Family Office Asset Management Visibility

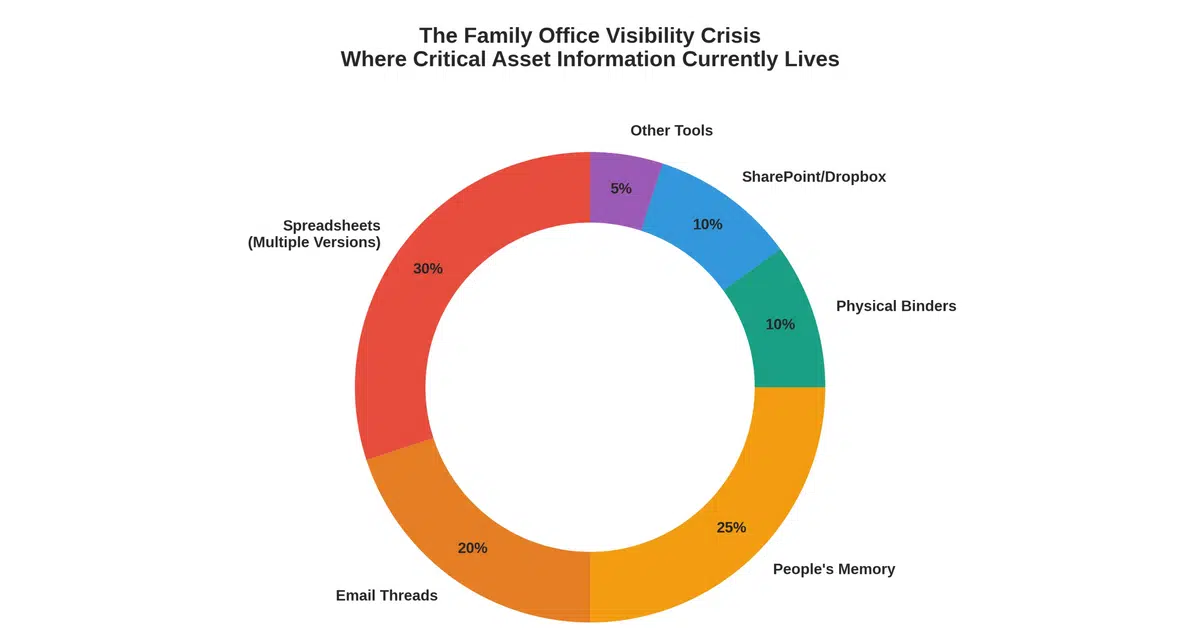

How Family Offices Can Achieve Complete Visibility Across Real Estate and Household Operations Family office asset management visibility remains one of the most critical—and overlooked—challenges facing wealth managers today. You're managing multiple properties, dozens of vendors, scattered documentation, and a team that somehow makes it work—until someone leaves. Then the knowledge walks out the door with them. If you've experienced the 2 a.m. email asking "Who services the HVAC at the Palm Beach property?" or watched a new manager spend six months learning what the previous person knew instinctively, you understand the problem. The real cost isn't just the time spent hunting for information. It's the 15-20% premium you're paying in carrying costs because you can't see what's actually happening across your portfolio. The Asset Management Visibility Crisis Facing Family Offices Modern family office…

Estate Digitization: Preserving Privacy & Personal Touch

How Private Estates Digitize Operations Without Losing Personal Touch or Privacy You're managing significant wealth and complex properties. Consequently, the estate digitization question isn't if you should adopt technology—it's how you accomplish estate digitization without sacrificing the discretion and personal relationships that define exceptional estate management. The fear is legitimate: Will estate digitization expose sensitive information? Will automation replace the human judgment that protects your privacy? Moreover, will digital systems feel corporate and impersonal? The answer is that the right estate digitization approach actually enhances privacy and personal service. Furthermore, here's how sophisticated estates are making this work. Why Paper Systems Create Privacy Risks Most estates resist estate digitization believing paper is more secure. However, the opposite is true. What actually happens with physical records: Binders in offices anyone can access Documents in…

- 1

- 2

- 3

- 4

- …

- 66

- Go to the next page