The family office landscape is experiencing unprecedented transformation. Ultra-high-net-worth families now demand greater transparency, real-time accessibility, and sophisticated oversight across their entire wealth portfolios. Family office digital transformation has become essential for meeting these evolving expectations.

Successful family office digital transformation requires strategic technology integration. This technology must enhance client relationships while delivering measurable operational improvements. Today’s family office professionals must navigate an evolving client base. These clients expect the same technological sophistication for their physical assets that they receive for their financial investments.

Traditional family office operations often struggle to meet these elevated expectations. They must maintain the personalized service and institutional-grade oversight that distinguish premium wealth management. Successful family office digital transformation requires platforms that enhance rather than replace the trusted advisor relationship.

The Evolution of Client Expectations

Modern family office clients represent a fundamentally different profile than previous generations with elevated expectations for service delivery:

- Information Transparency Demands: Clients expect real-time access to their complete asset portfolio performance, operational costs, and strategic optimization opportunities.

- Multi-Generational Communication Requirements: Younger family members prefer digital-first interactions while older generations value traditional relationship-based service delivery.

- Operational Efficiency Expectations: Families demand streamlined processes, automated reporting, and proactive issue resolution matching their business operations’ sophistication.

- Strategic Partnership Preferences: Families increasingly seek advisors who can demonstrate measurable value creation beyond purely administrative oversight.

- Technology Integration Standards: Clients accustomed to sophisticated business technology expect equivalent capabilities from their family office service providers.

Family offices face increasing pressure to justify premium fees through demonstrable value creation and operational excellence.

Current Family Office Digital Transformation Challenges

Family office professionals encounter operational limitations that compromise service delivery:

- Fragmented Information Systems: Client data remains scattered across multiple platforms, preventing comprehensive portfolio oversight.

- Manual Reporting Requirements: These consume disproportionate staff time while limiting client communication frequency.

- Reactive Problem Management: Issues receive attention only after client complaints rather than through preventive oversight.

- Limited Real-Time Visibility: Physical asset performance and optimization opportunities lack transparency that clients expect.

- Scalability Constraints: Efficient growth is prevented without proportional increases in operational overhead.

How Family Office Digital Transformation Enhances Client Relationships

Leading family offices are implementing comprehensive digital platforms that strengthen client relationships while improving operational efficiency:

- Enhanced Information Sharing: Secure, real-time platforms enable transparent communication while maintaining confidentiality protocols.

- Proactive Client Education: Systems provide contextualized insights, market analysis, and strategic recommendations through data visualization capabilities.

- Streamlined Multi-Generational Engagement: Different communication preferences are accommodated while ensuring consistent information access across all family members.

- Measurable Value Demonstration: Comprehensive analytics quantify operational improvements, cost optimizations, and strategic value creation.

- Operational Excellence Enhancement: Automated workflows eliminate routine administrative tasks while improving response times and service quality.

These platforms reduce operational overhead by 33% while improving client satisfaction scores through enhanced transparency.

Real-World Impact

Consider a family office managing $2B across financial and physical assets for a multi-generational family with members across three continents. Previously, providing consistent updates required extensive manual coordination and miscommunications.

With integrated digital platforms, all family members access unified dashboards showing real-time portfolio performance, operational status, and strategic opportunities. AI-powered analytics identify optimization opportunities before they impact performance.

The family office achieved a 50% reduction in administrative time while receiving the highest client satisfaction scores in their history.

Strategic Components of Effective Family Office Digital Transformation

Modern platforms address critical requirements for institutional-grade operations:

- Unified Asset Oversight: Financial and physical asset management integrate through comprehensive dashboards providing complete portfolio visibility.

- Advanced Communication Systems: Secure, multi-channel engagement accommodates generational preferences while maintaining professional standards.

- Automated Workflow Management: Routine operations are streamlined while ensuring consistent service delivery across all relationships.

- Sophisticated Reporting Capabilities: Executive-level insights and strategic recommendations demonstrate measurable value creation.

- Compliance and Security Integration: Regulatory requirements are maintained while providing appropriate transparency for multi-generational families.

