Estate Management Digital Transformation

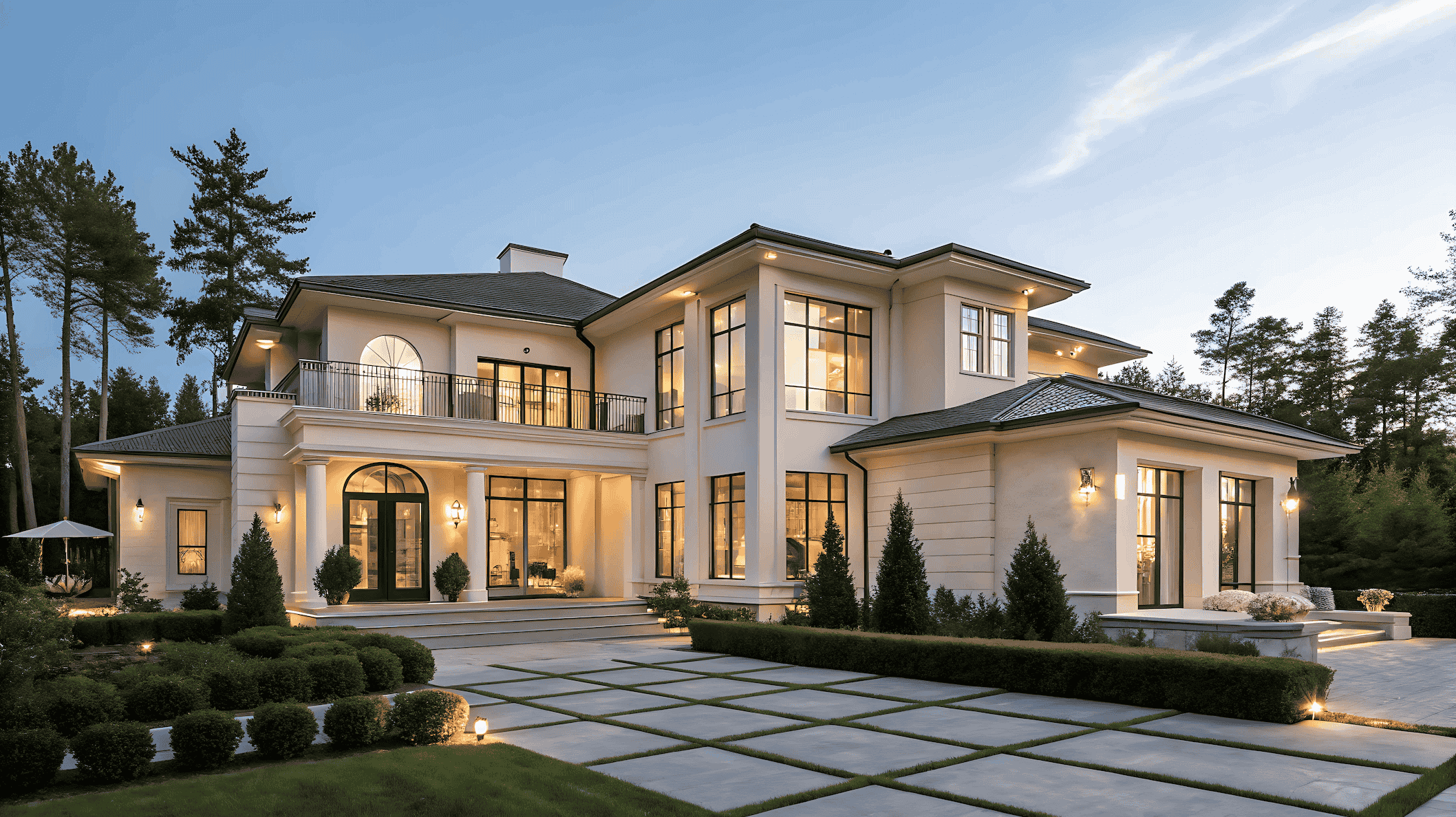

Estate management digital transformation revolutionizes how property professionals streamline operations through AI-powered platforms and automated workflows Estate management digital transformation fundamentally changes how property professionals handle complex portfolios, providing streamlined operations through AI-powered platforms. Furthermore, estate managers can now automate routine tasks, track assets in real-time, and reduce administrative costs by 33% while delivering superior client service. Consider Sarah, a seasoned estate manager overseeing five luxury properties across different states. Previously, she spent countless hours coordinating between staff, vendors, and property owners through endless phone calls and email chains. However, after implementing digital transformation solutions, she now manages her entire portfolio from a single platform while her administrative workload decreased by 60%. Consequently, estate management digital transformation has emerged as the essential solution for property professionals seeking operational efficiency and competitive advantage. Estate Management Digital…