The wealth management industry stands at a critical inflection point. Meanwhile, while financial asset management has achieved remarkable technological sophistication, tangible asset oversight—representing half of global wealth at $250 trillion—remains trapped in outdated operational models that create systemic inefficiencies and strategic blind spots for family offices and financial advisors.

Furthermore, this disparity has profound implications for comprehensive wealth management. Moreover, as ultra-high-net-worth families accumulate increasingly diverse portfolios spanning real estate, art, aircraft, luxury vehicles, and collectibles, the gap between financial and physical asset capabilities becomes a significant competitive disadvantage and operational risk.

Understanding the Tangible Asset Oversight Challenge

Tangible asset oversight encompasses the systematic supervision of tangible wealth beyond traditional financial instruments. However, this critical wealth component faces unique operational challenges that differentiate it from financial portfolio management:

Asset Complexity and Heterogeneity where each physical asset class—from residential properties and commercial real estate to fine art and luxury vehicles—requires specialized knowledge, vendor relationships, and maintenance protocols

Geographic Distribution Challenges as physical assets exist across multiple locations, jurisdictions, and regulatory environments, making centralized oversight exponentially more complex than financial portfolio management

Operational Intensity Requirements since tangible assets demand active maintenance, insurance coordination, security oversight, and vendor management that financial assets simply do not require

Documentation and Compliance Complexity where asset management involves property records, insurance policies, appraisals, provenance documentation, and regulatory compliance across multiple jurisdictions

Valuation and Performance Tracking Difficulties as physical assets lack real-time market pricing mechanisms and require specialized expertise for accurate performance assessment and strategic planning

Succession Planning Complications when asset knowledge, vendor relationships, and operational procedures exist primarily in institutional memory rather than systematic documentation

Ultimately, traditional wealth management approaches have largely ignored these challenges, creating a massive gap in comprehensive wealth oversight that affects both family offices and their advisor relationships.

Current Industry Pain Points in Tangible Asset Oversight

Family offices and wealth advisors consistently encounter specific operational challenges when attempting to provide comprehensive physical asset management:

Operational Inefficiencies

- Fragmented Systems where asset information remains scattered across spreadsheets, email chains, and location-specific filing systems

- Manual Coordination Requirements that consume disproportionate staff time for vendor management, maintenance scheduling, and performance tracking

- Reactive Management Approaches where issues receive attention only after problems arise rather than through systematic preventive oversight

- Administrative Overhead that can consume 40-60% of operational budgets without contributing to asset performance or client satisfaction

Strategic Limitations

- Incomplete Portfolio Visibility preventing holistic wealth analysis and strategic optimization across all asset classes

- Performance Measurement Gaps where physical asset returns remain unmeasured or incorrectly calculated in total portfolio performance

- Risk Management Blind Spots as insurance gaps, maintenance deferrals, and vendor performance issues go undetected until costly problems emerge

- Succession Planning Vulnerabilities when operational knowledge lacks systematic preservation for generational wealth transfers

Client Service Challenges

- Service Standard Inconsistencies across different asset categories and geographic locations

- Communication Coordination Difficulties when multiple parties require updates and approvals for routine operational decisions

- Emergency Response Limitations where urgent situations require manual coordination between multiple vendors and stakeholders

- Transparency and Reporting Gaps that prevent families from understanding physical asset performance and optimization opportunities

Industry Trends Shaping Tangible Asset Oversight Evolution

Several converging trends are driving demand for more sophisticated tangible asset oversight approaches:

Technology Integration Expectations as families accustomed to sophisticated financial portfolio technology demand equivalent capabilities for physical asset management

Generational Wealth Transfer Acceleration with $68 trillion transferring to younger generations who expect systematic, technology-enabled asset management

Regulatory Complexity Increases across multiple jurisdictions requiring more sophisticated compliance and documentation capabilities

Alternative Investment Growth as families diversify into physical assets requiring specialized oversight and performance measurement

Service Provider Consolidation where families prefer advisors who can deliver comprehensive oversight rather than fragmented service relationships

ESG and Impact Considerations that extend beyond financial investments to include sustainable practices in physical asset management and operations

Emerging Solutions and Strategic Approaches

Forward-thinking family offices and wealth advisors are exploring innovative approaches to address tangible asset oversight challenges:

