When disaster strikes high-value properties, family offices face a critical challenge. The biggest problem isn’t the damage itself. Instead, it’s the complex physical asset risk management required. They must prove proper stewardship to insurance carriers. Scattered maintenance records, outdated valuations, and incomplete documentation turn straightforward insurance claims into lengthy disputes that expose principals to significant financial losses.

If you’re managing insurance policies across multiple high-value properties and diverse asset classes, this scenario keeps you up at night. When you have 15+ different policies with varying renewal cycles and different carriers, gaps become inevitable. How confident are you about vulnerabilities that could devastate your principals’ wealth?

The Insurance Risk Management Crisis

Here’s what’s happening in most family offices. You’re juggling dozens of insurance policies across multiple asset classes. Real estate, art, jewelry, yachts, aircraft, and collectibles each require different coverage. Moreover, each policy has different renewal dates and unique documentation requirements.

For instance, your art collection policy requires annual appraisals. Meanwhile, your property policies need maintenance records. Furthermore, your yacht coverage demands specific safety compliance documentation.

Asset values are changing constantly. New acquisitions need coverage. Unfortunately, existing policies may have gaps you don’t know about. The documentation proving proper asset care is scattered across property managers, contractors, and various filing systems.

This creates four critical insurance risk exposures:

- Coverage gaps – Policies don’t align with current asset values

- Documentation failures – Missing maintenance records jeopardize claims

- Renewal oversights – Policy lapses create windows of zero protection

- Compliance issues – Failure to meet carrier requirements voids coverage

The real cost isn’t just premiums. It’s catastrophic loss potential when you can’t prove proper asset stewardship or discover coverage gaps during claims.

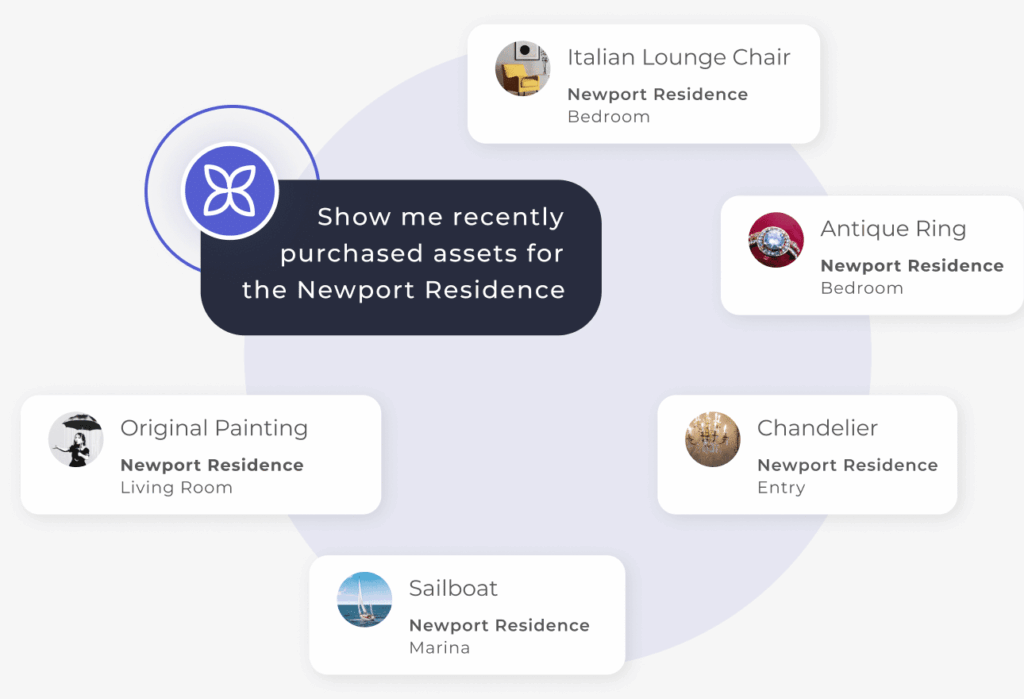

How EstateSpace Transforms Physical Asset Risk Management

Rather than hoping your coverage is adequate, EstateSpace provides comprehensive visibility. Our platform manages physical asset risk management across all assets and policies.

