Sudden wealth management strategies require specialized approaches that help wealth advisors guide newly affluent clients through complex emotional and financial transitions while building long-term stewardship relationships.

Hollywood stardom and great wealth capture most people’s imagination. These financial windfalls seem like ultimate life achievements. However, while celebrity downfalls receive extensive media coverage, few understand how unexpected wealth can completely disrupt lives. According to the National Endowment for Financial Education, seventy percent of people who suddenly acquire substantial assets declare bankruptcy within years. Many also experience “Sudden Wealth Syndrome,” including depression, anxiety, paranoia, and destructive behaviors.

For wealth managers and financial advisors, these statistics represent critical challenges. Successfully guiding newly affluent clients requires specialized sudden wealth management strategies. These approaches address both financial complexity and emotional turbulence that accompany major asset transitions.

Sudden Wealth Management: Understanding Client Psychology

Private wealth professionals encounter unique challenges when serving clients experiencing sudden financial transitions. Whether from inheritance, business exits, legal settlements, or investment windfalls, these clients need specialized guidance beyond traditional portfolio management.

Without proper sudden wealth management protocols, new clients often make devastating financial decisions. Moreover, they struggle with relationship changes and identity confusion. Consider these frequent challenges affecting your advisory practice:

- Financial Decision Paralysis: Overwhelmed clients make impulsive purchases or avoid decisions entirely, creating missed opportunities and poor asset allocation

- Relationship Trust Issues: Clients become suspicious of family and friends, leading to isolation and poor support system development

- Lifestyle Inflation Dangers: Immediate spending on luxury items without understanding ongoing maintenance costs and tax implications

- Privacy and Security Concerns: Lack of discretion about wealth creates safety risks and unwanted attention from opportunistic individuals

- Emotional Processing Difficulties: Guilt, anxiety, or identity confusion prevents rational decision-making about asset management and life planning

- Professional Service Overwhelm: Multiple advisors, attorneys, and specialists create confusion without proper coordination and leadership

AI-Powered Sudden Wealth Management Solutions

Modern wealth advisory practices leverage AI-driven platforms to enhance client guidance during sudden wealth transitions. These systems provide comprehensive support that addresses both financial and emotional complexities through intelligent automation.

AI-powered assessment tools help advisors quickly evaluate client situations, risk tolerance, and emotional readiness for major decisions. Predictive analytics identify potential problem areas before they become costly mistakes.

Intelligent portfolio modeling enables real-time scenario planning for lifestyle decisions. Clients can understand long-term implications of purchases, investments, and spending patterns through interactive AI dashboards.

Automated privacy monitoring helps protect client information across digital platforms. AI systems track potential exposure risks while providing secure communication channels for sensitive discussions.

Educational AI modules deliver personalized learning paths about wealth management, helping clients build confidence and knowledge gradually. Machine learning adapts content based on individual learning styles and comprehension levels.

Strategic Implementation of Sudden Wealth Management

Experienced advisors recognize that successful sudden wealth management requires systematic approaches that balance financial planning with emotional support. Rather than overwhelming clients with complex strategies, effective sudden wealth management focuses on gradual education and measured implementation.

Comprehensive Net Worth Assessment: Begin with thorough asset evaluation before any major decisions. Help clients understand their true financial position, including hidden costs, tax implications, and maintenance requirements for luxury assets. Prevent impulsive purchases that could destabilize long-term financial security.

Coordinated Professional Team Assembly: Build integrated advisory teams including specialized attorneys, tax professionals, and mental health specialists familiar with wealth transition challenges. Ensure clear communication protocols and unified strategic approaches that prevent conflicting advice.

Privacy Protection Protocols: Establish strict confidentiality measures and educate clients about discretion importance. Implement secure communication systems and guide clients away from social media exposure that could compromise safety or invite unwanted attention.

Gradual Lifestyle Integration: Recommend measured lifestyle changes rather than dramatic shifts. Test major decisions through temporary arrangements before permanent commitments. This includes rental properties before purchases, trial luxury services, and gradual social circle adjustments.

Emotional Support Integration: Connect clients with therapists specializing in wealth psychology. Address isolation concerns through appropriate social groups and philanthropic opportunities that provide meaningful connections with similarly situated individuals.

