Asset management software for estate managers is transforming how professionals oversee ultra-high-net-worth family portfolios. As an asset manager, you’re responsible for portfolios spanning multiple residences, valuable collections, equipment, and personal property worth millions. However, the question isn’t whether you’re tracking these assets—it’s whether your current systems position you as the strategic advisor your clients expect.

Meanwhile, today’s affluent families own increasingly complex portfolios. From vintage wine collections and classic automobiles to art installations and technology equipment, every item requires meticulous oversight. Unfortunately, traditional estate management approaches often fail when scaling across multiple properties and thousands of individual assets.

Why Asset Management Software for Estate Managers Is Essential

Your spreadsheets and disparate systems create operational blind spots that undermine client confidence. Furthermore, when a client asks about their art collection’s current value or needs documentation for insurance claims, delays in response signal inefficiency. Consequently, these moments directly impact your ability to command premium fees and retain sophisticated clients.

Estate managers using traditional methods spend 60% of their time on administrative tasks rather than strategic oversight. As a result, this reactive approach limits your capacity to demonstrate measurable value—the primary challenge preventing many asset managers from differentiating their services.

Moreover, consider the financial impact: When you’re manually tracking hundreds of assets across multiple locations, critical maintenance windows get missed. Additionally, insurance documentation becomes outdated. Similarly, vendor performance goes unmonitored. Therefore, these operational gaps directly translate to decreased asset values and client dissatisfaction.

Furthermore, the competitive landscape has shifted dramatically. Now, sophisticated clients expect real-time insights, predictive maintenance schedules, and comprehensive reporting that demonstrates your value proposition. Consequently, asset managers who continue relying on spreadsheets and email coordination find themselves losing clients to competitors who leverage technology effectively.

How Modern Asset Management Software for Estate Managers Transforms Operations

Importantly, modern asset management software for estate managers transforms how you oversee client portfolios. Additionally, AI-driven platforms like EstateSpace create comprehensive digital inventories that go beyond basic tracking to deliver actionable insights.

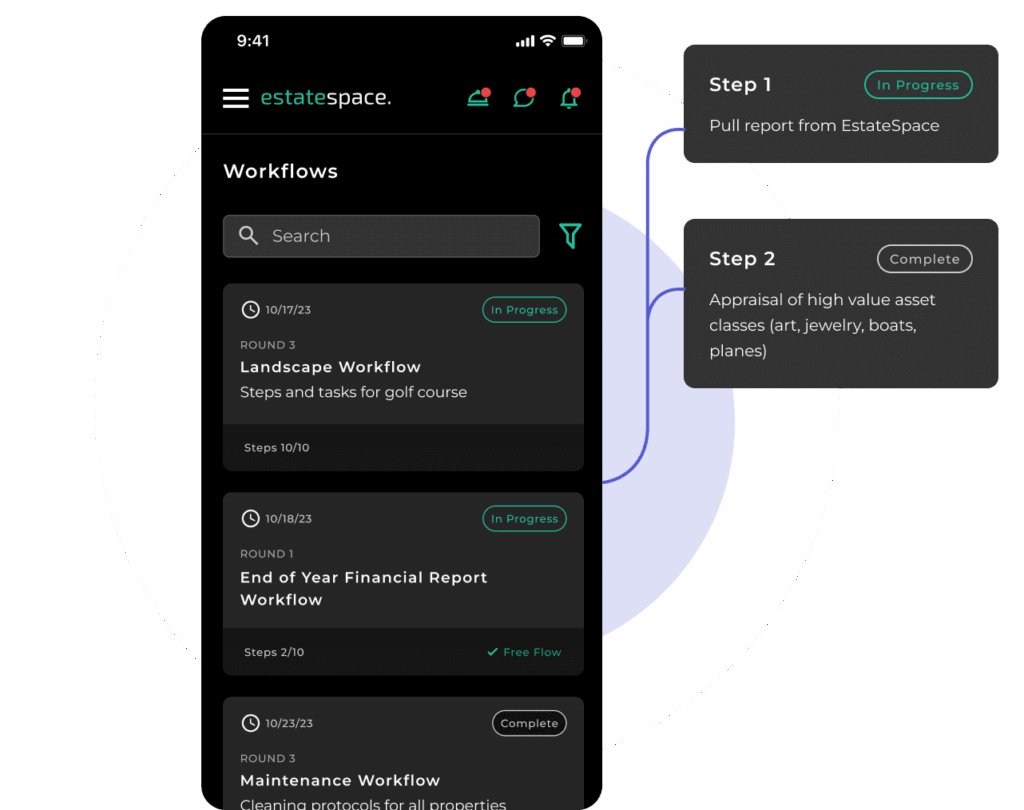

Furthermore, the technology revolution in estate management centers on predictive analytics and automated workflows. Instead of reacting to problems after they occur, sophisticated asset management software for estate managers identifies patterns and trends that enable proactive decision-making.

