Specialty Asset Management Rare Plant Collecting

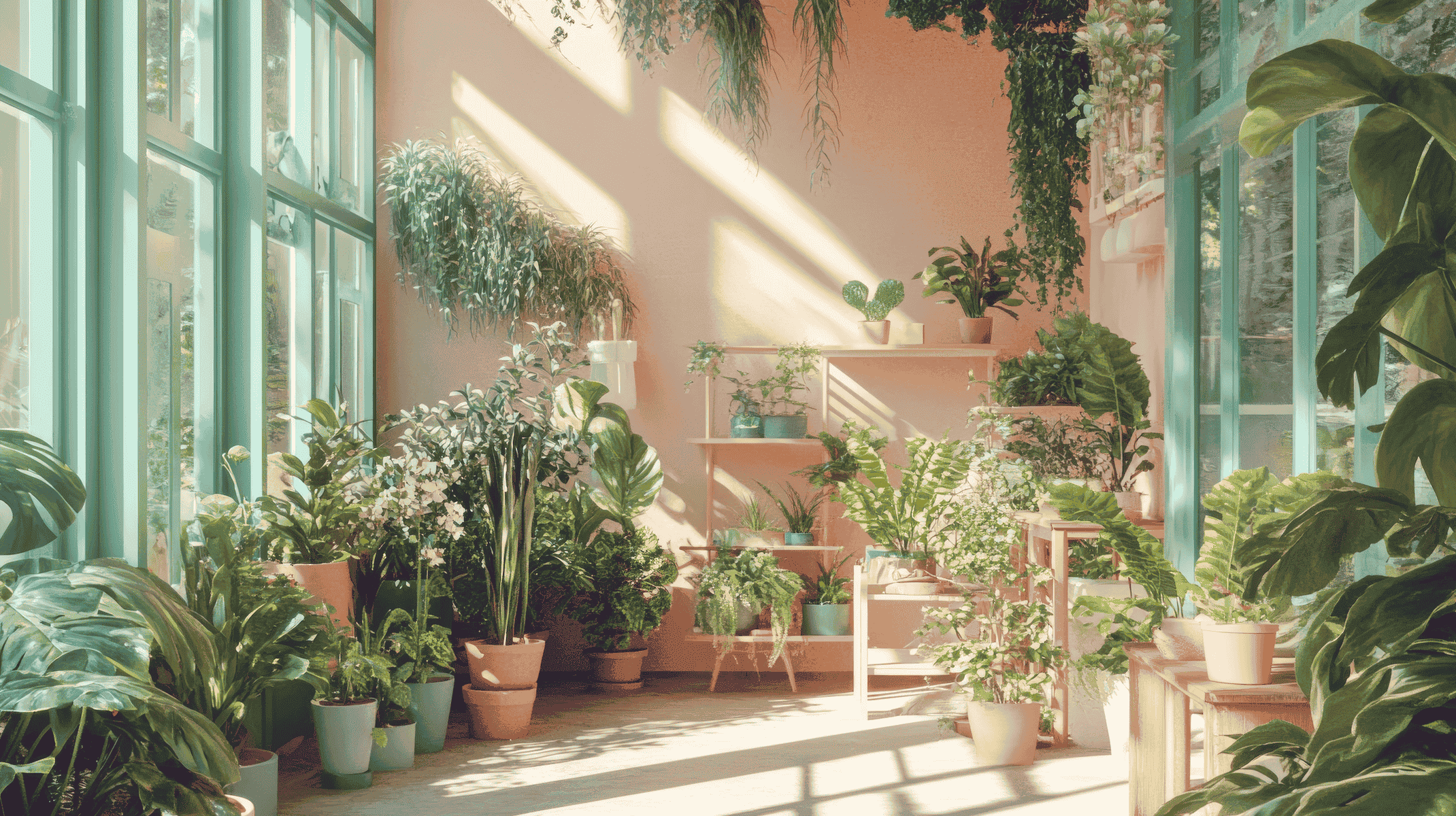

Asset managers helping clients diversify into specialty asset management must understand that rare plant collecting represents both significant investment opportunities and serious responsibilities, requiring specialized knowledge, environmental controls, and comprehensive care strategies to protect these valuable living assets over time. Collecting rare plants has become increasingly popular, particularly accelerating during Covid lockdowns. Subsequently, demand has driven prices through the roof, with collectors investing several thousand dollars for specific specimens. A single Monstera Deliciosa 'Thai Constellation' cutting recently sold for $5,000, while rare Philodendron Spiritus Sancti specimens have commanded prices exceeding $20,000 at auction. Consequently, asset managers must guide clients through essential considerations before starting collections. Research Foundation in Specialty Asset Management Thorough research becomes paramount in specialty asset management for rare plants. Even experienced collectors must enhance their botanical knowledge significantly when dealing with rare…