Physical asset planning strategies enable wealth managers to protect and optimize client portfolios across real estate, vehicles, aircraft, and fine art through AI-powered technologies that drive measurable value creation and cost efficiency.

As a seasoned wealth manager, you understand your work extends far beyond monitoring financial markets. Everything starts with that first client meeting. Rather than just gathering information in dollars and cents, you explore details about their work, family dynamics, and legacy vision. Additionally, you assess their physical asset holdings across real estate portfolios, luxury vehicles, aircraft, and art collections.

As you understand their unique situation, you realize your role encompasses multiple responsibilities. You serve as financial strategist, trusted advisor, and forward-thinking planner. You help clients navigate present and future challenges while holding them accountable for decisions. This multifaceted relationship enables you to create comprehensive physical asset planning strategies that reflect their priorities. These strategies also protect them from tax burdens, partnership dissolutions, and asset management inefficiencies.

However, global wealth statistics reveal a critical oversight in traditional advisory approaches. World wealth divides equally between financial assets ($250 trillion) and physical assets ($250 trillion). Yet almost all wealth managers focus exclusively on financial asset management (AUM). This creates massive opportunities for advisors who understand effective physical asset planning strategies.

Physical Asset Planning Strategies: Addressing Market Gaps

Wealth managers serving ultra-high-net-worth clients encounter unique challenges when coordinating comprehensive portfolio strategies. Physical assets require specialized oversight approaches that traditional financial planning often overlooks. Without proper physical asset planning strategies, significant wealth components remain unoptimized.

Modern AI technologies now enable owners and managers of physical assets to manage these holdings similarly to financial assets. This happens securely, accurately, and increasingly in real-time. Consider these critical areas affecting your advisory practice:

- Physical Asset Underutilization: Real estate, vehicles, aircraft, and art collections lack systematic management approaches that optimize value creation and cost efficiency

- Expense Management Gaps: Like financial assets, expenses diminish physical asset values without proper oversight and optimization strategies

- Integration Challenges: Physical and financial asset management operate in silos, preventing comprehensive wealth optimization across entire portfolios

- Technology Adoption Lag: Traditional physical asset management approaches fail to leverage AI technologies that enable real-time monitoring and predictive optimization

- Measurable ROI Difficulties: Unlike financial assets, physical asset performance tracking lacks sophisticated analytics and reporting capabilities

- Communication Inefficiencies: Coordinating maintenance, valuations, and strategic decisions across diverse physical asset types creates operational complexities

AI-Powered Physical Asset Planning Strategies

Modern wealth management leverages AI agents and intelligent automation to transform physical asset oversight. These technologies enable comprehensive physical asset planning strategies that protect, improve, and create wealth from previously hard-to-manage assets through systematic optimization.

Multi-agent AI platforms drive cost efficiency across all physical asset categories. Real estate portfolios benefit from predictive maintenance scheduling and automated property management. Luxury vehicles and aircraft receive optimized care protocols that preserve values while reducing operational costs.

Fine art collections gain sophisticated monitoring systems that track conditions, valuations, and conservation requirements through intelligent automation. AI-driven insights identify optimization opportunities across entire physical asset portfolios while maintaining security and efficiency standards.

Integrated communication systems enable seamless coordination between physical asset managers, financial advisors, and family members. Real-time reporting provides transparency and accountability that builds client confidence while demonstrating measurable value creation.

Strategic Client Relationship Management for Physical Assets

Experienced advisors recognize that successful physical asset planning strategies require ongoing client engagement and education. Rather than periodic check-ins, effective strategies focus on continuous relationship building and proactive communication about physical asset opportunities.

Encourage Comprehensive Sharing: Changes in client circumstances often impact physical asset planning strategies significantly. New property acquisitions, family dynamics, or lifestyle changes affect optimization approaches. Reach out periodically to understand evolving needs while maintaining informal, friendly communication that elicits critical information for planning updates.

Provide Continuous Education: Educate clients that effective physical asset planning strategies represent dynamic approaches subject to changing market conditions, tax laws, and family circumstances. Share relevant content about physical asset optimization, AI technology benefits, and emerging opportunities that separate your advisory approach from traditional financial-only services.

Implement User-Friendly Technology: Deploy digital tools that make physical asset management decisions easier to discuss and implement. Some clients prefer traditional communication methods while others embrace AI-powered platforms. Meet each client where they are while helping them understand technology benefits that enable proactive engagement and ownership of asset optimization decisions.

Maintain Proactive Communication: Busy periods make it easy to lose touch with clients, especially when no immediate issues exist. However, you cannot assume clients will contact you first when circumstances change. Studies show many people, including ultra-high-net-worth individuals, neglect updating their physical asset planning strategies until problems arise.