For example, the platform can analyze historical maintenance data across similar assets to predict optimal service intervals. Moreover, it tracks environmental conditions that affect asset preservation and sends alerts when intervention is needed. Ultimately, this level of intelligence transforms your role from reactive administrator to strategic advisor.

Key Features of Professional Asset Management Software for Estate Managers:

- Automated asset cataloging with photo documentation and condition assessments

- Predictive maintenance scheduling that prevents costly repairs

- Real-time valuation tracking for investment-grade assets

- Risk assessment alerts for time-sensitive decisions

- Integrated vendor coordination across all service providers

When you implement comprehensive asset management automation, you shift from reactive administrator to proactive strategist. As a result, clients notice the difference immediately through enhanced reporting and faster response times.

Beyond operational efficiency, the transformation extends to strategic capabilities. Specifically, professional asset management software for estate managers enables you to identify revenue opportunities that manual processes miss. Furthermore, when market conditions change, you can quickly assess portfolio impacts and recommend strategic actions.

Additionally, client communication becomes seamless through integrated messaging systems and automated status updates. Instead of fielding constant questions about project progress or asset conditions, clients receive proactive communications that demonstrate your oversight capabilities.

Revenue Protection Through Advanced Asset Management Software for Estate Managers

Consider this scenario: Your client owns a collection of vintage automobiles stored across three locations. In contrast, traditional tracking might catch maintenance issues months after damage occurs. However, professional asset management software for estate managers identifies optimal service intervals, tracks environmental conditions, and alerts you to potential problems before they impact value.

This proactive approach doesn’t just preserve asset value—it demonstrates sophisticated oversight that justifies premium pricing. Furthermore, Asset management automation stops manual chaos by centralizing all oversight functions into one intelligent platform, enabling you to provide insights competitors simply cannot match.

Moreover, the financial implications are substantial. Specifically, preventive maintenance typically costs 30-40% less than reactive repairs. Therefore, when multiplied across hundreds of assets, these savings directly impact your client’s portfolio performance and your ability to demonstrate measurable value.

Strategic Advantage in Client Acquisition

When competing for new UHNW clients, your operational sophistication becomes a deciding factor. Indeed, prospects expect detailed reporting, transparent communication, and seamless coordination across their entire portfolio.

Often, the selection process comes down to demonstrating capabilities during initial presentations. Notably, asset managers who can showcase real-time dashboards, predictive analytics, and comprehensive reporting immediately differentiate themselves from competitors using traditional methods.

Additionally, modern clients expect integration capabilities. Therefore, your asset management software for estate managers must connect with their existing financial systems, insurance providers, and other service professionals. As a result, this interconnected approach eliminates information silos and creates a cohesive management experience.

EstateSpace’s AI-powered platform provides:

- Comprehensive portfolio dashboards showing real-time asset status

- Automated reporting that eliminates manual compilation

- Secure client portals for transparent communication

- Integration capabilities with existing financial systems

These features position you to win clients from competitors who rely on outdated methods, helping you identify revenue opportunities others miss.

Furthermore, the competitive advantage extends to staff productivity and client satisfaction. Specifically, when your team can access complete asset histories, maintenance schedules, and vendor performance data instantly, response times improve dramatically. Consequently, clients perceive this efficiency as superior service quality, supporting premium fee structures.

Implementation That Drives Results

Successful asset managers understand that technology adoption must align with client expectations for premium service. Importantly, EstateSpace’s purpose-built asset management software for estate managers integrates seamlessly with existing workflows while providing immediate operational improvements.

Additionally, the implementation process focuses on minimizing disruption while maximizing value realization. In fact, most estate management teams see significant productivity gains within the first month, with full ROI achieved within 90 days.

Moreover, training requirements are minimal due to intuitive interface design. Therefore, your team can maintain operational continuity while learning advanced features that enhance client service delivery. Furthermore, the platform scales with your business, accommodating growth without requiring system changes.

Ultimately, the result? Asset managers typically see 60% reduction in administrative time within 90 days, allowing focus on value-add services that strengthen client relationships and support premium pricing strategies.

Ready to transform your asset management approach? Book a demo to see how EstateSpace’s AI-powered platform positions you as the strategic advisor your clients expect.

Summary: Asset management software transforms traditional estate operations into strategic advisory services through AI-powered tracking, automated workflows, and comprehensive reporting that demonstrates clear value to UHNW clients.