How Private Estates Digitize Operations Without Losing Personal Touch or Privacy

You’re managing significant wealth and complex properties. Consequently, the estate digitization question isn’t if you should adopt technology—it’s how you accomplish estate digitization without sacrificing the discretion and personal relationships that define exceptional estate management.

The fear is legitimate: Will estate digitization expose sensitive information? Will automation replace the human judgment that protects your privacy? Moreover, will digital systems feel corporate and impersonal?

The answer is that the right estate digitization approach actually enhances privacy and personal service. Furthermore, here’s how sophisticated estates are making this work.

Why Paper Systems Create Privacy Risks

Most estates resist estate digitization believing paper is more secure. However, the opposite is true.

What actually happens with physical records:

- Binders in offices anyone can access

- Documents in multiple locations with no audit trail

- Information scattered across staff members who eventually leave

- No way to control who sees what

- Lost institutional knowledge with every transition

One family office principal told us: “We thought we were being cautious with paper. Then we realized 15 people had access to our complete financial picture.”

Therefore, family offices managing sensitive wealth need the granular control that estate digitization provides.

Three Essential Requirements for Estate Digitization

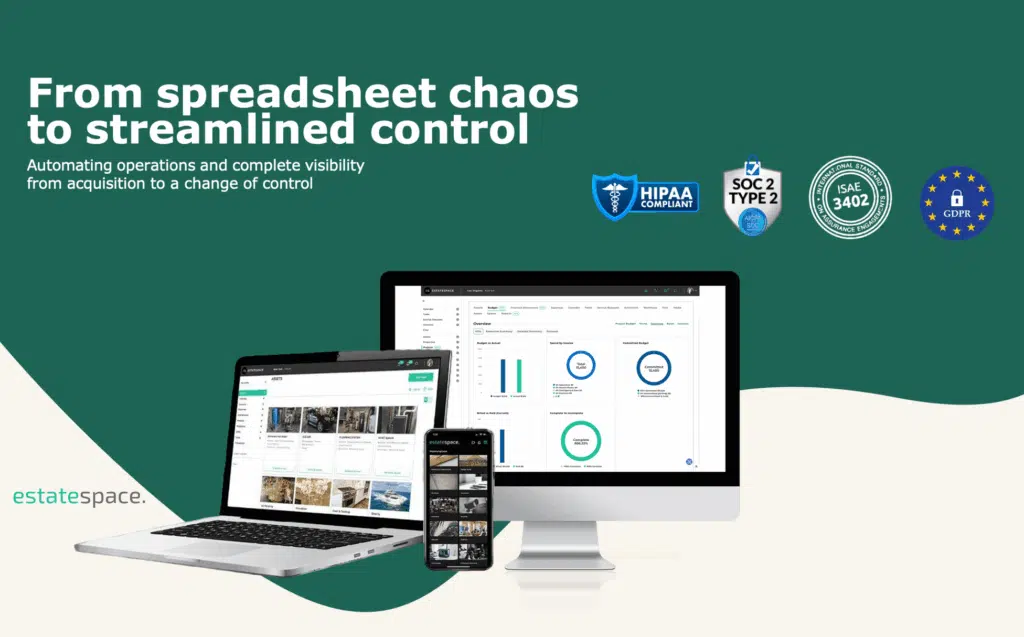

1. Enterprise-Grade Security Through Digital Estate Management

Not all platforms are built equal. In fact, basic property software lacks the certifications required for sensitive wealth management.

Minimum security requirements:

- SOC 2 Type 2 compliance

- HIPAA and GDPR standards

- Field-level permission controls

- Complete data isolation between users

- Client-side encryption capability

This means your principal sees different data than your property manager, who sees different data than your vendors. As a result, everyone accesses only what they need. Nothing more.

The EstateSpace AI platform was purpose-built with these privacy layers from day one, not retrofitted later.

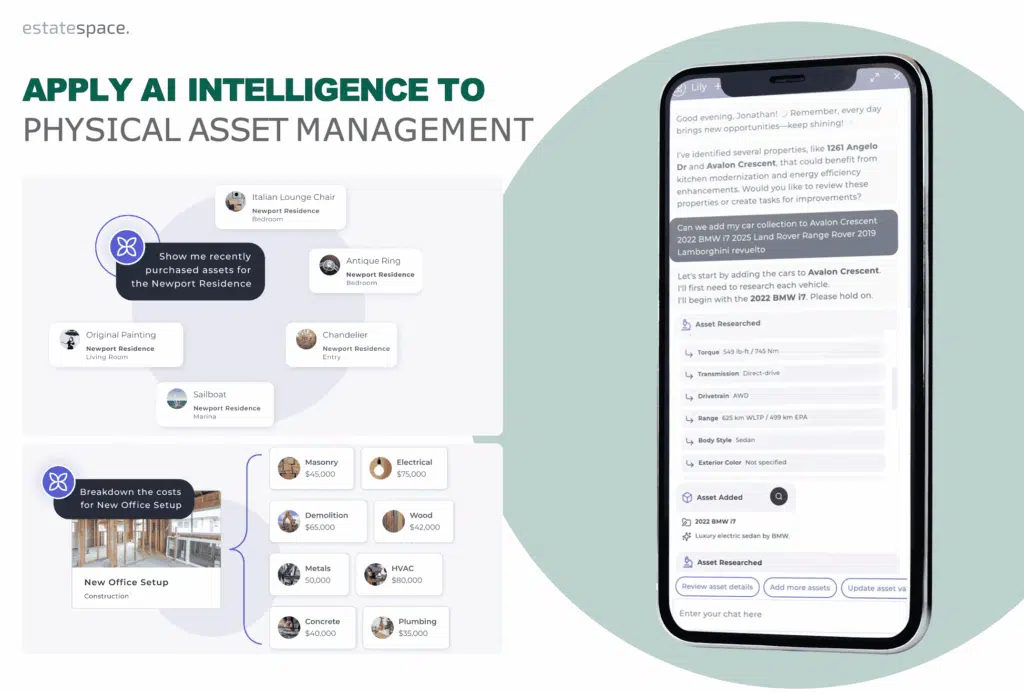

2. AI-Powered Estate Digitization That Protects Relationships

The question isn’t whether to use AI in estate management workflows—it’s what kind of AI you deploy during estate digitization.