The EstateSpace Solution: Leading Physical Asset AUM Innovation

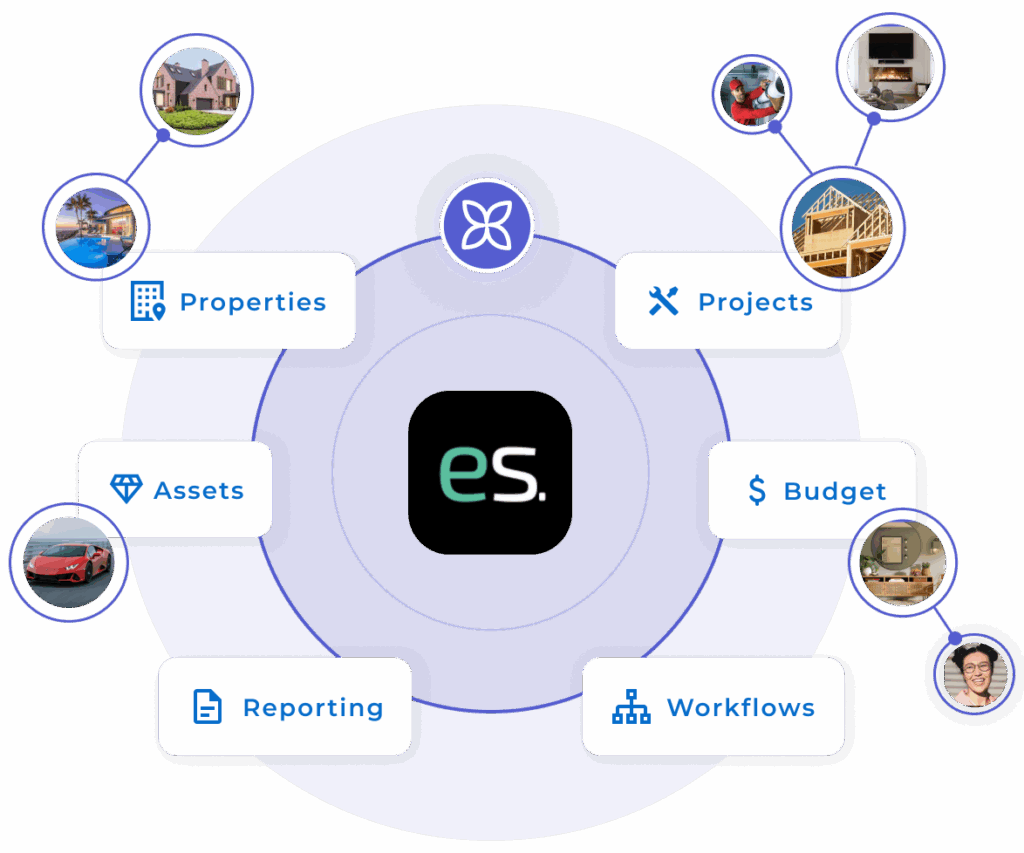

EstateSpace empowers wealth managers to become leaders in physical asset AUM through AI agent technologies that protect, improve, and create wealth across real estate, vehicles, aircraft, and fine art portfolios. Our multi-agent platform drives measurable cost efficiency and value creation across all physical asset categories.

Comprehensive Physical Asset Management

EstateSpace’s AI agents provide systematic oversight across entire physical asset portfolios. Our platform enables wealth managers to manage real estate, luxury vehicles, aircraft, and art collections with the same precision and real-time capabilities used for financial assets. Predictive analytics optimize maintenance, reduce expenses, and maximize value creation.

Integrated Wealth Optimization

AI-powered integration connects physical and financial asset management into unified strategies. Our platform provides comprehensive reporting that demonstrates total portfolio performance while identifying optimization opportunities across all asset categories. Clients gain transparency into complete wealth pictures rather than fragmented views.

Scalable Technology Solutions

EstateSpace’s multi-agent platform scales from ultra-high-net-worth families to broader market segments. Our technology delivers measurable ROI through cost reduction, value enhancement, and operational efficiency gains. Wealth managers gain competitive advantages through comprehensive physical asset AUM capabilities.

Implementing Comprehensive Physical Asset Planning Strategies

Transform your advisory practice with these strategic actions:

- Assess Physical Asset Opportunities: First, evaluate client portfolios to identify unoptimized real estate, vehicles, aircraft, and art holdings that require systematic management

- Integrate AI-Powered Solutions: Next, deploy multi-agent platforms that enable real-time monitoring and optimization across all physical asset categories

- Develop Specialized Expertise: Then, build knowledge about physical asset planning strategies that complement traditional financial planning approaches

- Create Continuous Engagement: Finally, establish communication protocols that keep clients informed about physical asset opportunities and optimization strategies

Wealth managers who implement comprehensive physical asset planning strategies today position themselves as comprehensive advisors rather than financial-only specialists. Moreover, they capture opportunities in the $250 trillion physical asset market while building deeper client relationships through expanded service offerings.

Ready to become a leader in physical asset AUM? Discover how EstateSpace’s AI agent technologies transform comprehensive wealth management through integrated physical and financial asset optimization.

Key Takeaway: Physical asset planning strategies enable wealth managers to optimize the often-overlooked $250 trillion physical asset market through AI-powered technologies that create measurable value alongside traditional financial planning services.

Schedule a consultation to experience multi-agent platforms that drive measurable value creation across entire client portfolios.