Family Office Asset Management Visibility

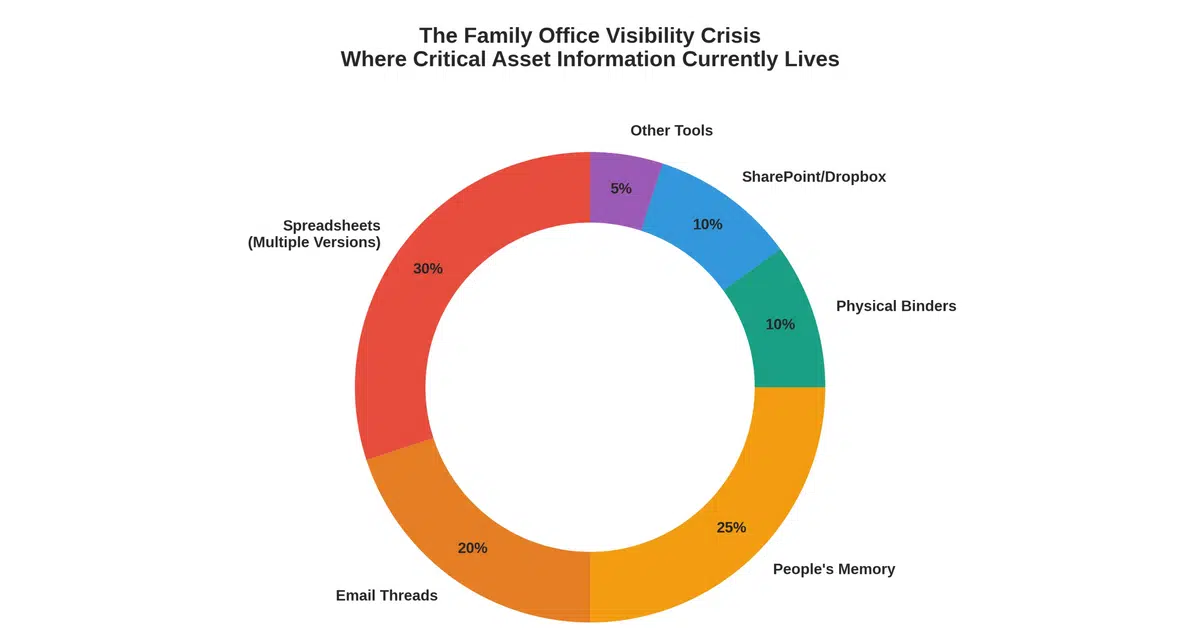

How Family Offices Can Achieve Complete Visibility Across Real Estate and Household Operations Family office asset management visibility remains one of the most critical—and overlooked—challenges facing wealth managers today. You're managing multiple properties, dozens of vendors, scattered documentation, and a team that somehow makes it work—until someone leaves. Then the knowledge walks out the door with them. If you've experienced the 2 a.m. email asking "Who services the HVAC at the Palm Beach property?" or watched a new manager spend six months learning what the previous person knew instinctively, you understand the problem. The real cost isn't just the time spent hunting for information. It's the 15-20% premium you're paying in carrying costs because you can't see what's actually happening across your portfolio. The Asset Management Visibility Crisis Facing Family Offices Modern family office…

Family Office Asset Management Systems

Family Office Asset Management: Why Systems Beat Spreadsheets The fundamental challenge facing family office asset management today comes down to one phrase: "Systems over heroics." You're managing exceptional properties and valuable assets with talented people performing daily heroics. However, heroics don't scale. Furthermore, they don't survive staff transitions. In addition, they're bleeding money you can't see. The Hidden Costs of Manual Asset Management The Real Cost of Manual Family Office Operations When you acquire a complex property without documentation, you're starting from zero. For instance, one family office principal described spending a year just figuring out how to run his newly purchased home. His estimate? Access to the previous owner's property knowledge would have been worth $100,000 minimum. This lack of estate management clarity creates cascading problems. Every time your estate manager troubleshoots something,…

- 1

- 2

- 3

- 4

- …

- 31

- Go to the next page