Family Office Asset Management Visibility

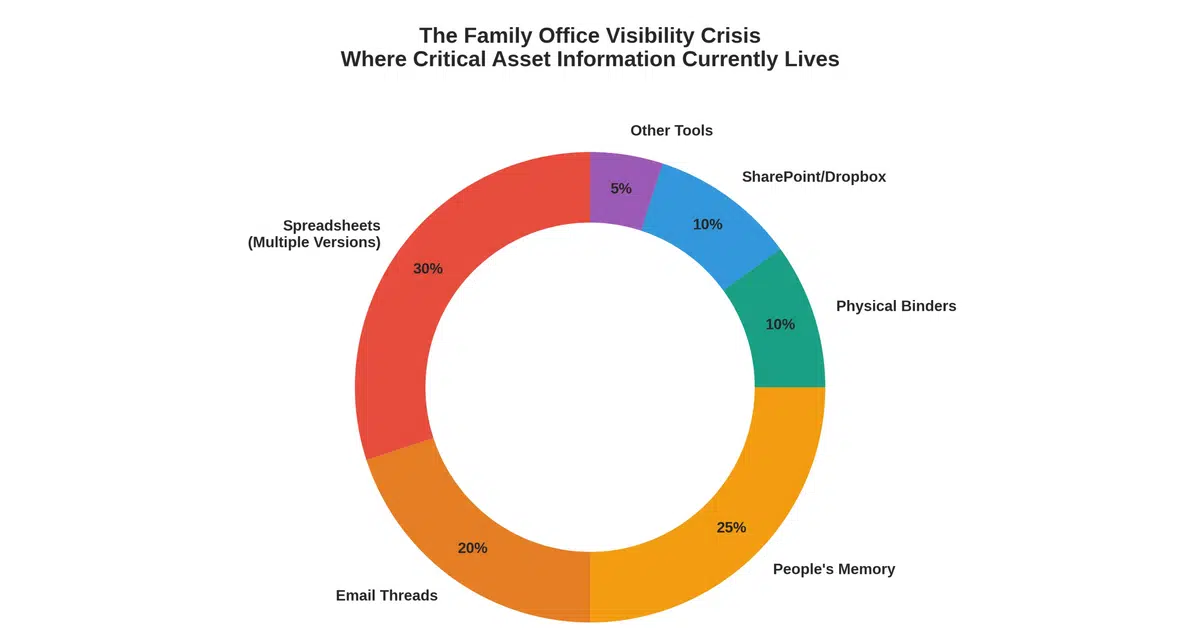

How Family Offices Can Achieve Complete Visibility Across Real Estate and Household Operations Family office asset management visibility remains one of the most critical—and overlooked—challenges facing wealth managers today. You're managing multiple properties, dozens of vendors, scattered documentation, and a team that somehow makes it work—until someone leaves. Then the knowledge walks out the door with them. If you've experienced the 2 a.m. email asking "Who services the HVAC at the Palm Beach property?" or watched a new manager spend six months learning what the previous person knew instinctively, you understand the problem. The real cost isn't just the time spent hunting for information. It's the 15-20% premium you're paying in carrying costs because you can't see what's actually happening across your portfolio. The Asset Management Visibility Crisis Facing Family Offices Modern family office…