Estate preservation physical assets demand sophisticated oversight strategies that protect client legacies while strengthening family relationships across generations.

Ask any wealth manager about their clients’ primary concerns, and family security consistently tops the list. However, even ultra-high-net-worth families face significant challenges. Physical assets often represent 50% of client portfolios, yet they frequently become sources of family discord rather than legacy preservation.

According to comprehensive research, seventy percent of estate plans for affluent families “fail.” These failures result in substantial financial losses and relationship breakdowns among heirs. For wealth managers overseeing significant physical asset portfolios, understanding these dynamics becomes crucial for protecting client legacies.

Estate Preservation Physical Assets: Common Management Challenges

Private wealth professionals managing substantial physical asset portfolios encounter recurring obstacles that threaten long-term preservation goals. Real estate holdings, art collections, luxury assets, and business properties require specialized oversight approaches.

Without proper estate preservation strategies, client assets suffer deterioration. Moreover, family relationships become strained through poor succession planning. Consider these frequent challenges affecting your client advisory role:

- Asset Succession Disputes: Heirs disagree over physical asset distribution, creating family conflicts that could have been prevented through proper planning

- Maintenance Oversight Gaps: Physical assets deteriorate when proper care protocols aren’t established or followed consistently across generations

- Valuation Inconsistencies: Family members hold different opinions about asset values, leading to disputes during distribution processes

- Operational Management Conflicts: Business properties and income-generating assets create ongoing management disputes among multiple heirs

- Preservation Standards Disagreements: Heirs maintain different standards for asset care, potentially compromising long-term value preservation

- Geographic Coordination Challenges: Physical assets in multiple locations require coordinated oversight that becomes complicated during succession planning

Strategic Estate Preservation Approaches for Physical Assets

Experienced wealth managers recognize that successful physical asset preservation requires proactive family education and systematic planning approaches. Rather than reactive problem-solving, effective estate preservation focuses on prevention and clear communication.

Respect Individual Heir Autonomy: Avoid conditioning physical asset inheritance upon specific life choices such as residing in family properties or maintaining certain lifestyles. Forcing heirs to choose between financial security and personal happiness creates lasting resentment. Instead, establish care requirements for the assets themselves while allowing flexibility in how heirs utilize or manage them.

Maintain Client Value Systems: Help clients align their physical asset bequests with their core principles and values. If clients built their wealth through specific business practices or social commitments, ensure asset distribution reflects these ideals. For example, conservation easements on land holdings or operational guidelines for business properties can preserve client intentions while providing heir flexibility.

Customize Distribution Strategies: Recognize that not all heirs share the same connection to physical assets. One child may treasure the family estate while another prefers liquid investments. Tailor asset distribution based on individual heir interests, capabilities, and circumstances rather than defaulting to equal splits that may not serve anyone well.

Implement Transparent Communication: Educate heirs about physical asset values, maintenance requirements, and operational complexities before succession occurs. Families often underestimate the costs and responsibilities associated with maintaining luxury properties, art collections, or business assets. Early education prevents unrealistic expectations and facilitates smoother transitions.

Technology Solutions for Estate Preservation Physical Assets

Modern wealth management leverages AI-powered platforms to enhance physical asset oversight and family communication. These systems provide transparency and accountability measures that strengthen estate preservation efforts.

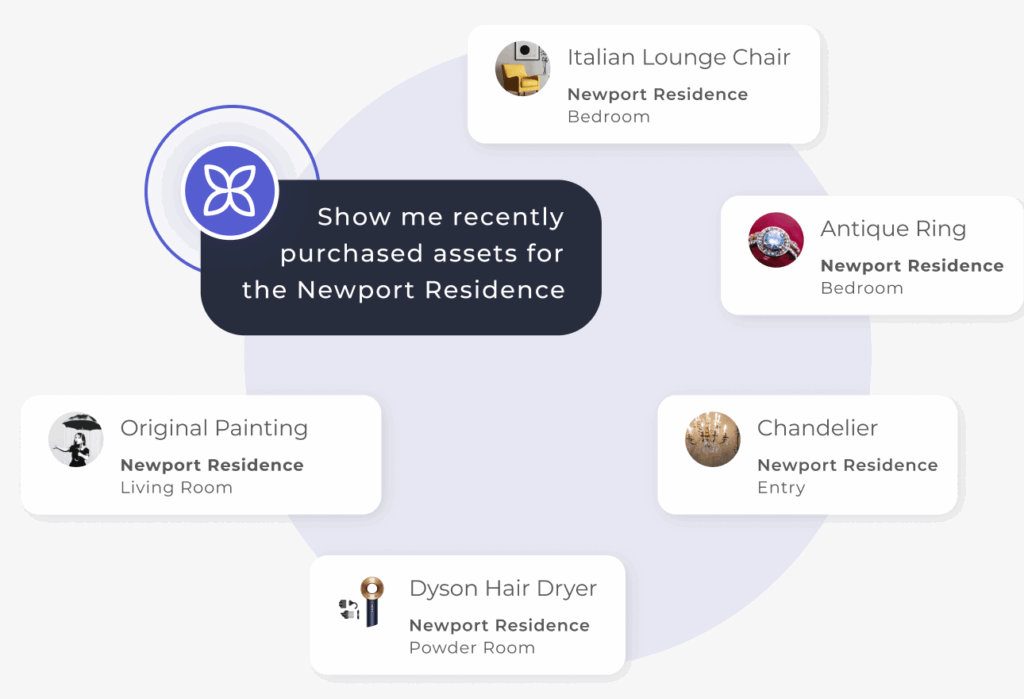

Centralized asset monitoring platforms track maintenance schedules, valuations, and operational performance across entire portfolios. Family members gain real-time visibility into asset conditions and care requirements without overwhelming detail.

Automated compliance systems ensure regulatory requirements, insurance obligations, and care protocols are consistently met. Legal and financial risks are minimized through systematic oversight that protects both current and future generations.

Digital communication tools facilitate ongoing family discussions about asset management decisions. Transparent information sharing builds trust while preventing misunderstandings that could compromise relationships.

Predictive analytics identify potential issues before they impact asset values or family dynamics. Proactive intervention protects both financial and emotional investments in physical asset preservation.

Advanced Estate Preservation Implementation

Transform your client estate preservation approach with these strategic actions:

- Conduct Comprehensive Asset Assessments: First, evaluate each physical asset’s current condition, maintenance requirements, and succession challenges that could impact family harmony

- Develop Family Education Programs: Next, create systematic approaches to educate heirs about asset values, care responsibilities, and operational complexities before inheritance occurs

- Establish Clear Governance Structures: Then, implement decision-making frameworks that respect individual heir autonomy while protecting asset integrity and client values

- Deploy Monitoring Technologies: Finally, utilize AI-powered platforms that provide transparent oversight, automated compliance tracking, and predictive maintenance capabilities

Wealth managers who implement comprehensive estate preservation strategies today protect client legacies more effectively. Moreover, they strengthen family relationships while ensuring physical assets continue generating value across generations. From luxury real estate to art collections, successful preservation becomes achievable through strategic planning.

Ready to enhance your estate preservation capabilities for physical assets? Discover how advanced management platforms can transform your client advisory services. Additionally, Schedule a consultation to experience comprehensive solutions that strengthen both asset protection and family relationships.

Key Takeaway: Strategic estate preservation for physical assets requires balancing client values with heir autonomy while leveraging technology to ensure transparent, systematic oversight across generatio