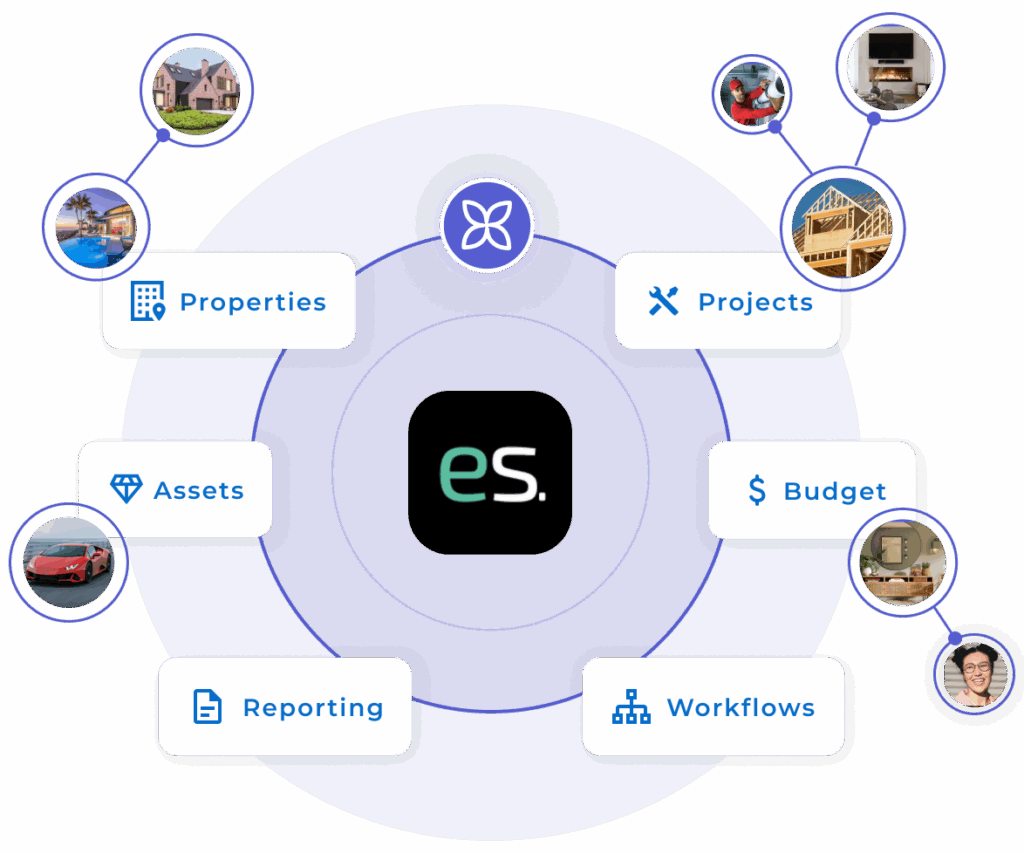

The EstateSpace Solution: AI Intelligence for Sudden Wealth Transitions

EstateSpace’s AI intelligence transforms how advisors support clients through sudden wealth transitions. Built by professionals who understand complex wealth management challenges, our AI-powered platform empowers advisors to provide comprehensive guidance that addresses both financial and emotional client needs.

Intelligent Assessment & Planning

EstateSpace’s AI analyzes client situations comprehensively, identifying potential risks and opportunities through predictive modeling. Our platform helps advisors develop customized strategies that prevent common sudden wealth pitfalls while optimizing long-term outcomes. AI-driven scenario planning enables clients to understand decision consequences before implementation.

Secure Communication & Education

AI-powered educational modules deliver personalized learning experiences that build client confidence gradually. Our platform provides secure communication channels for sensitive discussions while maintaining strict privacy protection. Intelligent content adaptation ensures information delivery matches individual comprehension levels and emotional readiness.

Comprehensive Coordination & Monitoring

Real-time AI dashboards enable seamless coordination among advisory team members while tracking client progress and satisfaction. Machine learning identifies potential issues early, enabling proactive intervention before problems escalate. AI-driven oversight ensures consistent service quality across all client touchpoints.

Implementing Effective Sudden Wealth Management Strategies

Transform your sudden wealth advisory approach with these strategic actions:

- Develop Specialized Assessment Protocols: First, create systematic approaches for evaluating client emotional readiness alongside financial circumstances

- Build Integrated Advisory Teams: Next, establish relationships with specialists who understand sudden wealth psychology and legal complexities

- Implement AI-Powered Monitoring: Then, deploy intelligent platforms that track client progress while identifying potential risks early

- Create Educational Pathways: Finally, establish structured learning programs that build client confidence and knowledge systematically

Wealth managers who implement comprehensive sudden wealth management strategies today protect new clients more effectively. Moreover, they build stronger long-term relationships while ensuring successful wealth transitions. From initial assessment to ongoing stewardship, exceptional outcomes become achievable through strategic AI-powered guidance.

Ready to enhance your sudden wealth management capabilities? Discover how EstateSpace’s AI intelligence empowers exceptional client guidance during complex financial transitions.

Key Takeaway: AI-powered sudden wealth management strategies enable advisors to guide clients through complex financial and emotional transitions while building lasting stewardship relationships that preserve and grow newfound wealth.

Schedule a consultation to experience comprehensive AI-driven tools that strengthen both client outcomes and advisory relationships.