AI that damages relationships:

- Sends automated messages that feel corporate

- Makes decisions without human oversight

- Exposes sensitive information to wrong people

AI that strengthens relationships:

- Handles data entry so staff focuses on people

- Surfaces insights for better decision-making

- Maintains privacy controls automatically

- Frees your team from administrative burden to provide exceptional service

Industry research confirms this approach. As Simple notes in their analysis of family office digitization, the most effective AI implementations are tailored to reflect each family’s unique priorities. Whether focused on philanthropy, legacy preservation, or conservative growth, AI agents work alongside human expertise, not as replacements.

We spent 16 years managing luxury estates before building software. Consequently, the difference matters. Our AI eliminates spreadsheet work so your asset managers can focus on what they do best—sophisticated client service.

Estate Digitization Workflows That Preserve Discretion

Here’s where AI estate management workflows become powerful without becoming intrusive during estate digitization.

Workflow 1: Intelligent Document Processing for Estate Digitization

The old way: Staff manually enters data from contracts, invoices, and reports. Meanwhile, anyone handling documents sees everything. Additionally, there’s no audit trail of who accessed what.

The AI approach: Drop any document—the system extracts data, creates relevant records, assigns tasks, and restricts visibility based on roles. Subsequently, you get a complete audit trail. Zero data leakage.

Your estate manager gets maintenance schedules. Meanwhile, your CFO gets cost data. Similarly, vendors see only their scope. Automatic. Discrete. Secure.

Workflow 2: Proactive Maintenance Without Micromanagement

Building repeatable systems doesn’t mean removing human judgment. Rather, it means eliminating the chaos that prevents good judgment through effective estate digitization.

Traditional approach: Property manager creates maintenance schedules manually, tracks completion in spreadsheets, follows up individually. Consequently, critical items get missed. Furthermore, there’s no consistency across properties.

AI-powered approach: System generates schedules based on asset specifications, sends appropriate reminders to the right people, escalates intelligently based on priority. Therefore, your team focuses on exceptions and strategic decisions, not administrative tracking.

This is how you deliver estate management clarity that principals expect without burning out your staff.

Workflow 3: Digital Knowledge Transfer That Protects Institutional Memory

The most expensive privacy breach isn’t external. Instead, it’s when institutional knowledge walks out the door with departing staff—something estate digitization prevents.

What gets lost in transitions:

- Vendor relationships and performance history

- Asset maintenance patterns and quirks

- Principal preferences and family protocols

- Cost benchmarks and negotiation history

Private estate management solutions built correctly capture this knowledge systematically. Moreover, they do this without requiring heroic documentation efforts.

As a result, your new estate manager inherits complete context—vendor performance data, maintenance history, cost trends, documented preferences. Therefore, six-month ramp time becomes six weeks. Service quality stays consistent.

The Technology Behind Successful Estate Digitization

The best estate technology operates invisibly. Indeed, your principal shouldn’t know you’re using software. Instead, they should simply experience exceptional service and complete peace of mind through seamless estate digitization.

What this looks like in practice:

- Project managers transition seamlessly from construction to operations—all documentation flows forward automatically

- Maintenance happens proactively without constant check-ins

- Financial reporting is sophisticated yet simple

- New team members come up to speed quickly

- Nothing falls through cracks

This is what estate chaos ending with visibility actually means. Not more technology. Rather, better outcomes through thoughtful estate digitization.

Implementing Estate Digitization Without Disruption

The concern about implementation is valid. Indeed, you can’t afford service interruptions during estate digitization.

Phased approach that works:

- Start with documentation – Consolidate existing knowledge without changing workflows through initial estate digitization steps

- Layer in automation gradually – Let team adapt to new tools one function at a time

- Transfer relationships, not just data – Ensure continuity of vendor partnerships and service standards during estate digitization

- Validate privacy controls – Test role-based access before full deployment

- Measure service quality, not just efficiency – Technology should improve client experience, not just reduce costs

EstateSpace handles complex family office asset management because it was built by people who managed estates for 16 years. Therefore, we understand the real-world requirements of estate digitization, not just theoretical software development.

What Sophisticated Estate Digitization Enables

When you get estate digitization right, you unlock capabilities impossible with paper systems:

For principals: Complete portfolio visibility without sacrificing privacy. Moreover, role-based access means total control over who sees what through proper estate digitization.

For family offices: Institutional knowledge systems that survive transitions. Additionally, reduced carrying costs through proactive management. Furthermore, sophisticated reporting that justifies premium service.

For estate teams: Administrative burden drops 60%. Consequently, time shifts from tracking spreadsheets to strategic client service. Tools that actually make work easier, not harder, through intelligent estate digitization.

For next generation: Technology sophistication that meets modern expectations. Meanwhile, it maintains family office discretion and security standards through careful estate digitization.

Your Next Step in Estate Digitization

Estate digitization isn’t about following trends. Rather, it’s about preserving what makes exceptional estate management exceptional. Moreover, it’s about eliminating the chaos that prevents your team from delivering it consistently.

The question isn’t whether your operations need institutional-grade systems. Instead, it’s whether you’ll complete estate digitization before or after your next key transition.

See how it works for your portfolio. Discover our complete product overview and the estate management software built for luxury properties.