Platform innovation leadership transforms wealth management practices through comprehensive technology solutions that enable advisors to manage physical assets, streamline operations, and deliver exceptional client service across all portfolio components.

The wealth management industry continues evolving through technology-driven innovations. These address complex client needs across both financial and physical asset portfolios. Modern platform innovation leadership emerges from professionals who understand operational challenges firsthand. They develop solutions that transform traditional advisory practices.

Industry pioneers recognize that effective wealth management requires comprehensive approaches. These span real estate, vehicles, aircraft, fine art, and other physical assets representing half of global wealth. Traditional advisory practices focus almost exclusively on financial assets. This creates significant opportunities for platforms that address this gap through intelligent automation and streamlined operations.

Successful platform innovation leadership combines deep industry expertise with modern technology capabilities. This approach enables advisors to deliver holistic services that protect, improve, and create value across entire client portfolios. Rather than focusing solely on traditional asset under management (AUM) categories, advisors can serve complete client needs.

Platform Innovation Leadership: Industry Transformation Drivers

Wealth managers serving sophisticated clients encounter recurring challenges. These require comprehensive technology solutions addressing both financial and physical asset management needs. Modern platform innovation leadership provides strategic advantages for advisory practices seeking to differentiate their services. It also helps them capture broader market opportunities.

Without proper platform innovation leadership, wealth advisory practices struggle to compete effectively in evolving markets. Moreover, clients increasingly expect comprehensive services that span all asset categories. They want these delivered through integrated technology solutions. Consider these critical areas driving industry transformation:

- Comprehensive Asset Management Gaps: Most platforms focus exclusively on financial assets. They ignore the $250 trillion physical asset market representing half of global wealth

- Operational Efficiency Challenges: Traditional advisory practices lack integrated systems for managing complex client operations. This affects diverse asset categories and service providers

- Technology Integration Difficulties: Legacy platforms fail to provide seamless communication and operational management capabilities. Modern clients expect these features

- Risk Management Limitations: Fragmented oversight approaches increase operational risks. They also reduce visibility into complete client portfolio performance

- Service Differentiation Pressures: Advisors need comprehensive platforms that enable them to offer unique value propositions. This goes beyond traditional financial planning services

- Client Relationship Evolution: Ultra-high-net-worth families expect integrated technology solutions. These should simplify complex lifestyle management requirements

AI-Powered Platform Innovation Leadership Solutions

Modern wealth management leverages cutting-edge AI technology to enhance comprehensive client service delivery. This happens through intelligent automation and predictive capabilities. These innovations represent the next generation of platform innovation leadership. They transform how advisors coordinate complex operations while maintaining exceptional service standards.

Multi-agent AI platforms enable systematic oversight across real estate portfolios, luxury vehicles, aircraft, and fine art collections. This occurs through automated monitoring and optimization protocols. Machine learning algorithms identify cost efficiency opportunities while ensuring asset protection and value enhancement across all categories.

Intelligent communication systems streamline coordination between advisors, clients, family members, and service providers. They use centralized platforms that capture institutional knowledge and maintain comprehensive documentation. AI-powered routing ensures critical information reaches appropriate stakeholders while preventing communication gaps.

Automated operational management capabilities handle routine tasks while flagging exceptions that require human intervention. This approach enables advisors to focus on strategic client relationships rather than administrative coordination. It also ensures consistent service quality across all touchpoints.

Predictive analytics identify optimization opportunities and potential issues before they impact client satisfaction or portfolio performance. Real-time monitoring capabilities provide transparency and accountability that builds client confidence. They also demonstrate measurable value creation.

Strategic Platform Innovation Leadership Implementation

Experienced industry leaders recognize that successful platform innovation leadership requires systematic approaches. These should enhance rather than disrupt existing client relationships. Rather than wholesale technology replacement, effective innovation focuses on gradual integration. This includes measurable improvement tracking and clear value demonstration.

Comprehensive Solution Development: Build platforms that address complete client needs rather than focusing on single asset categories or operational functions. Successful platform innovation leadership emerges from understanding client pain points across all aspects of wealth management and developing integrated solutions that streamline complex operations.

Industry Expertise Integration: Combine deep operational knowledge with modern technology capabilities to create solutions that resonate with both advisors and clients. The most effective platform innovation leadership comes from professionals who have experienced industry challenges firsthand and understand practical implementation requirements.

