EstateSpace vision emerged from a deeply personal problem that revealed a massive market opportunity in physical asset management. Furthermore, our journey demonstrates how “spreadsheet hell” and operational inefficiencies drove innovation. This innovation addresses a $250 trillion market gap between financial and physical asset management technologies.

The evolution of EstateSpace reflects a fundamental market insight. Global wealth is split equally between financial assets ($250T) and physical assets ($250T). Yet advanced technology exists only for financial asset management. Moreover, our transformation from overwhelmed construction managers to AI-powered platform leaders illustrates how personal challenges can uncover transformative business opportunities.

The Problem That Sparked Our Vision

The foundation of EstateSpace vision began with founders experiencing operational chaos. They were managing luxury construction projects and high-value physical assets. Nevertheless, this challenge revealed a broader industry problem. It affects wealthy families and their professional management teams.

From Spreadsheet Hell to Market Insight: Initially, our team was working 80 to 100 hours a week. They were managing physical assets across multiple clients. They were missing family milestones and feeling overwhelmed by administrative burdens. However, this experience illuminated a massive market opportunity. Physical asset management represents half of global wealth yet lacks sophisticated technology solutions.

Market Discovery: Subsequently, we recognized that family offices use advanced technology for financial assets. But they rely on spreadsheets for physical assets like real estate, jets, yachts, art, and jewelry. Thus, EstateSpace vision crystallized around bringing financial-grade technology to physical asset management. This happens through AI-powered solutions.

EstateSpace Vision Physical Asset Management Technology Innovation

EstateSpace vision accelerated through developing purpose-built AI technology. This technology addresses unique challenges of managing high-value physical assets. Specifically, our platform demonstrates how AI can transform reactive asset management. It becomes proactive portfolio optimization.

AI Agent Development: Furthermore, over the past five years, EstateSpace has secured two patents. We developed cutting-edge AI capabilities including smart data creation, task automation, and workflow optimization. Meanwhile, our Lily AI Assistant eliminates manual data entry. It provides real-time intelligence.

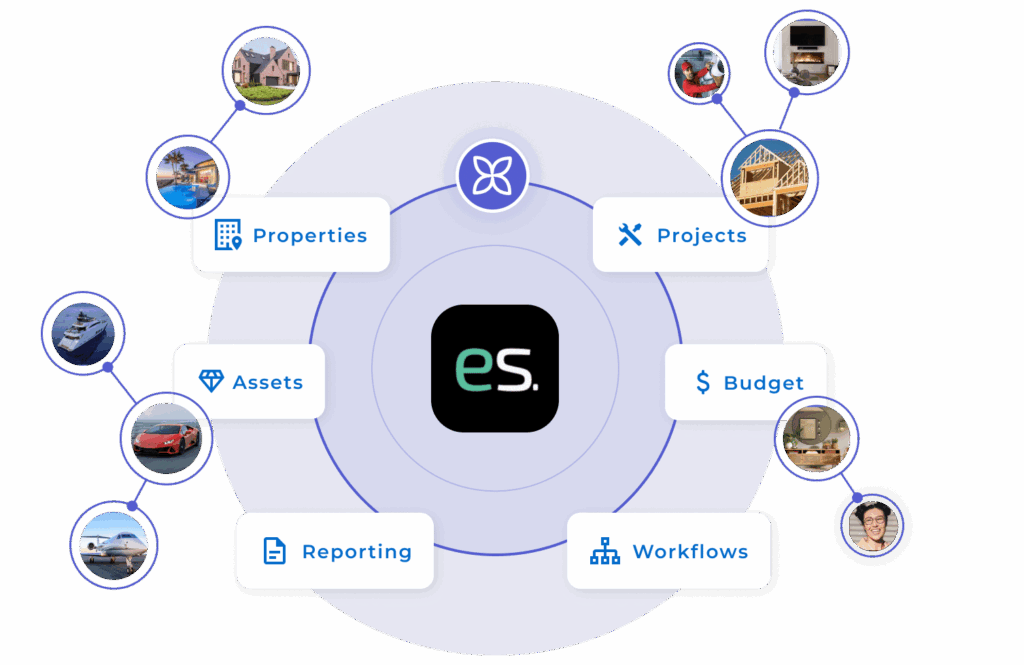

Platform Architecture: Simultaneously, our comprehensive solution integrates asset management, property management, and project management. It includes enterprise-grade security including SOC 2 Type II, HIPAA, and GDPR compliance. Moreover, these capabilities enable professionals to confidently adopt our platform for valuable assets.

Competitive Differentiation: In addition, EstateSpace focuses on being the only complete solution for physical asset management. Competitors handle only pieces of the ecosystem. Thus, our AI agents manage the entire asset lifecycle from acquisition to transfer of ownership.

EstateSpace Vision Industry Recognition and Market Validation

The trajectory of EstateSpace vision received significant validation through industry recognition and market response. Consequently, these milestones validate our approach. They provide momentum for continued innovation.

Industry Recognition: Initially, EstateSpace earned recognition on Nathan Latka’s Top 500 Fastest Growing SaaS Companies list. We ranked among just 2.7% of companies that qualified based on growth metrics. Furthermore, securing two patents for our AI-driven technology demonstrates innovation leadership. This leadership is in physical asset management.

Market Traction: Most importantly, our platform now manages billions in physical asset AUM. This spans family offices, enterprises, and institutions where product-market fit and ROI are strongest. Therefore, this traction validates our vision of becoming the dominant platform for physical asset management.

Value Creation Through EstateSpace Vision Physical Asset Management

EstateSpace vision directly benefits core customer segments. It transforms how they manage and optimize high-value physical asset portfolios. Specifically, our platform addresses unique challenges faced by stakeholders in the physical asset ecosystem.

Family Office Transformation: Consequently, family offices leverage EstateSpace to achieve 60% administrative time savings and 33% cost reduction. This happens through AI-powered asset management. Furthermore, our platform provides real-time intelligence that transforms physical assets from liabilities into optimized investments.

Professional Manager Empowerment: Similarly, estate managers and asset professionals use EstateSpace to demonstrate measurable value. They do this through systematic documentation and predictive maintenance. Thus, professionals can focus on strategic oversight rather than administrative tasks.

Future Vision: Additionally, EstateSpace will lead in physical asset AUM by starting with family offices and institutions. Then we expand down-market to serve broader audiences seeking sophisticated asset management technology. Meanwhile, our AI agents will become increasingly sophisticated. They will handle complex decision-making autonomously.

The EstateSpace vision demonstrates how personal challenges with operational inefficiency can drive innovation. This innovation addresses massive market opportunities while improving lives. It creates substantial value across the physical asset management ecosystem.

Discover how EstateSpace’s AI-powered platform can transform your physical asset management approach and join the revolution in intelligent portfolio oversight for high-value assets.

Summary: EstateSpace vision transforms physical asset management through AI-powered solutions that address the $250 trillion market gap between financial and physical asset technologies, delivering measurable value through operational efficiency, cost reduction, and proactive portfolio optimization for family offices, estate professionals, and institutional asset managers.