Estate managers today face an unprecedented challenge: managing increasingly complex physical asset portfolios while clients demand institutional-grade oversight and real-time insights. However, without AI estate management software, traditional manual processes create bottlenecks that limit scalability and erode profitability.

Fortunately, AI estate management software is revolutionizing how property professionals approach these challenges, offering intelligent automation that reduces administrative overhead by up to 60% while enhancing client satisfaction through proactive oversight.

The Hidden Costs of Manual Estate Management

Most estate managers underestimate the true cost of manual processes. Moreover, beyond the obvious time drain, these inefficiencies create several critical problems:

- Scattered data across multiple systems makes it impossible to gain comprehensive portfolio insights

- Reactive management approach leads to costly emergency repairs and missed maintenance windows

- Limited scalability prevents firms from taking on additional clients without proportional staff increases

- Inconsistent reporting undermines client confidence and makes it difficult to justify premium fees

Furthermore, according to recent industry analysis, estate management firms using traditional methods spend 40% more on administrative tasks compared to those leveraging AI-powered platforms.

How AI Estate Management Software Addresses Core Challenges

Intelligent Document Management

In addition to basic storage, AI-powered platforms automatically categorize and organize maintenance records, vendor contracts, warranties, and compliance certificates. Meanwhile, machine learning algorithms can even predict which documents you’ll need based on seasonal patterns and property characteristics.

Predictive Maintenance Scheduling

Rather than relying on fixed schedules, AI analyzes historical data, weather patterns, and asset conditions to recommend optimal maintenance timing. As a result, this proactive approach prevents costly emergency repairs while extending asset lifespans.

Automated Workflow Optimization

Similarly, AI agents handle routine tasks like:

- Vendor scheduling and coordination

- Budget variance alerts

- Compliance deadline tracking

- Client communication updates

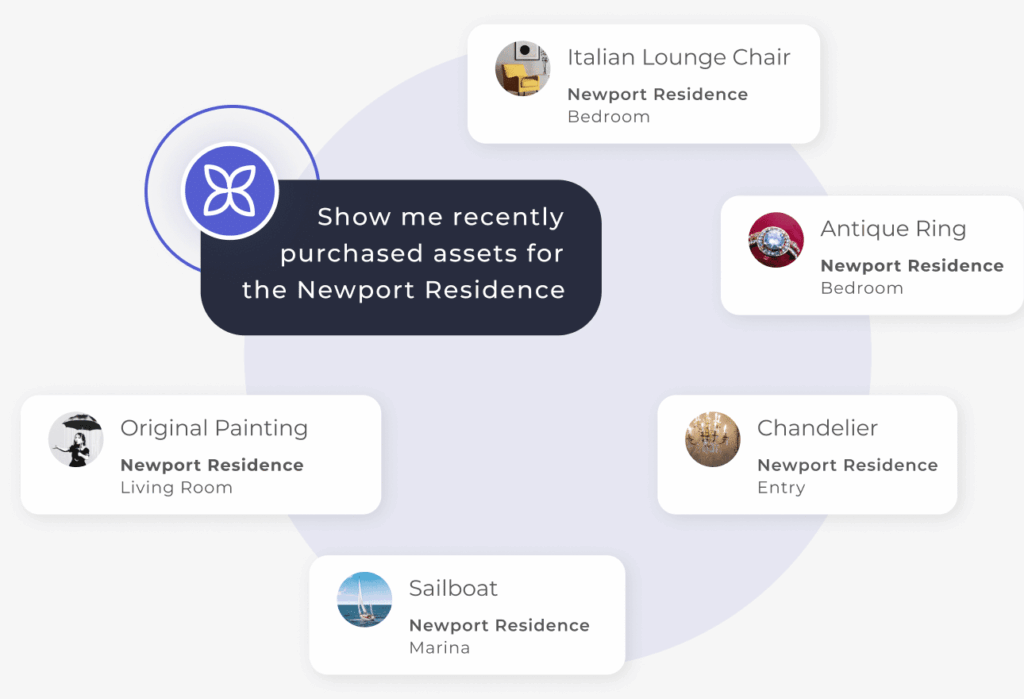

Real-Time Portfolio Intelligence

Additionally, advanced analytics provide instant insights into portfolio performance, enabling data-driven decisions that were previously impossible with manual tracking methods.

Getting Started with AI Estate Management: A Practical Guide

Step 1: Assess Your Current Operations

Before implementing any AI solution, conduct a thorough audit of your existing processes. Subsequently, identify the most time-consuming manual tasks and areas where data silos create inefficiencies.

Step 2: Choose the Right Platform Features

When evaluating AI estate management software, prioritize platforms that offer:

- Multi-agent AI capabilities for handling diverse operational tasks

- Integrated financial tracking that connects maintenance costs to asset performance

- Mobile accessibility for field teams and remote oversight

- Customizable reporting that matches your clients’ specific requirements

- Scalable architecture that grows with your business

Step 3: Plan Your Implementation Strategy

Successful AI adoption requires structured rollout. Therefore:

- Start with a pilot property to test workflows

- Train your team on new processes before full deployment

- Establish clear success metrics and tracking methods

- Create backup procedures during the transition period

Why EstateSpace Leads AI Estate Management Innovation

EstateSpace represents the next generation of AI estate management software, specifically designed for property professionals managing high-value physical assets. Furthermore, our multi-agent platform delivers institutional-grade oversight while dramatically reducing operational complexity.

Key differentiators include:

- AI agents that learn from your specific portfolio patterns

- Complete asset lifecycle management from acquisition to ownership transfer

- Seamless integration with existing financial management systems

- Enterprise-level security for ultra-high-net-worth client data

Notably, estate managers using EstateSpace typically see an 8x return on investment within the first year, primarily through reduced administrative costs and improved client retention.

The Future of Estate Management is AI-Powered

The wealth management industry has fully embraced technology for financial assets, with sophisticated platforms providing real-time insights and automated portfolio management. Now, physical asset management is experiencing the same transformation.

Consequently, forward-thinking estate managers who adopt AI-powered solutions today position themselves as strategic advisors rather than reactive administrators. This evolution not only improves operational efficiency but also justifies premium fees through demonstrable value creation.

As AI capabilities continue advancing, estate management firms that delay adoption risk becoming obsolete in an increasingly competitive market where clients expect the same level of technological sophistication they receive from their financial advisors.

Ready to transform your estate management operations? Discover your potential with EstateSpace’s AI-powered platform and join the property professionals already reducing costs while delivering superior client experiences.