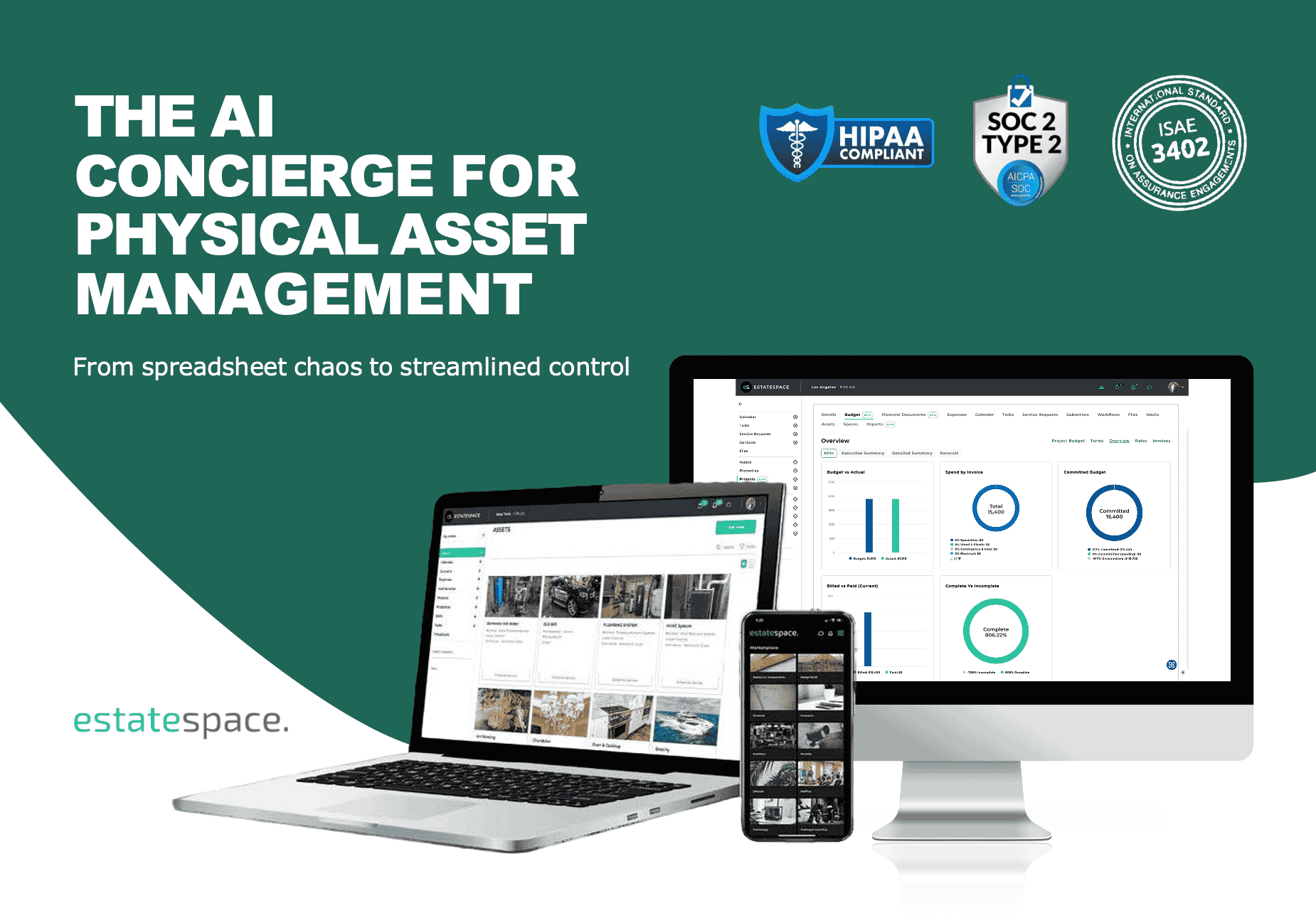

AI Property Maintenance Assistant: Predictive Automation

AI Property Maintenance Assistant: Stop Losing 35% of Your Asset Value to Poor Maintenance Your maintenance team spends 18 hours weekly just coordinating tasks and updating spreadsheets. Meanwhile, critical inspections slip through cracks, emergency repairs drain budgets, and assets deteriorate faster than they should. An AI property maintenance assistant changes this reality by automating what consumes your time and predicting what threatens your assets. The data is stark: poorly managed maintenance shortens asset lifespans by up to 35%. For family offices and estate managers still relying on manual tracking, this represents millions in lost value—value that intelligent automation protects. The Hidden Cost of Manual Maintenance Management Think about what happens when your facilities manager leaves. Years of vendor relationships, maintenance histories, and operational knowledge walk out the door. The replacement starts from scratch, repeating mistakes…