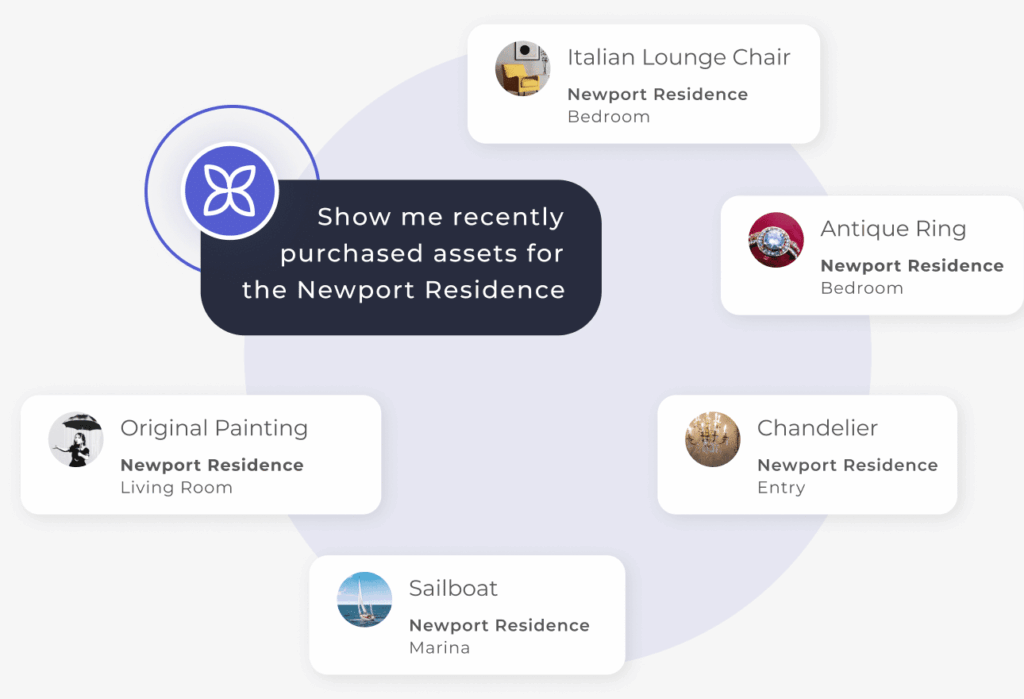

Integrated Technology Platforms that provide unified oversight across financial and physical asset portfolios with real-time performance tracking and strategic analytics

AI-Powered Predictive Analytics for maintenance optimization, risk identification, and performance enhancement across diverse physical asset portfolios

Systematic Documentation Protocols that preserve operational knowledge, vendor relationships, and family preferences for succession planning and institutional continuity

Vendor Network Optimization through coordinated service provider management that ensures consistent quality standards and cost efficiency across all physical assets

Performance Measurement Standardization that applies institutional-grade analytics to asset management enabling true comprehensive wealth assessment

Compliance Automation that systematically maintains regulatory requirements, insurance documentation, and audit trails across multiple jurisdictions and asset types

For family offices seeking to optimize their operational infrastructure, essential software solutions for family office operations provide the foundation for addressing these systematic challenges through comprehensive technology integration.

The Strategic Imperative for Tangible Asset Oversight Evolution

The wealth management industry cannot continue to ignore half of global wealth simply because tangible assets require different operational approaches than financial portfolios. Moreover, families increasingly expect their advisors to deliver institutional-grade oversight across all asset classes, not just financial investments.

This represents both a significant challenge and an unprecedented opportunity for family offices and wealth advisors who can develop comprehensive physical asset management capabilities. Those who master this integration will differentiate their services, justify premium fees, and build deeper client relationships through truly comprehensive wealth stewardship.

The future belongs to wealth managers who recognize that physical asset management is not an operational burden but a strategic advantage. By applying the same analytical rigor and technological sophistication to physical assets that the industry has developed for financial portfolios, forward-thinking advisors can transform their value proposition and client relationships.

Ready to understand how institutional-grade asset oversight can transform your wealth advisory practice? Learn Our Approach to discover how leading family offices are bridging the asset management gap.