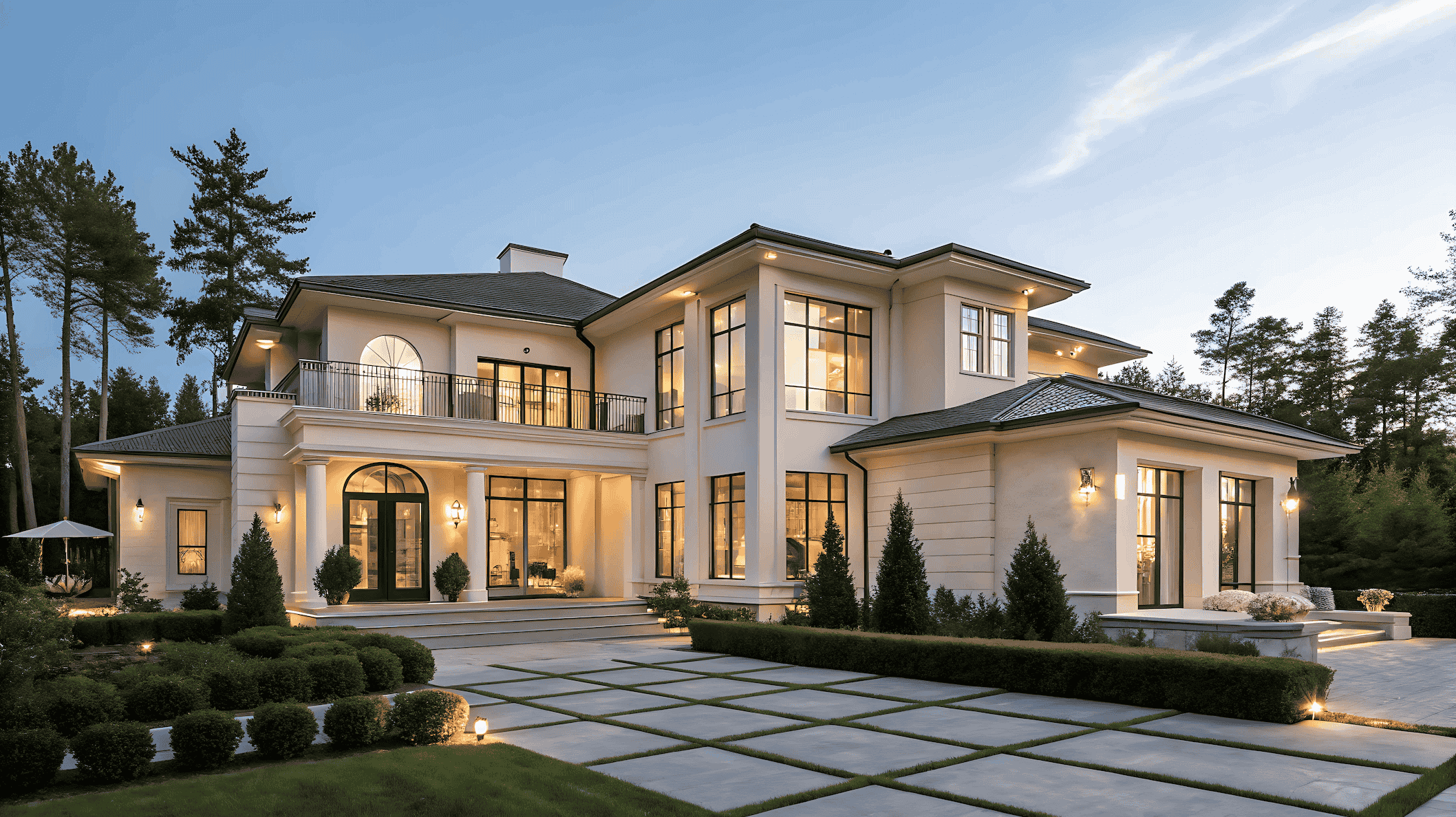

AI Physical Asset Management for Estate Managers

AI physical asset management for estate managers has become more than a helpful tool—it’s a critical part of running efficient, secure, and trustworthy estate operations. As portfolios expand and family dynamics grow more complex, estate professionals need the right technology to meet expectations, preserve value, and reduce risk. Spreadsheets and email threads aren’t enough. Fortunately, platforms like EstateSpace bring structure, automation, and transparency to estate operations—elevating both the process and your position. Why AI Physical Asset Management for Estate Managers Is Essential Estate managers are responsible for preserving physical wealth across generations. However, managing multiple homes, vendors, staff, and service records manually is no longer sustainable. With AI physical asset management for estate managers, you gain: Centralized dashboards for real-time tracking Automated maintenance scheduling and task delegation Complete document storage tied to each asset Reporting…