The platform consolidates insurance policy data, maintenance documentation, and asset valuations into one secure system. It tracks coverage adequacy, renewal schedules, and compliance requirements in real-time.

Concrete example: When your Nantucket property’s wind coverage renewal arrives, the system automatically provides your broker with updated property valuations, complete maintenance records, and documented compliance with all carrier requirements—ensuring optimal coverage at best rates.

Insurance Risk Management in Practice

Policy Portfolio Dashboard: See all insurance policies across your portfolio with renewal dates, coverage gaps, and compliance status in one consolidated view.

Claims Documentation Ready: When incidents occur, complete documentation is immediately accessible. Maintenance histories, professional inspections, and asset records support faster claims processing and better outcomes.

Proactive Gap Analysis: The system identifies coverage gaps before they become problems. It flags when asset appreciation outpaces policy limits and alerts you when new acquisitions aren’t properly covered.

This predictive asset maintenance approach for high-value portfolios ensures your insurance carriers see you as a sophisticated, low-risk client with comprehensive physical asset risk management practices.

Insurance-Focused Risk Mitigation

Carrier Compliance Management: Automated tracking ensures you meet all carrier requirements for fire safety inspections, security system maintenance, and professional property assessments—preventing policy cancellations or claim denials.

Valuation Alignment: Regular asset valuation tracking identifies when policy limits need adjustment, preventing underinsurance situations that could devastate claim recoveries.

Multi-Policy Coordination: The platform identifies overlapping coverage areas and potential gaps between policies, optimizing insurance spend while ensuring complete protection.

Asset managers using the platform report significantly improved relationships with insurance brokers and carriers who appreciate the comprehensive documentation and proactive approach.

Implementation for Physical Asset Risk Excellence

The transition focuses on insurance risk reduction through three strategic phases:

- Insurance Audit (Month 1) – Complete analysis of current policies, coverage gaps, and documentation deficiencies

- Documentation Integration (Months 2-3) – Consolidate maintenance records and compliance documentation into centralized system

- Proactive Management (Month 4+) – Automated renewal tracking, gap analysis, and carrier requirement compliance

Your existing broker relationships remain unchanged—they’ll appreciate having a client with superior documentation and proactive physical asset risk management.

Technology Built for Insurance Requirements

EstateSpace’s platform maintains detailed documentation insurance carriers require, with automated compliance tracking and audit trails satisfying stringent policy requirements.

The system generates specific reports carriers need for underwriting, renewal negotiations, and claims processing, positioning you as a preferred, low-risk client worthy of better rates and coverage terms.

Claims Support: When incidents occur, the platform immediately provides claims adjusters with comprehensive asset documentation, maintenance histories, and compliance records—supporting faster processing and better outcomes.

Strategic Physical Asset Risk Advantages

Comprehensive physical asset risk management delivers measurable benefits:

- Negotiating Power – Documentation and proven risk management provide leverage in renewal negotiations

- Premium Optimization – Detailed maintenance records justify lower premiums and better coverage terms

- Claims Success – Complete documentation significantly improves claim approval rates and settlement amounts

- Carrier Preference – Positions you as institutional-quality client worthy of preferred rates

Project managers benefit from automated documentation satisfying insurance requirements throughout construction and ongoing operations, ensuring continuous coverage protection.

Beyond Documentation: Strategic Risk Intelligence

The platform transforms how you work with financial advisors and insurance brokers. Instead of scrambling to gather documentation during renewals or claims, proactive analysis becomes possible. Insurance costs can be analyzed as a percentage of asset value. Additionally, coverage strategies can be optimized while demonstrating sophisticated physical asset risk management to carriers.

As noted in a recent CFA Institute analysis on modern family office risk management, “Risk management lies at the heart of effective family office operations.”

This positions your office as an institutional-quality client that insurance companies want to retain at preferred rates—exactly the relationship you need to protect your principals’ wealth.

Your Physical Asset Risk Assessment

If you’re concerned about coverage gaps, documentation deficiencies, or claim vulnerabilities, EstateSpace provides the comprehensive physical asset risk management approach that sophisticated family offices require.

Ready to eliminate physical asset risk blind spots? Schedule a consultation where we can review your current risk exposures and discuss how comprehensive documentation can better protect your principals’ assets.