting provide the technology sophistication younger family members expect.

The Strategic Shift in AI Estate Management Workflows

Forward-thinking family offices are reconsidering their entire approach to physical asset management. The question isn’t “how do we track assets better?” Rather, it’s “how do we manage physical assets with the same rigor we apply to financial holdings?”

That requires AI-powered systems that provide:

- Automated workflows that preserve institutional knowledge

- Predictive intelligence that prevents problems before they impact value

- Real-time visibility across complex asset portfolios

- Clarity and transparency that enables strategic decision-making

This isn’t about technology for technology’s sake. Instead, it’s about building operational systems that protect wealth across generations without depending on individual personnel.

Built for Family Office Needs

EstateSpace was designed specifically for the sophistication family offices require. This includes privacy controls, role-based access, discretionary reporting, and comprehensive technology infrastructure that integrates across diverse asset classes.

Our platform serves asset managers who need client-ready reporting and project managers who require lifecycle continuity. Meanwhile, it maintains the institutional-grade oversight family offices demand.

The AI learns your specific operational patterns, vendor relationships, and preferences. As a result, it becomes more valuable over time rather than requiring constant configuration.

Moving Forward

Your physical assets likely represent equal or greater value than your financial portfolio. Therefore, the operational infrastructure managing them should reflect that importance.

Contact our team to explore how AI estate management workflows might transform your operations from manual coordination to automated intelligence.

The families who will preserve wealth across generations aren’t just managing assets better—they’re building institutional systems that transcend individual personnel.

EstateSpace is purpose-built for family offices managing complex physical asset portfolios. Our AI-native platform combines institutional-grade oversight with the privacy and security ultra-high net worth families require.