The wealth management landscape is experiencing a fundamental shift. While financial assets have long dominated portfolio conversations, physical asset tracking software is revolutionizing how professionals manage the other half of global wealth. For asset managers, property specialists, and wealth advisors working with high-net-worth clients, this represents both a challenge and an unprecedented opportunity.

Modern physical asset tracking software is revolutionizing how professionals manage luxury properties, collectibles, vehicles, and fine art. However, traditional wealth management systems fall short when it comes to the unique complexities of physical assets. This gap creates inefficiencies that can significantly impact client relationships and operational scalability.

Moreover, integrating physical assets into comprehensive portfolio management delivers substantial value for wealth managers. Clients increasingly view their wealth holistically—from financial investments to luxury properties, art collections, and other tangible assets. Therefore, advisors who can provide unified oversight across both asset classes position themselves as complete wealth stewards rather than limited financial managers.

Why Traditional Methods Fall Short for Physical Asset Tracking

Managing physical assets through spreadsheets, email chains, and disparate systems creates operational vulnerabilities. Picture this scenario: You’re overseeing a client’s portfolio that includes multiple luxury properties, a classic car collection, and valuable artwork. Meanwhile, maintenance schedules live in different systems. Additionally, insurance documentation is scattered across emails. Furthermore, vendor communications happen through various channels.

The catering coordinator for a property event needs updated access codes. Simultaneously, the art conservator requires climate control data. Moreover, the classic car appraiser is requesting maintenance records. All this occurs while you’re trying to provide your client with comprehensive portfolio reporting that includes both financial and physical assets.

This fragmented approach isn’t just inefficient. In fact, it creates compliance risks, especially when managing assets worth millions. Therefore, wealth advisors need sophisticated solutions that match the complexity of their clients’ portfolios.

How AI Transforms Wealth Management Operations

Artificial intelligence and machine learning are at the core of modern asset management systems in 2025. These technologies help organizations forecast equipment failures, automate maintenance tasks, and optimize asset utilization. However, physical asset tracking software takes this further by addressing the unique needs of luxury asset management.

Advanced platforms deliver measurable improvements for wealth management professionals:

- Real-time visibility across entire physical asset portfolios

- Automated maintenance scheduling and vendor coordination

- Integrated compliance tracking and reporting

- Centralized documentation and communication hubs

Modern physical asset tracking software understands the unique requirements of luxury assets. For instance, it recognizes the importance of provenance tracking for fine art. Additionally, it manages complex maintenance schedules for multiple properties. Most importantly, it maintains the discretion and security standards that high-net-worth clients demand.

Critical Features of Physical Asset Tracking Software

Physical asset tracking software designed for wealth management must address specific operational challenges:

Portfolio Integration: The platform should seamlessly integrate physical assets into existing wealth management workflows. Furthermore, it must provide comprehensive reporting that combines financial and physical asset performance. This creates a complete picture of client wealth.

Security and Privacy: High-net-worth clients require sophisticated security measures. Therefore, the software must include encrypted communication channels, role-based access controls, and comprehensive audit trails. Additionally, it should support privacy compliance requirements.

Vendor Management: Coordinating multiple service providers across different asset types requires centralized vendor management. Moreover, the platform should track vendor performance, credentials, and insurance status. As a result, wealth advisors can ensure consistent service quality.

Lifecycle Tracking: From acquisition to disposal, physical assets require comprehensive lifecycle management. For example, this includes purchase documentation, maintenance records, valuations, and transfer protocols.

Key security and compliance features include:

- Bank-level encryption for all data transmission

- Multi-factor authentication and device verification

- Detailed audit logs for regulatory compliance

- Role-based permissions for staff and vendors

Getting Started: Modernizing Your Practice

Ready to integrate physical asset tracking software into your wealth management practice? Begin with these strategic steps:

- Audit current processes – Document how physical asset information is currently managed and shared

- Identify integration points – Determine how physical assets connect to your existing wealth management systems

- Start with high-value clients – Use a pilot approach with clients who have significant physical asset portfolios

- Engage your service network – Ensure key vendors and partners are comfortable with digital coordination

The Strategic Advantage for Wealth Advisors

The global asset management market size was estimated at USD 458.02 billion in 2023 and is expected to reach USD 3,677.39 billion by 2030, growing at a CAGR of 36.4%. However, this growth primarily focuses on financial assets. Therefore, wealth advisors who embrace physical asset tracking software gain a significant competitive advantage.