Modern Business Model Adoption: Implement subscription-based platforms with marketplace capabilities that enable multi-sided interactions between advisors, clients, and service providers. AI machine learning capabilities personalize experiences while maintaining security and efficiency standards that sophisticated clients require.

Continuous Education Focus: Maintain commitment to learning and sharing knowledge with other industry professionals. Effective platform innovation leadership involves teaching others while continuously expanding perspectives through engagement with like-minded entrepreneurs and advisors.

Niche Market Understanding: Focus on specific client segments where platform capabilities provide measurable return on investment and clear value propositions. Understanding client pain points, triggering events, and purchasing priorities enables development of compelling solutions that drive adoption.

For additional insights into how industry pioneers develop comprehensive platform solutions, successful entrepreneurs recently shared their approaches to building technology companies that transform traditional business models through innovative thinking and persistent execution.

The EstateSpace Solution: Pioneering Comprehensive Wealth Technology

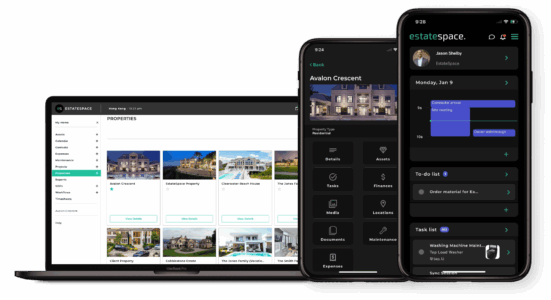

EstateSpace represents the evolution of platform innovation leadership through comprehensive technology solutions designed specifically for wealth managers serving ultra-high-net-worth clients. Built by professionals with decades of operational experience, our AI-powered platform addresses the complete spectrum of client needs across financial and physical asset categories.

Integrated Asset Management Capabilities

EstateSpace’s multi-agent AI platform provides systematic oversight across real estate, vehicles, aircraft, and fine art portfolios while maintaining the same precision and real-time capabilities used for financial assets. Our technology enables advisors to manage complete client portfolios through unified interfaces that streamline complex operations.

Advanced Communication & Operational Management

AI-powered systems facilitate seamless coordination between advisors, clients, family members, and service providers through centralized platforms that maintain comprehensive documentation and institutional knowledge. Automated workflows handle routine tasks while intelligent routing ensures critical information reaches appropriate stakeholders efficiently.

Comprehensive Risk Reduction & Value Creation

Real-time monitoring capabilities provide transparency and accountability across all client touchpoints while identifying optimization opportunities that enhance portfolio performance. Our platform reduces operational risks while creating measurable value through cost efficiency improvements and enhanced service quality.

Implementing Effective Platform Innovation Leadership

Transform your advisory practice through these strategic actions:

- Assess Comprehensive Service Opportunities: First, evaluate client portfolios to identify gaps between current service offerings and complete wealth management needs across all asset categories

- Develop Technology Integration Plans: Next, implement AI-powered platforms that enable real-time monitoring, automated operations, and seamless communication across all client touchpoints

- Build Industry Expertise Networks: Then, establish relationships with other innovation leaders who understand modern technology business models and comprehensive wealth management approaches

- Create Measurable Value Propositions: Finally, demonstrate clear return on investment through cost efficiency improvements, enhanced service quality, and expanded client relationship opportunities

Wealth managers who embrace platform innovation leadership today position themselves as comprehensive advisors capable of serving sophisticated clients across all aspects of wealth management. Moreover, they capture opportunities in overlooked market segments while building competitive advantages through technology-enabled service differentiation.

The most effective approach combines continuous learning with practical implementation. Whether developing platforms, selling software, or providing comprehensive services, seeking guidance from experienced professionals who have successfully navigated similar challenges accelerates progress while avoiding costly mistakes.

Ready to embrace platform innovation leadership for comprehensive wealth management? Discover how EstateSpace’s AI-powered solutions enable advisors to serve clients across all asset categories through integrated technology platforms.

Key Takeaway: Platform innovation leadership transforms wealth management by addressing complete client needs across financial and physical assets through AI-powered technology solutions that enable comprehensive service delivery and measurable value creation.

Schedule a consultation to experience comprehensive platforms that drive innovation leadership in modern wealth management practice.