Collectible asset management for wine represents a sophisticated investment approach that asset managers can offer to diversify client portfolios beyond traditional securities. As wine transitions from beverage to valuable collectible, asset managers must understand proper storage, authentication, and inventory management to protect their clients’ growing wine investments and ensure optimal appreciation over time.

The 2004 movie Sideways impacted the wine industry and revealed a subculture where wine represents an intellectual pursuit—inspiring many high-net-worth clients to explore wine collecting.

Whether your clients are veteran oenophiles or new to collecting, asset managers must guide them through proper collectible asset management to ensure wine investments are included in comprehensive wealth portfolios.

Wine as a Hybrid Collectible: Client Education Essentials

When advising clients, explain that wine is a hybrid collectible—consumed like luxury vehicles or displayed like fine art. Moreover, each bottle has provenance from grape history to previous owners. Additionally, this history can be faked.

Therefore, unless clients purchase wine for immediate consumption, asset managers must ensure proper provenance verification. Otherwise, it’s equivalent to advising clients to hang fake art.

Essential Storage Requirements: Protecting Client Assets

Client wine collections require proper maintenance within your collectible asset management strategy. Specifically, advise storing wine in dark places at consistent fifty-degree temperatures, as UV light, heat, and fluctuations can “turn” it.

Furthermore, horizontal storage prevents cork drying while minimizing vibration affects taste and aging. Asset managers should verify proper storage before recommending wine investments.

Critical storage elements:

- Consistent temperature control around 50°F

- Humidity levels between 60-70%

- Protection from UV light exposure

- Minimal vibration and movement

- Proper horizontal bottle positioning

Importantly, information on storage history and preservation efforts by previous owners should be documented in client files as part of comprehensive asset management records.

Inventory Management: Asset Manager Best Practices

As experienced asset managers know, detailed inventories are crucial for wealth management and succession planning. For wine collectibles, catalogues also inform strategic buy/sell recommendations.

Whether clients have ten bottles or two hundred, maintain detailed descriptions including wine type, year, and current valuation. Proper inventory management protects both client wealth and advisor reputation.

Essential inventory details include:

- Wine type and vintage year

- Purchase price and current valuation

- Storage location and conditions

- Provenance documentation

- Insurance coverage information

Professional Guidance: Building Your Advisory Network

Asset managers shouldn’t navigate wine investments alone initially. Understand what type of collector each client wishes to be. If clients don’t want hands-on management, recommend professional wine consultants.

Wine experts provide buy/sell recommendations and preservation strategies that complement broader wealth management. They understand market trends, holding periods, and exit strategies maximizing returns.

Digital Tools: AI-Powered Asset Management Revolution

Asset managers should employ AI-powered tools to enhance collectible asset management. While sophisticated technology exists for financial assets, nothing comparable existed for physical asset management—until now.