EstateSpace: Pioneering Excellence in Family Office Digital Transformation

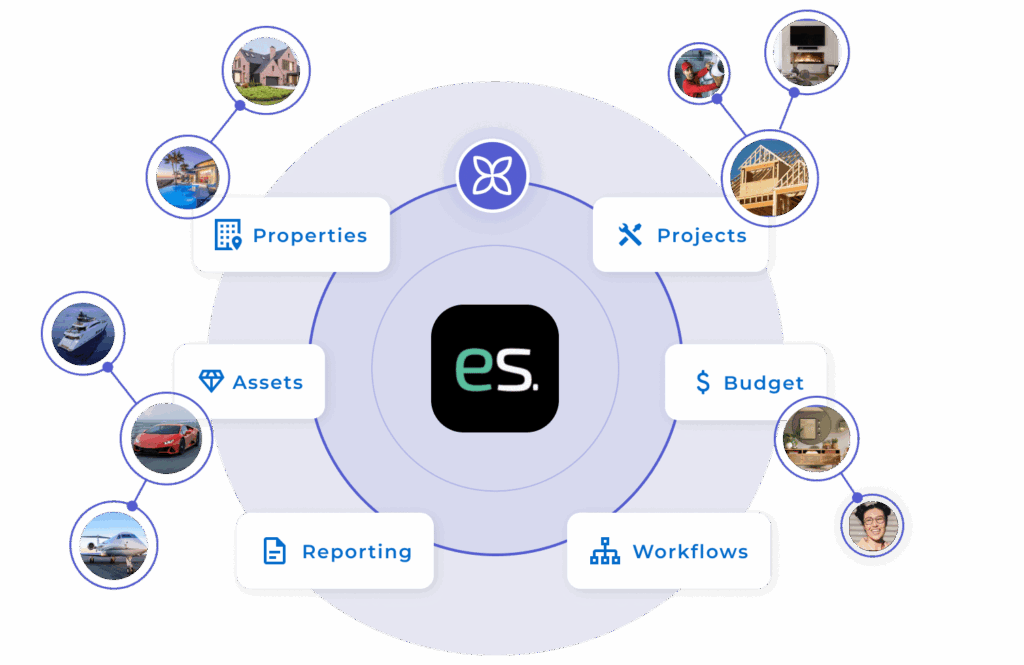

EstateSpace is the recognized leader in family office digital transformation. We provide the industry’s most comprehensive platform for integrating physical and financial asset oversight. Our AI-powered solution addresses the unique challenges that family offices face when serving ultra-high-net-worth families.

Transformative Client Relationship Enhancement

Real-Time Portfolio Intelligence: Our proprietary AI agents provide comprehensive oversight across all asset classes, enabling proactive communication and strategic recommendations.

Multi-Generational Engagement: Sophisticated access controls ensure each family member receives appropriate information through their preferred channels while maintaining security.

Proactive Issue Prevention: Predictive analytics identify potential problems before they impact performance, enabling exceptional oversight capabilities.

Operational Excellence Advancement

60% Administrative Time Reduction: Automated workflows and intelligent reporting eliminate routine tasks while improving service consistency.

Enhanced Competitive Positioning: Deliver sophisticated oversight capabilities that traditional wealth managers cannot match, justifying premium fees.

Scalable Growth Framework: Manage larger portfolios and complex asset structures without proportional increases in operational complexity.

For family offices seeking comprehensive operational optimization, personalized asset management solutions provide the foundation for delivering truly differentiated client experiences through advanced technology integration.

The Strategic Imperative for Evolution

The family office industry cannot ignore the fundamental shift in client expectations and competitive dynamics. Those who embrace digital transformation while preserving personalized service excellence will dominate the market.

EstateSpace enables family offices to enhance rather than replace the trusted advisor relationship by providing the technological foundation for demonstrating measurable value creation and operational excellence.

Ready to understand how EstateSpace’s digital transformation platform can enhance your client relationships while improving operational efficiency?

Learn Our Approach to discover how leading family offices are leveraging AI-powered platforms to achieve unprecedented client satisfaction and operational excellence.