Integrating physical assets into portfolio management creates deeper client relationships and higher retention rates. When advisors can provide comprehensive oversight of a client’s complete wealth ecosystem, they become indispensable strategic partners. Furthermore, this holistic approach justifies premium fee structures and differentiates practices from competitors who only manage financial portfolios.

Clients increasingly expect the same technological sophistication in their physical asset management that they receive for their financial portfolios. Moreover, demonstrating expertise across both asset classes enhances advisor credibility and expands service offerings organically.

EstateSpace: Purpose-Built for Wealth Management Excellence

EstateSpace represents a new generation of physical asset tracking software specifically designed for wealth management professionals. Unlike generic asset management tools, EstateSpace understands the nuanced requirements of high-net-worth clients and their advisors.

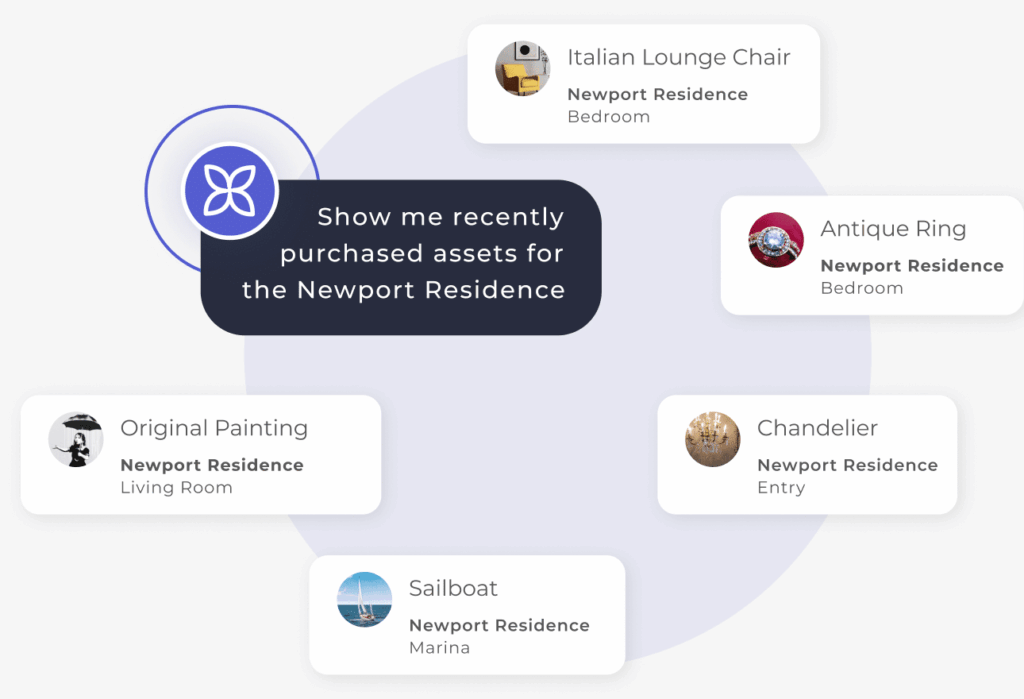

Our AI-driven platform transforms how wealth advisors manage physical assets. For instance, it provides real-time intelligence across property portfolios, collectibles, and luxury assets. Additionally, it integrates seamlessly with existing wealth management workflows. Most importantly, it maintains the security and discretion standards that elite clients expect.

Wealth advisors using EstateSpace report enhanced client satisfaction through comprehensive portfolio oversight. Simultaneously, they achieve operational efficiencies that allow them to scale their practice. Furthermore, the platform’s intelligent automation reduces administrative burden while improving service quality.

The wealth management industry stands at an inflection point. Instead of treating physical assets as administrative burdens, forward-thinking advisors are recognizing them as strategic opportunities. Physical asset tracking software isn’t just about operational efficiency—it’s about delivering the comprehensive wealth stewardship that creates lasting client partnerships and sustainable business growth.

Physical asset tracking software represents the next frontier in wealth management technology. By integrating AI-powered platforms like EstateSpace, wealth advisors can deliver enhanced service quality while building deeper client relationships. As a result, they position themselves as indispensable partners in managing their clients’ complete wealth ecosystem.

For wealth management professionals ready to embrace this transformation, learn our approach and elevate your practice to new standards of excellence.