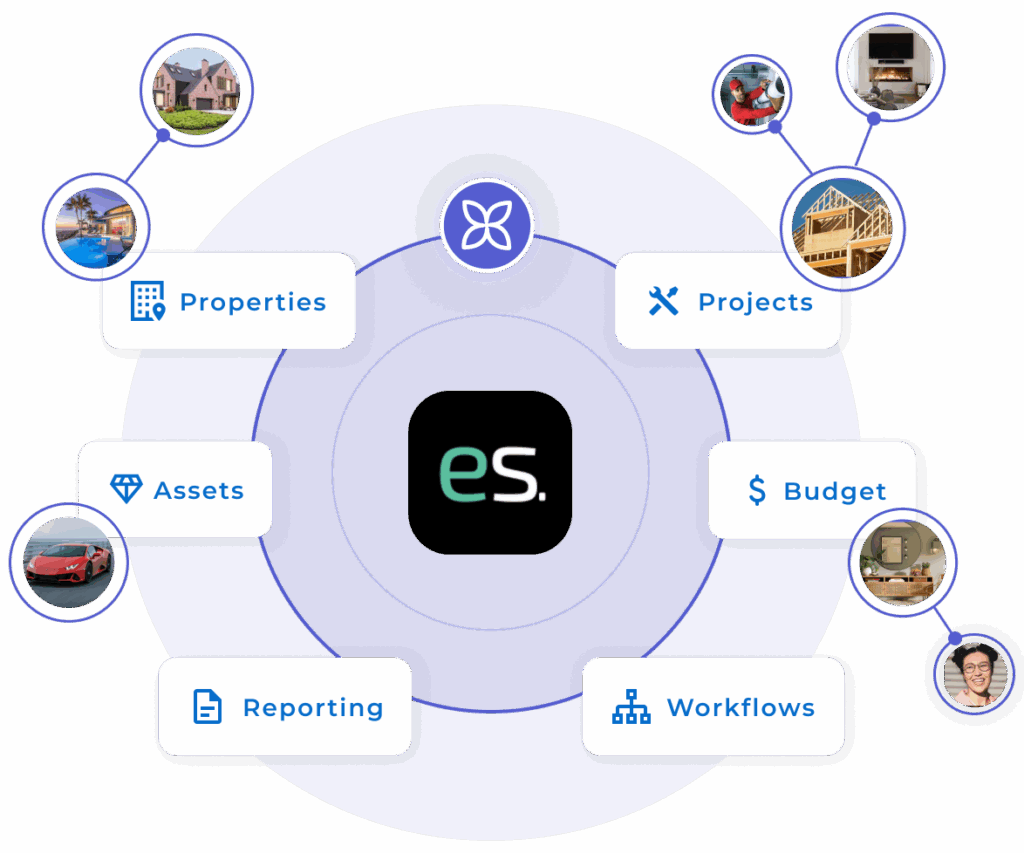

EstateSpace provides AI Agents offering institutional-grade oversight and streamlined workflows for collectible assets. These systems enable real-time intelligence, automated valuations, and proactive oversight transforming reactive management into strategic optimization.

Asset managers can cut administrative time by 60% while delivering transparency and control sophisticated clients expect.

AI-Enhanced Technology Benefits:

- Real-time valuation tracking with market intelligence

- Automated workflow management and reporting

- Predictive analytics for optimal holding periods

- Integration with estate planning and portfolio systems

- Proactive alerts for maintenance and market opportunities

Strategic Portfolio Integration: Overcoming Industry Challenges

Asset managers face a critical problem: sophisticated technology exists for financial assets, but nothing comparable existed for physical asset management. Most advisors use spreadsheets and disconnected systems creating inefficiencies, making it difficult to justify premium fees.

AI-powered platforms solve this by providing unified systems for complete asset lifecycle management. These solutions reduce administrative costs by 33% while enabling sophisticated oversight competitors cannot match.

Professionally managed wine collections offer portfolio diversification, inflation hedging, and attractive returns while providing personal enjoyment that enhances overall wealth experience.

Implementation Strategies: Transforming Your Practice

Asset managers implementing AI-powered collectible asset management transform from reactive administrators to strategic advisors through:

Assess client suitability leveraging AI analytics for optimal collection strategies.

Build specialist networks with unified platform communication eliminating scattered data.

Integrate wine holdings using AI Agents providing real-time intelligence and automated workflows.

Implement comprehensive tracking delivering institutional-grade oversight justifying premium fees.

Scale relationships efficiently cutting administrative time 60% while enhancing trust through proactive oversight.

AI-powered collectible asset management enables sophisticated physical asset oversight competitors cannot match, providing complete lifecycle management today’s clients demand.

Ready to Transform Your Physical Asset Management?

Book a Strategy Session to discover how EstateSpace’s AI-powered collectible asset management platform can help you eliminate spreadsheets, reduce administrative costs by 33%, and provide the institutional-grade oversight for wine collections that differentiates your practice and justifies premium fees.